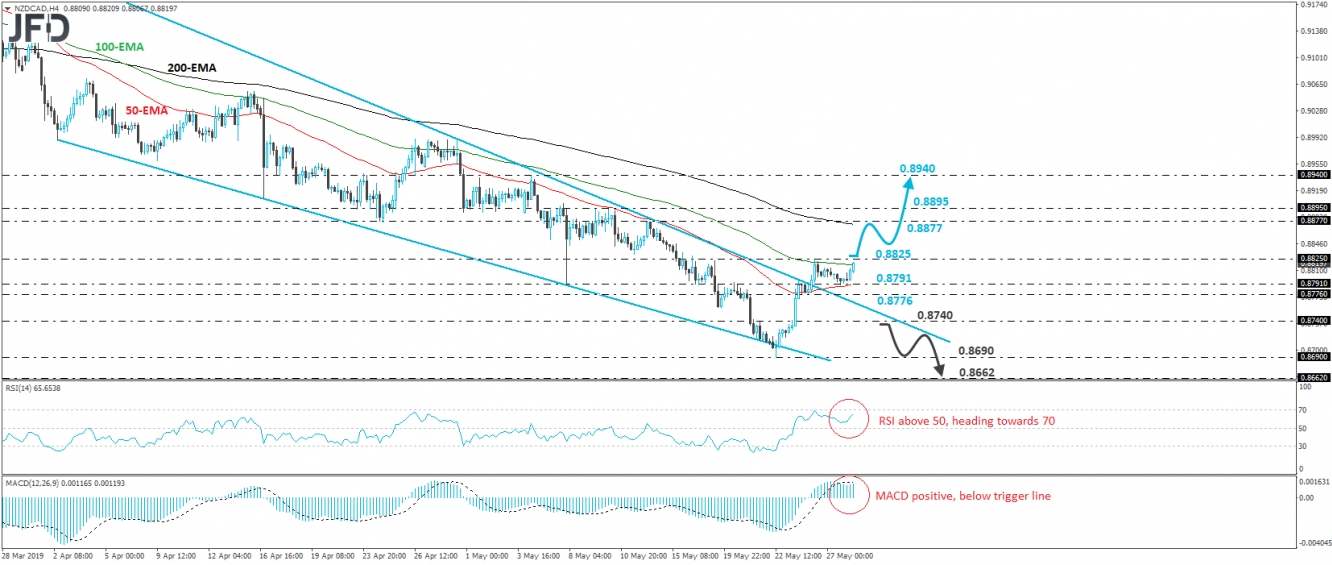

NZD/CAD traded slightly higher today, after it hit support near the 0.8791 level. Since May 24th, the pair has been oscillating in a very narrow range, between 0.8791 and 0.8825, but in a broader scale, we can see that this is taking place above the prior downside resistance line drawn from the high of March 25th. In our view, this keeps the near-term outlook positive and suggests that the bulls are likely to stay in the driver’s seat for a while more.

A clear break above 0.8825 could confirm the case and may see scope for upside extensions towards the high of May 14th, at around 0.8877. That said, in order to start examining the case for further recovery, we would like to wait for a move above the 0.8895 hurdle, which provided decent resistance between May 8th and 10th. Such a break could carry more bullish implications, perhaps paving the way towards 0.8940, defined by the peak of May 6th.

Shifting attention to our short-term oscillators, we see that the RSI, already above 50, has turned up again and now looks to be heading towards 70. The MACD, although below its trigger line, lies within its positive territory, and has started to turn north as well. It could cross back above the trigger soon. These indicators suggest that the pair is gaining upside momentum and corroborate our view for some further near-term advances.

In order to abandon the bullish case, we would like to see a decisive dip back below 0.8740. This would also bring the rate back underneath the aforementioned downside line and may allow the bears to aim for last Wednesday’s low, at around 0.8690. A break below that level would confirm a forthcoming lower low on both the 4-hour and daily charts and may extend the slide towards the 0.8662 zone, marked by the inside swing high of October 19th.