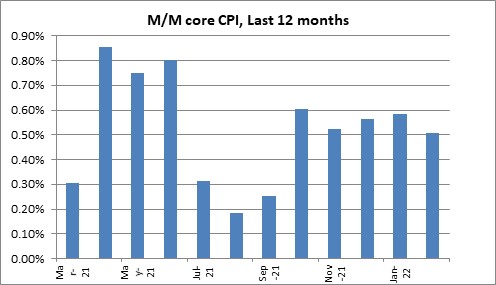

CPI has passed. Of course, that’s entirely a mechanical fact due to the fact that Core CPI in April, May and June last year was +0.85%, +0.75% and +0.80%, and it (probably) won’t be that high this year.

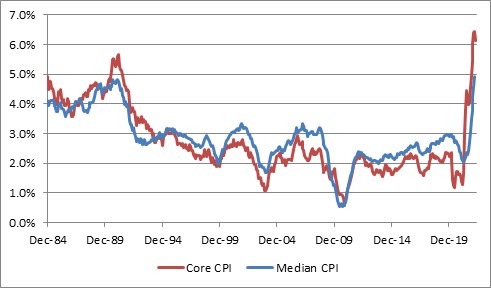

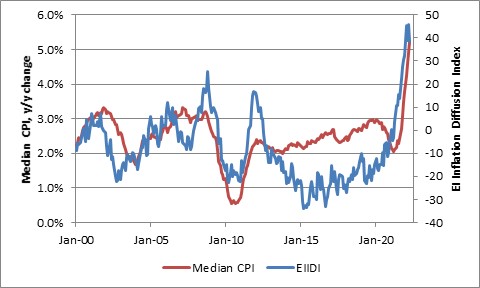

It certainly doesn’t mean inflation pressures themselves have peaked. In fact, Median CPI, which is a better measure of the central tendency of inflation pressures, is almost certain to rise to new year-over-year highs. But don’t let the facts get in the way of a party.

The bigger issue I think is that people confuse peak inflation, which is a rate of change, with peak prices. Prices aren’t going to fall, even if the inflation rate falls. (Some prices will fall, of course, but not generally). Price level is here to stay.

Back to the report walk-up. The consensus for CPI is +0.2% m/m, dropping y/y to 8.1%. Gasoline should actually be a small drag this month, but contribute again next month. Consensus for core is +0.4%/6.0% after 6.5% y/y as of last month.

The interbank market isn’t so sanguine; it has been trading today’s headline print at a level suggesting 0.3%/8.2% for the headline number, so a snick higher than economists’ estimates.

That’s my feeling, too. There’s more risk to the upside than the downside in this number today, I think.

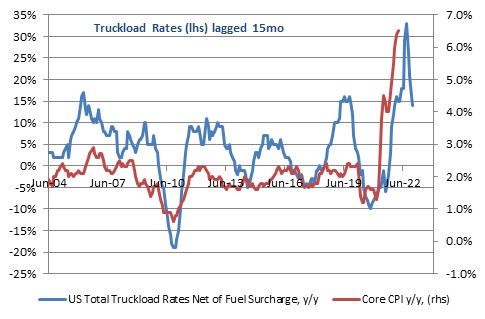

The good news is that truckload rates are coming down, and this tends to precede ebbing in core. Not sure that effect is being felt yet; the typical lead is pretty long and manufacturers I speak to are still assuming high shipping in their pricing.

