While growth investing is always a popular strategy, you should not discount the benefits that come with focusing on value metrics. Value investing allows investors to discover stocks with low price-to-earnings ratios, solid outlooks, and decent dividends.

Today, we have identified a good candidate that offers impressive value: Marathon Petroleum Corp. (NYSE:MPC) .

Marathon in Focus

Headquartered in Findlay, Ohio, Marathon is the third-largest U.S. refiner based on crude oil refining capacity, operating an integrated oil refining system concentrated primarily in the Midwest. Shares have gained over 23% so far this year compared to its industry’s year-to-date return of 9.6%

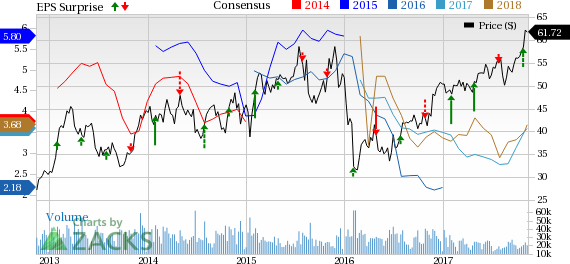

MPC could be an interesting play for a number of reasons. The company’s forward P/E of 17.18, P/S ratio of 0.42, and dividend yield of 2.59% suggest that Marathon is a pretty good value pick, since investors have to pay a relatively low level for each dollar of earnings. MPC also has decent revenue metrics to back up its bottom line.

But before you think that Marathon is just a pure value play, it’s important to note that the company has been witnessing solid estimate revision activity. For the current year, earnings are expected to grow nearly 68%, with sales increasing 14.5% in the same time frame; nine analysts have shifted their estimate higher in the last 30 days compared to none lower.

This overall estimate strength has been enough to push MPC to a Zacks Rank #2 (Buy), suggesting the company is poised to outperform. Marathon is looking great from a number of different angles, from its low value ratios and to its strong Zacks Rank, which means that this oil giant could be a solid pick for value investors at this time.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Original post

Zacks Investment Research