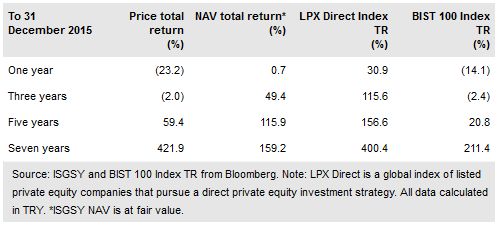

Is Private Equity (LON:IPRV) seeks to provide capital gains and attractive dividends from making private equity (PE) investments in Turkish companies. Market conditions were challenging for investee companies in 2015 and the fair value of its PE investments fell by c 5%, although still higher than the initial investment costs. Investment income from its other investments resulted in flat NAV per share before dividend payments. ISGSY’s PE investments amounted to 51% of total assets at year-end 2015, from 38% at end 2014, as it added to one PE holding and made one new acquisition. It has a relatively immature PE portfolio and we do not anticipate disposals in the near term, although it did sell a small part of a stake in one holding during the year to a strategic investor. ISGSY could have paid a 2015 cash dividend out of retained earnings but, given the exceptionally low level of profits and the current level of economic uncertainty, it decided not to and retain the cash for new investment opportunities.

NAV flat after dividend payment

NAV at 31 December 2015 was TRY255.1m, down TRY9.3m (4%) on the end-2014 figure. Fair value losses on its PE portfolio amounted to TRY4.7m (c 5% of the opening total) and administrative expenses amounted to TRY9.7m. These two items were slightly offset by TRY14.5m of investment income from its holdings of cash and liquid investments and TRY0.8m of gains from a partial sale of its holding in Radore. Dividends paid during the year were TRY10.1m.

To read the entire report Please click on the pdf File Below