While last week's geopolitical tensions have eased a bit, the OPEC+ members’ meeting knocks at the door. How will it affect crude inventories?

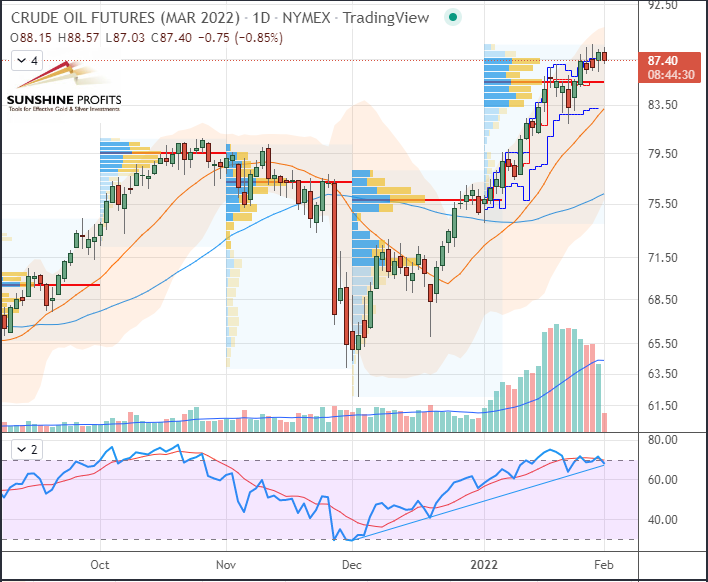

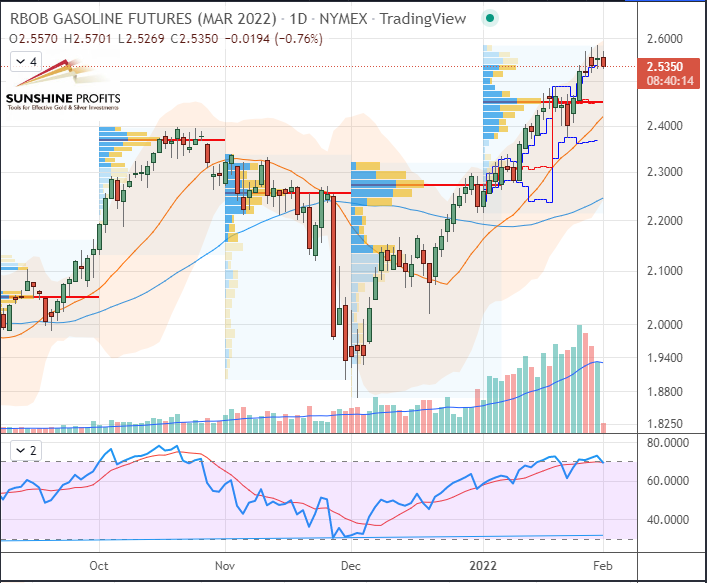

Crude oil prices paused this morning in the European trading session, the day after a new technical increase linked to the expiration of futures contracts. OPEC+ members, including Russia, are due to hold a meeting tomorrow in which speculative talks suggest that OPEC+ could announce a quicker increase in supply. On the other hand, U.S. crude inventories should be scrutinized this week, with the first figure to be released later today by the American Petroleum Institute (API) at 2130 GMT / 1530 Chicago Time.

Therefore, we could see a new rise in crude stockpiles of 2 million barrels. As a result, the oil market could be set to start a pullback down to previous support – $ 85.80 could represent a level that would attract more bulls, eventually.

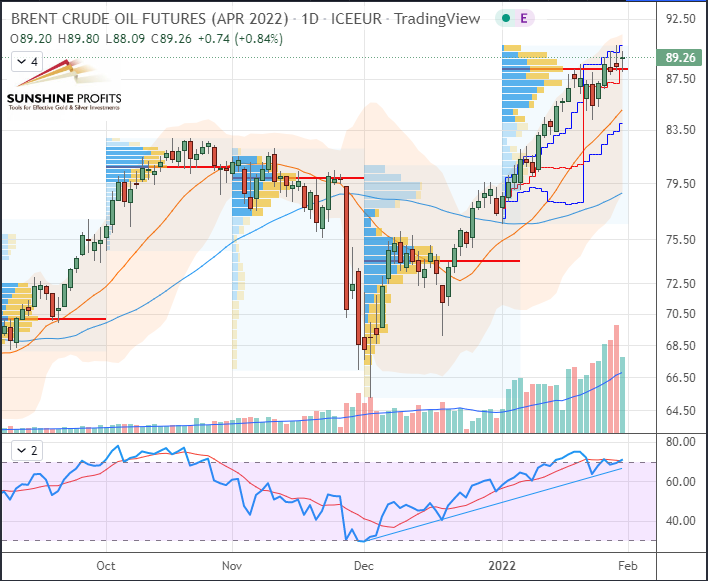

Regarding OPEC+ output, Saudi Arabia could decide to add barrels on top of its quota, as the kingdom is one of the only members of the cartel able to ramp up production, if necessary.

On the U.S. dollar side, the recent rally of the greenback has propelled the dollar index towards higher levels, even though it has not had a huge impact on crude oil. The overall inverted/negative correlation between the USD and black gold could catch up now as we have a greenback sliding after less hawkish comments from the Fed than expected and a barrel located in overbought territory.

On the geopolitical scene, the slight ease of tensions from the past week – or, at least, the diminution of anxiety inducing news in the mainstream media headlines – is characterized by decreasing volatility. The latter is thus marked by a volatility index (VIX) – aka “Fear Index” sliding just below 25 today.

WTI Crude Oil (CLH22) Futures (March contract, daily chart).

Brent Crude Oil (BRNJ22) Futures (April contract, daily chart).

Gasoline RBOB Futures (RBH22) Futures (March contract, daily chart).

In summary, after such a rally in crude oil prices in January, we may start to see a weakening of the momentum, which could result in correcting oil prices.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.