A few days ago a short seller made an appearance on TV and compared the price action in Nvidia (NVDA) to a casino. Right now, the stock is a Zacks Rank #3 (Hold) but it trades 25M shares a day which, by dollar volume, makes it one of the most active stocks in the market.

There were a few catalysts that brought the short seller into the name, so let’s review what prompted the stock to soar, what the short talked about and what has transpired in the few days after the report. Finally, we will take a look at what the Zacks Rank is telling us about the stock.

The Run Up

Nvida was on a solid run, moving higher in price in most sessions following the May 9 earnings report. The company beat earnings estimates by $0.04 and topped sales expectations by ~$200M. Datacenters saw the biggest growth, while gaming was far and away the highest dollar generator for the company. Management also guided sales higher, making that the seventh consecutive quarter of higher revenue guidance.

The stock surged more than $18 in the session following the report and closed up 18%. That still wasn’t the biggest move in recent history with shares of NVDA advancing 25% following the October 2016 report on November 10, 2016.

The Big Jolt

On June 8, Citigroup (NYSE:C) started the ball rolling and increased their target price from $145 to $180. Argus followed suit the next day, bumping their target to $175 from $140 and Bank of America/ Merrill Lynch jacked their number to $185 from $155.

Those big price target increases sent the shorts running for cover and the algos and day traders pounded them on the way out. The stock was moving by leaps and bounds on a nearly daily basis, so maybe it was a casino style stock.

Selling It Short

Andrew Left of Citron Research is known for finding companies that are a fraud or a scam, but here and there the firm makes a bold call on valuation. That appears to be just what happened on this instance, as the head of the firm stated that it is a “wonderful company” and not a fraud on television.

The short seller didn’t want to put a price out at where he thought he would cover, but the idea of shorting near what had become a top gripped traders. Instead of bidding it up, investors and traders alike were dumping shares as fast as they could and the stock tumbled more than $15 per share on Friday.

Since Then

The tech market has settled down… and today we have a new price target of $171 on the stock from Goldman Sachs (NYSE:GS). Thing is, Goldman was already bullish on the stock (as were the other brokers) with a Buy rating. Interestingly, their target price of $171 is just $6 ahead of the previous target of $165.

The stock seems to have found a home around $150 for the time being, but let’s be honest about this one, it will go higher.

Follow Brian Bolan on Twitter: @BBolan1

Zacks Rank

A quick look at the detailed estimates page on Zacks.com shows us that over the last 60 days there were 7 estimate increases for the current quarter and 1 decrease. The consensus estimate has moved from $0.62 to $0.69 over that same time period. Still the Zacks Rank #3 (Hold) is placed on the stock, but it is probably as strong of a #3 as you can get.

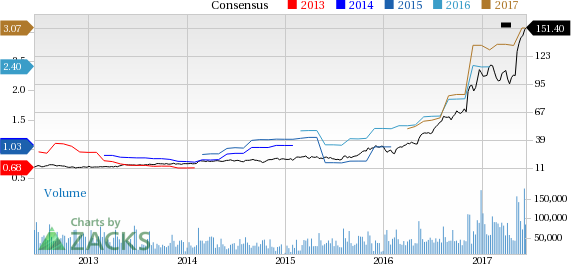

For right now, the traders might move this stock up or down, but investors focused on the long-term need only look at the price and consensus chart. This chart shows how the upward move in earnings estimates continue to power the stock higher. So, with higher estimates, we can expect the stock to move higher in the future.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research