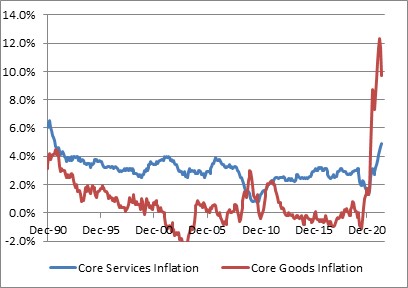

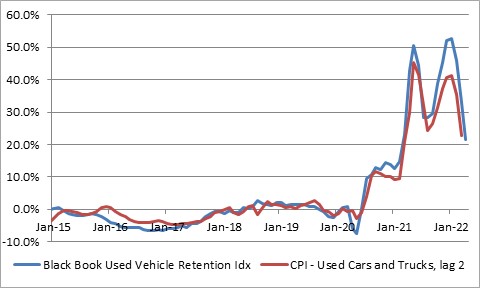

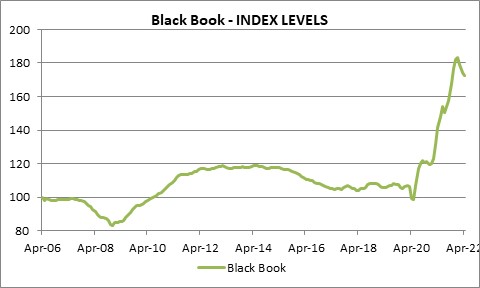

And the strong dollar will bring down core goods eventually too. (It should decline today, but is still in double-digits). That is also a long lead. Used cars should drag slightly today. They were -3.8% m/m last month, and private surveys have them a smidge lower this month.

But again, the rate of increase in used car prices is declining mostly because of base effects, not because prices themselves are going back to the old levels. And they won’t. We have 40% more money than we had two years ago; that’s not consistent with prices where they were two years ago.

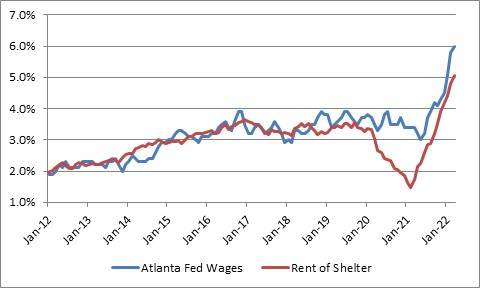

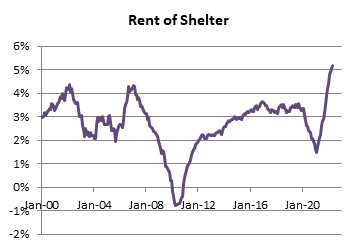

On the other side of the coin, primary rents surprised on the low side last month. I expect a bit of a retracement higher this month, and I’m still not sure we’ve seen the peak m/m OER rate. Those are the 500-pound gorillas, and until they ebb, we won’t get 2% CPI.

As longtime followers know, I’ve also been watching Medical Care for a while. This month I actually saw stories about nurses’ salaries starting to pressure hospital prices higher. So still attentive to that. It’s one of the only sectors that hasn’t really participated.

We are also eventually going to get a bump higher in college tuition CPI. I saw a story yesterday about BU raising tuition ~5%. But the NSA series mostly puts those adjustments in the summer, so we shouldn’t see an inflection yet.

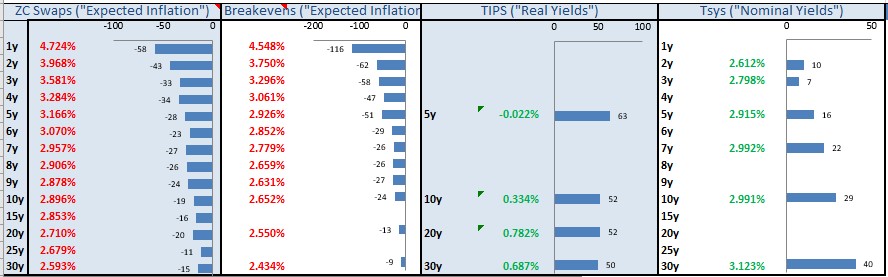

In the markets, the past month has seen a massive shift in interest rates higher, and break-even inflation rates lower (the break-even reversal coming mostly over the last few days). One-year inflation swaps are -58bps on the month. Only some of that is carry.

Stocks have obviously been under pressure from rising inflation and real rates. Over the last couple of days, the stock market debacle has caused some unwinding of the rate selloff but break-evens are still on the back foot.

Stocks today seem chipper, but most of that is coming from signs of lower COVID transmission in Shanghai and a sense that lockdowns there may end soon.

I still don’t see the Fed as hawkish, as what is priced in, mainly because I think it will lose its nerve as asset prices fall. I don’t really care about it changing the price of money. I’m watching for a change in quantity of money. So far, I am not impressed.

CPI Is In

Headline CPI fell to 8.3% y/y, not as far as expectations. The bigger deal is that Core CPI was several ticks higher than expected, at 0.57% m/m.

I am scrunching up my eyes, but I can’t see a decline in inflation pressures here.

