Oil is once again the talking point of the market as it traded below the $27 a barrel mark for the first time in 12 years yesterday. The fundamental oversupply is still in place, and cracks are beginning to form within OPEC. Could this mean the cartel is losing its grip on the oil market?

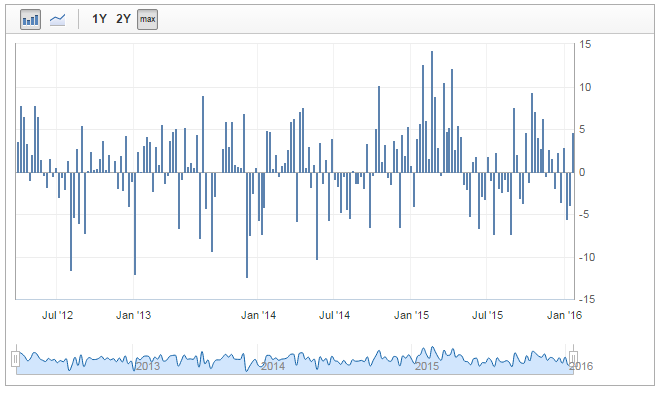

The rout continues as the market is concerned the oversupply will last longer than expected. Yesterday, figures from the American Petroleum Institute were released and added yet more downward pressure on WTI crude prices. The API report showed crude inventories rising by another 4.6 million barrels last week.

Source: Investing.com

Earlier this week the western sanctions on Iran were lifted, which will add further supply to the glut. Some reports suggest Iran has wasted no time and has already begun to export crude onto the international markets. Iran, an OPEC member, has said it will export oil regardless of what OPEC says. Thus, it appears cracks may be forming between Iran and Saudi Arabia, two OPEC giants, as tensions between Iran and the west thaw.

Further adding to the OPEC soap opera, Venezuela requested an emergency OPEC meeting to discuss ways to halt the slide in oil, but this was dismissed by other members. This suggests OPEC members will keep the taps on. The declining oil price is a predicament for many OPEC nations, as their export receipts dwindle along with their foreign reserves, but spending on social programmes must continue. If OPEC slows production, they will lose market share to other producers, and this is clearly causing a rift amongst members.

Saudi Arabia’s oil minister has vowed to keep on pumping oil, presumably in order to hurt rival producers further, but they also expect demand to pick up in 2016. This point is up for debate, especially with renewed fears over the economic health of China. As we have seen above, consumer demand in the US may be showing signs of fatigue, so it is difficult to see where the pickup in demand is going to come from.

The fundamental oversupply is firmly entrenched and is unlikely to abate. OPEC is already pumping oil at close to record levels, even before any extra Iranian crude reaches the market. The next scheduled OPEC meeting is not until June. We are currently seeing a race to the bottom as OPEC try and force out their higher-cost rival produces, particularly in the USA.

The race to the bottom might end up hurting the OPEC cartel more than anyone else and the lower oil prices go, the more cracks will begin to show.