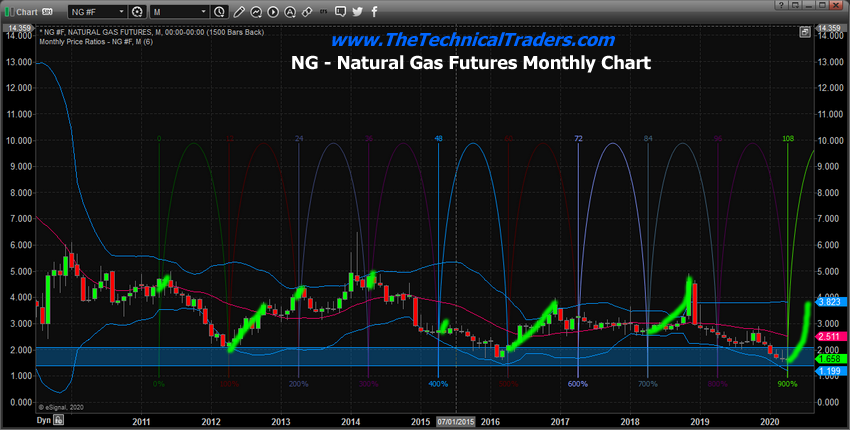

Our researchers have been following Natural Gas for many months and believe the current price level, near $1.65, is acting as a continued historical support level (a floor in price). Our researchers also used one of our data mining tools to attempt to identify if any opportunity exists in NG over the next 30 to 60+ days for skilled traders. The purpose of this data mining tool is to explore historical price activity and to determine if there is any true price “bias” that exists within certain months.

For example, if we could determine that Natural Gas tends to rally in April by a 2:1 ratio (historically) and that the rally in NG is typically somewhere between $0.50 and $1.50 to the upside, then we could attempt to use this information to set up a trade that allows us to attempt to profit from this potential future trend bias. A 2:1 ratio would indicate that, historically, the price rallied 10 times and didn’t rally 5 times over a span of 15 instances.

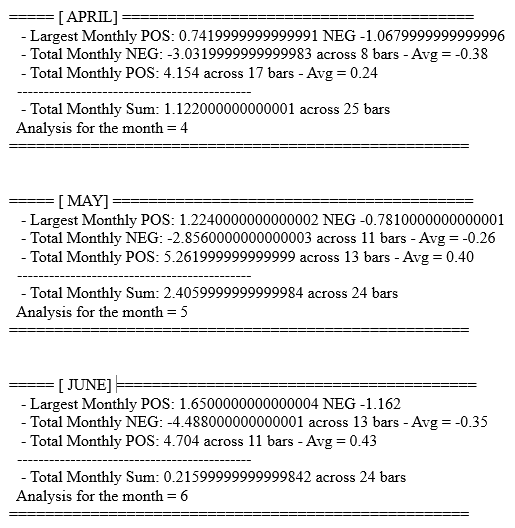

Our data mining utility reported the following data for April, May, and June in Natural Gas.

Monthly Natural Gas Price Chart

If we look at the APRIL data, the POS bars = 17 and the NEG bars = 8 – that sets up a slightly greater than 2:1 ratio of advancing price over declining price in April. The “Total Monthly Sum” across 25 instances of data is $1.12 whereas the Average for the POS price activity comes to just $0.24.

This suggests that in April, we have a fairly high opportunity for some upside price activity in Natural Gas based on this data – a nearly 2:1 advancing price ratio (historically). Yet it also means that advancing price may only rally $0.35 to $0.75 from any price bottom – so we have to be aware of risks that may exist with a small price advance from the current low levels.

If we take a look at the MAY data, the POS bars = 13 and the NEG bars = 11 – that sets up a 1.18:1 ratio that suggests a very slight advantage to the possibility that continued upside price activity will happen in May. Yet, the upside price advantage shown my the “Total Monthly Sum” data suggests a very big opportunity for a breakout rally in May (+$2.40). The way I interpret this data is to understand that May is roughly 60/40 biased to the upside whereas if any upside move takes place in April, a continuation of that trend in May could be incredibly profitable with a proper strategy.

Take a look at the JUNE data and try to come up with an interpretation yourself. The POS bars / NEG bars represent a less than 1:1 ratio. The Total Monthly Sum ($0.21) is not a very substantial price advance. The data is somewhat indecisive or inconclusive in suggesting any real price advantage in June for trading.

Yet, we have a very clear advantage in April and May. So, how are we going to approach this trade setup?

Weekly Natural Gas Chart – Cycles & Support

Currently, NG is testing very deep price levels within the BLUE support range box. Aggressive traders can attempt to look for opportunities within this range but must understand risks are still high for continued moderate price decline before a bottom sets up in April. Skilled traders would wait for the bottom to set up and possibly look for opportunities in ETFs as a means to limit risks on initial positions – attempting to scale into the trade comfortably.

Once the rally in NG really sets up and breaches the $1.98 level moving higher, then we believe we have a very real rally on our hands that may see price levels back above $2.75 eventually. The $1.85 to $1.99 price level will act as resistance as price attempts to move higher.

Why are these types of setups so important to skilled traders? Historical price structures and patterns, like this data mining pattern, help to clearly illustrate strategic advantages in certain markets for skilled traders. Determining how to set up a proper trade knowing this data is also important. Risks exist with every trade you make and I’m sure we’ve all learned a lesson or two about making a hasty trade and not thinking about it?

Our research team believes April and May 2020 could be very exciting for Natural Gas.