Well, let’s see. Used cars -0.38% m/m, small drag. New cars +1.14%, though. The spread between used:new needs to close, but most of that spread probably will be new car prices coming up.

Owners’ Equivalent Rent 0.46% to 4.78% y/y from 4.54%. That’s in line with where it has been. But Primary Rents jumped back up after the surprise last month: 0.56% m/m to 4.82% y/y from 4.45% y/y.

The COVID recovery continues: Lodging Away from Home +1.7% m/m; airfares +18.6%!

Now, I have been seeing a lot of stories about this one. It’s only 0.04% of the consumption basket, but it really hits viscerally. Baby Food, +3.05% m/m, +12,9% y/y.

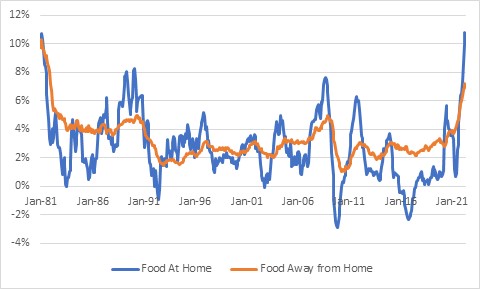

Food and Beverages as a whole, +0.84% m/m, +9.00% y/y. Ow!

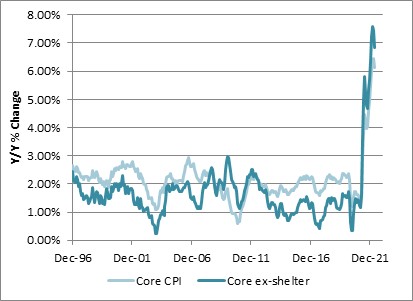

Now, I don’t know if this is good news or not, but core inflation ex housing declined to 6.8% y/y from 7.5%. The good news is that means some of the outliers are coming back. The bad news is that means the big slow categories are carrying most of the upward momentum.

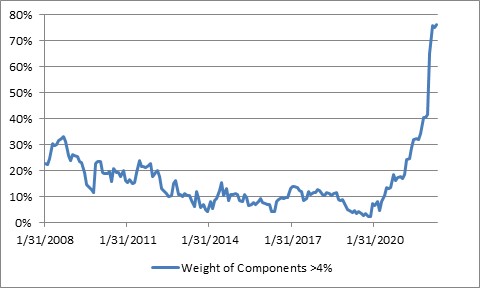

I guess looking at the chart, I probably shouldn’t get very excited about that last point.

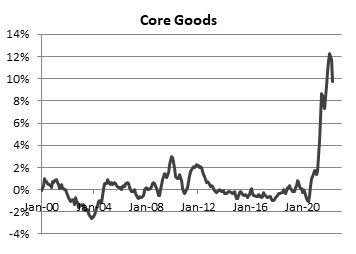

Of note is that Apparel was -0.75% m/m. Apparel is only 2.5% of the basket these days (yet ,still a major subgroup), but it is Core Goods and one of the categories that you’d expect to see a dollar effect in. Core goods y/y dropped under 10%. But it still a long ways to go.

Turning to Medical Care: It was +0.44% m/m, up to 3.23% y/y, led by Hospital Services, +0.48% m/m. It is still not alarming and below the price pressures we’re seeing everywhere else. Weird.

Within food, here are some of the m/m NSA changes that people are seeing. This is why they’re yelling, Joe. Putin’s arm is long: Dairy +2.4% m/m. Meats, poultry, fish and eggs +1.7%. Cereals/bakery products +1%. Nonalcoholic beverages +1.4%.

The biggest losers in core (annualized monthly rate): Jewelry/Watches -19%, Footwear -15%, Women’s/Girls’ Apparel -10%.

The biggest winners in core (annualized monthly rate): Lodging away from home +23%, Motor Vehicle Parts and Equipment +15%, New Vehicles +15%, Car/Truck Rental +10%. It's a shorter list than we’ve seen in a while, anyway.

My guess at Median CPI is not good news: 0.53% m/m is my estimate, 5.23% y/y. That’s a better sense of where the inflation pressures are. We’ll revert to something like 4.5%-5% just on y/y effects, but until the monthly Median CPI is not hitting 0.5%, we’re not out of the woods.

There’s also this: I’d want to see core below median as a sign inflationary pressures are ebbing. In disinflationary environments, tails are to the low side.

