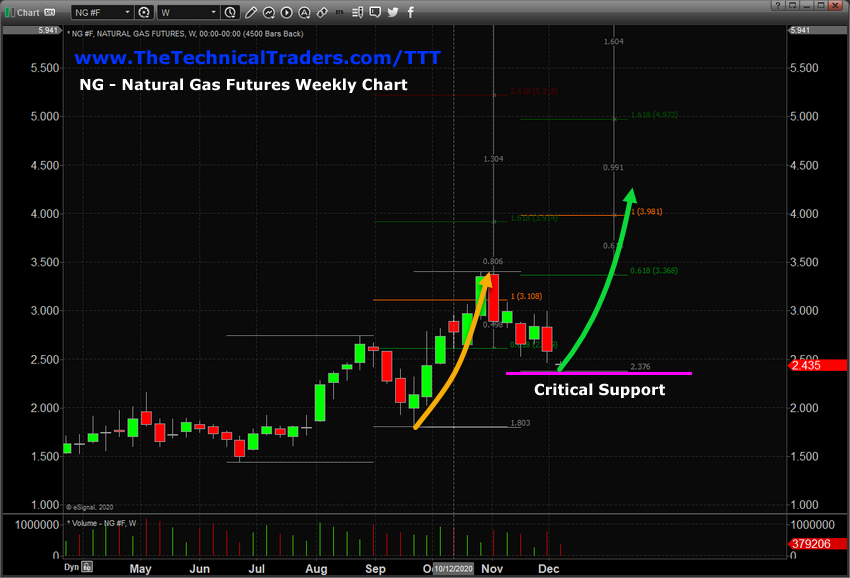

Recent downward price trends in Natural Gas have setup a nearly perfect 100% price contraction equal to the price contraction from the highs near late August to the lows in late September – totaling $0.95. The current highs near early November, $3.393, to the recent lows, $2.381, represent a $1.012 range – a 106.52% expansion of the August~September price contraction. We believe Natural Gas may be setting up another “100% Measured Move” price structure where a new upward price rally may push Natural Gas price levels above $4.15 in the near future.

NATURAL GAS 100% MEASURED MOVE SETUP

The upside price move highlighted on this Weekly chart (the orange line) shows a 125% Fibonacci Price Expansion of the previous upward price trend from the lows near mid-June to the highs in late August. If another rally were to take place which was similar to this 125% range expansion from the current lows, the upside price target would be somewhere near $4.15 to $4.25.

The Technical Analysis structure behind our analysis of Natural Gas is that a nearly perfect 100% Measured Move price contraction is taking place which may prompt another 100% Measured Move price advance equal to the previous price advance – equaling a $1.90+ price advance targeting $4.15 to $4.25.

Historically, January and February are predominantly bearish for Natural Gas. Over the past 25 years, Natural Gas has only moved higher in January and February in 9 or 10 of those years. Therefore, any upward price move in Natural Gas after the end of 2020 would be somewhat of a price anomaly.

Having said this, the largest monthly advance in January for Natural Gas is $1.37 and for February is $2.49. If an anomaly were to happen late in 2020 or early in 2021, Natural Gas would find support above $2.35 and begin to advance higher, setting up the 100% Measured Move structure, then advance towards $4.00 or higher as price accelerates within this trend. If this technical pattern fails, then Natural Gas will fall below $2.35 – breaking the 100% Measured Move structure and establishing a new downward price trend.

Ultimately, the current price lows in Natural Gas suggest a “make or break” setup is taking place right now and we are watching this setup to determine if our research team has pinpointed a valid opportunity for a potential 80% rally in Natural Gas.