Upstream energy player Newfield Exploration Company (NYSE:NFX) is expected to report second-quarter 2017 earnings on Aug 1, before the market opens.

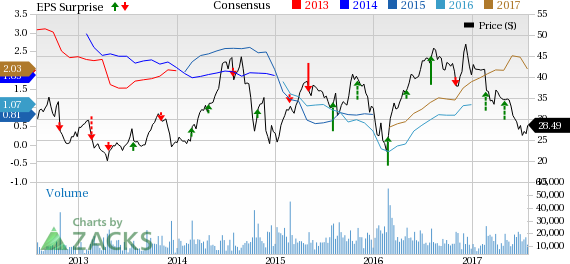

The company’s earnings surprise history is impressive. Newfield beat the Zacks Consensus Estimate in three of the prior four quarters with an average positive earnings surprise of 41.24%. Let’s see how things are shaping up for this announcement.

Factors Likely to Influence Earnings

Though we remain positive on Newfield’s emerging resource play development program, we believe that a lower natural gas price environment as compared withmid-2014 level could weigh on the stock since most of its reserves are tied up in the commodity. Since oil and gas prices have been increasingly volatile in recent years, it tends to effect the sector’s stock performance.

Additionally, Newfield’s high leverage and its Rockies and Gulf Coast-centered asset portfolio, along with its lack of meaningful exposure to the emerging shale plays, is a competitive disadvantage.

However, horizontal drilling in Wasatch and high pressure Uteland Butte are likely tohelp the company enhance its shareholders’ value.

Q2 Stock Price Performance

Pricing chart for the first three months of this year reveals that Newfield’s shares have outperformed the industry. During the aforesaid period, the company’s shares have lost 8.3% compared with a 9.4% decrease for the broader industry.

Earnings Whispers

Our proven model does not conclusively show that Newfield will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Most Accurate estimate stands and the Zacks Consensus Estimate are pegged at 44 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank:Newfield currently carries a Zacks Rank #4 (Sell). Note that the Sell-rated stocks (Zacks Rank #4 or5) should never be considered going into an earnings announcement.

Stocks to Consider

Though, earnings beat looks uncertain for Newfield, here are some firms that you can consider on the basis of our model. These have the right combination of elements to post an earnings beat this quarter:

TransCanada Corporation (TO:TRP) has an Earnings ESP of + 6.00% and sports a Zacks Rank #1.You can see the complete list of today’s Zacks #1 Rank stocks here.

Boardwalk Pipeline Partners LP (NYSE:BWP) has an Earnings ESP of +6.90% and carriesa Zacks Rank #1.

The Williams Companies Inc (NYSE:WMB) has an Earnings ESP of + 50.00% and carries a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Boardwalk Pipeline Partners L.P. (BWP): Free Stock Analysis Report

Williams Companies, Inc. (The) (WMB): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Newfield Exploration Company (NFX): Free Stock Analysis Report

Original post

Zacks Investment Research