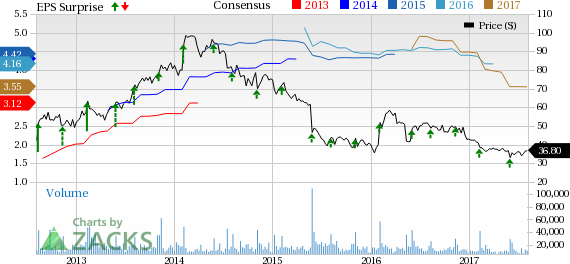

Michael Kors Holdings Limited (NYSE:KORS) is scheduled to report first-quarter fiscal 2018 results on Aug 8. In the last quarter, the company delivered a positive earnings surprise of 4.3%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

Michael Kors has a remarkable history, at least in terms of the bottom line. The company continued with its positive earnings surprise streak for the seventh straight quarter, as it reported fourth-quarter fiscal 2017 results. In the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 8.1%. The current Zacks Consensus Estimate for the quarter is 62 cents, reflecting a year-over-year decline of over 29%. Analysts polled by Zacks expect revenues of $918 million, down over 4% from the year-ago quarter.

Well the obvious question that comes to mind, will Michael Kors be able to sustain its positive earnings surprise streak in the fourth quarter. Well past trends do indicate toward that direction but it will not be wise to jump to a conclusion without analyzing the factors at play.

Factors at Play

We remained concerned about Michael Kors’ wholesale segment performance, which has witnessed a sharp decline in the previous few quarters. In fourth-quarter fiscal 2017, wholesale segment sales declined 22.8% to $456.1 million primarily due to dismal performance of Americas and European regions, while on a constant currency basis, it fell 22.3%. In the third, second and first quarters of fiscal 2017, wholesale segment sales declined 17.8%, 18.4% and 7%, respectively. In fiscal 2018, the company expects wholesale segment to decrease in the low-teens range.

Stiff competition, waning comps, aggressive promotional environment and sluggish mall traffic are making things tough for Michael Kors. We noted that comparable sales had fallen 14.1% in the final quarter of fiscal 2017, following declines of 6.9%, 5.4% and 7.4% in the third, second and first quarters, respectively. The company is also struggling with its top-line performance. After registering a meager growth of 0.2% in the first quarter of fiscal 2017, it had declined 3.7%, 3.2% and 11.2% in the second, third and fourth quarters of fiscal 2017.

For the first quarter, Michael Kors forecasts total revenue between $910 million and $930 million, and expects comparable sales to decline in the high-single digit range. Operating margin is anticipated to be approximately 13%. Management projects earnings in the range of 60–64 cents per share for the first quarter.

However, the company has been constantly deploying resources to expand product offerings, open new stores, and build shop-in-shops along with upgrading information system and distribution infrastructure. Management intends to upgrade eCommerce platform and expects the channel to be a significant contributor in the long run. We note that despite the possibility of heavy investments weighing upon the margins in the short term, management continues to take up strategic endeavors.

What the Zacks Model Unveils?

Well our proven model does not conclusively show that Michael Kors is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Michael Kors has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 62 cents. Moreover, the company carries a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and a Zacks Rank #2.You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco Wholesale Corporation (NASDAQ:COST) has an Earnings ESP of +0.50% and a Zacks Rank #3.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research