By the way, for everyone thinking that rents have to stop going up because people can’t afford these levels. Again, the price level has changed. And wages are keeping up with rent increases, on average. There is no obvious sign to me that rents are overextended at all.

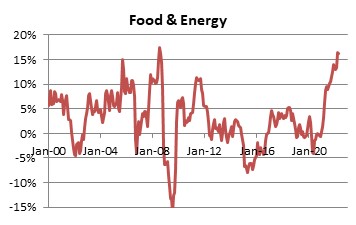

Here are the four-pieces charts, and I think we’re going to see the same story in the diffusion calculations. The stickier stuff is coming along for the ride. Here is piece 1: food and energy. No surprise here. And gasoline will be back as an addition next month.

Core goods. This is where the dollar effect, and the decline in the cost of shipping, will eventually be felt. And at some level, it actually is (see Apparel).

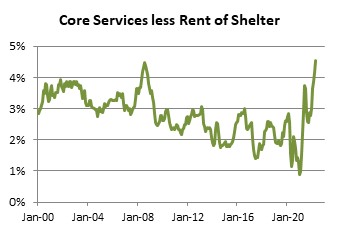

But now we get to core services less rent of shelter. This has been inert for years until just recently. This is the second-stickiest of the four pieces.

And rent of shelter. The stickiest. Rising, and not yet showing signs of slowing (although I think 5-6% is where it flattens out for a while). There’s just not a lot of great news here.

Tying up one loose end here: Used cars was a small drag. But look at how the y/y plunged. Again, this is because even with little change in the price level of used cars, the rate of change will decline.

Here are a couple of quick diffusion charts. Here is the proportion of the consumption basket that is inflating faster than 4%. It’s at 76%, and actually just reached a new high. No sign of peak inflation here.

And finally, the Enduring Investments Inflation Diffusion Index. It actually declined slightly. In the last few months it has rocked back and forth a little bit at a very high level. No real sign of peak inflation here either.

Summing up, the peak y/y CPI print is now behind us, at least for now. Expect a victory lap from policy-makers talking about how their policies are winning. But there’s no sign of peak inflation pressure yet.

The core and headline numbers actually fell less than expected. And let’s face it, this month’s Core CPI figure annualizes to almost 7%.

In fact, 6 of the last 7 Core CPI numbers have been between 0.5% and 0.6%, which would annualize, of course, to 6%-7.2%. If that’s what we’re celebrating with “peak CPI” behind us, I guess I’ll bring the whiskey. But I’m not sure I’m celebrating.

And the “peak” is because we dropped off 0.86% (core m/m) from April 2021. We have 0.75% to drop next month, then 0.80%. But then we see 0.31%, 0.18% and 0.25%. In other words, apres le deluge, more deluge.

Core CPI is likely to still be 5%-6% at year end! The sticky categories are still accelerating, and there will be other long tails to the upside. That’s just what an inflationary environment looks like. Watch Median CPI, which will be lower but no less concerning.

Will the Fed keep hiking, raising the price of money? Probably, although I think the swagger might leave it when stocks are another 20% lower.

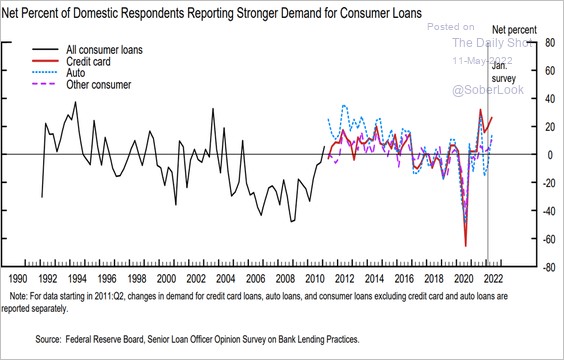

Will the Fed actually decrease the quantity of money, which is what matters? It can’t, because banks are not reserve-constrained any more. So it’s up to loan demand and supply, and recently loan demand has been increasing, not decreasing.

Source Fed, h/t DailyShot

The bottom line, folks, is that this might be a clearing in the woods, but there’s a lot of woods ahead. Eventually inflation will ebb to 4%-ish, but it will take time. I don’t see 2% for quite a long time, and not until interest rates are quite a bit higher.