Mexico had a great run in the round robin portion of the World Cup. A tie against favorite Brazil in their home country and then the big win against Croatia to finish second in the group and advance. But that is all forgotten now as they prepare to play the Netherlands on Sunday in the elimination round. The Netherlands breezed through their group with 3 wins including a thrashing of the defending champion Spain. So who will win on Sunday? That will be answered on the field and hopefully with no biting. But it is quite possible that the Mexican run may be over.

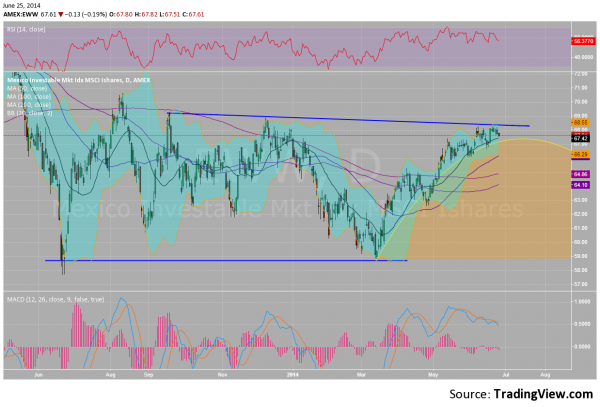

Interestingly the Mexican stock market (iShares MSCI Mexico (ARCA:EWW)) has been moving higher as well during this time. But it too is showing possible signs of tiring and a pullback. Take a look at the chart below.

From the middle of March it has been rising off of a double bottom in anticipation of the World Cup. Then it paused just ahead of the start. When play began the market continued higher. But the rate of growth has been slowing as it approaches trend line resistance. Will it fall back along the curve? Or will it regroup and push through to new highs? The momentum indicators do not give good news for Mexican fans. Both the RSI and MACD are falling, supporting at least a consolidation and perhaps a pullback. A move under 67 would seal the deal for a move lower likely to at least the 64.10 to 64.80 area. Fortunately for Mexican Fotbul fans, this has no real correlation to the outcome of the game. Or does it? I will be watching Sunday.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.