By Alex Kimani

- Wall Street is raising serious concerns about sky-high valuations of EV-makers

- Lithium markets have grown significantly tighter in 2021

- EV-makers continue to use more lithium per battery

The EV revolution is well and truly underway, and the sector continues setting new records. A recent report by the Korea Automotive Technology Institute (KAII) shows that global EV sales exceeded 3 million units in the first three quarters of 2021, a run rate that puts it on course to break 4 million units a year for the first time ever. BloombergNEF is even more sanguine and expects global sales of electric passenger vehicles this year to clock in at 5.6 million units, good for an impressive 8% of new vehicle sales.

China remains, by far, the biggest buyer of electric vehicles, with 1.76 million units sold in the country during the period. The United States comes in a distant second with 272,554 units followed by Germany 243,892 units; UK 131,832 units; France 114,836 units; and Norway 84,428 units. EV sales accounted for 9.4% of new vehicle sales in China but just 2.3% in the USA.

On a company basis, Tesla (NASDAQ:TSLA) remains the most popular model after moving 625,624 units; China's SAIC Motor (SS:600104) sold 413,037 units; Volkswagon (OTC:VLKAF) 287,852 units; and China's BYD Corp (OTC:BYDDY) with 189,751 units. Back in October, Tesla reported that it delivered 241,300 electric vehicles during the third quarter of 2021, more than 70% higher than last year's deliveries for the same period and significantly better than the 220,900 deliveries predicted by Wall Street.

Sales figures for the fourth quarter are already looking great, with Xpeng (NYSE:XPEV) and BYD reporting that October sales tripled vs. a year earlier while Li Auto (NASDAQ:LI) has reported that sales have doubled.

While these are very impressive numbers by any yardstick, investing in EV stocks is anything but simple or straightforward.

To wit, those rosy growth numbers have not stopped a cross-section of Wall Street from raising serious concerns about the stratospheric valuations in the space.

According to Bernstein analysts, the 15 largest ICE manufacturers command a collective market cap of $1.2T compared to the $1.1T collective valuation of pure-play EV vendors, despite the fact that the former sell 99% of all new vehicles globally while the latter manage a minuscule 1%.

And that could prove problematic for EV stocks.

Steep valuations

Bernstein's Tony Sacconaghi makes a pretty succinct point about how the market values EVs versus traditional ICE makers:

"The thinking–of course–is that pure play EV vendors will ultimately come to dominate the automotive world. In 2014, they accounted for 15% of all BEVs sold. Today they account for 28%. However, even if they ultimately were to account for 50% of all EVs sold by 2030 – which may be aggressive – it remains difficult to justify their current valuations."

Bernstein is worried that the market is assuming that traditional OEMs will not be able to deliver competitive EV offerings in the future, or they will be very delayed in doing so. Further, the market appears to think that EV upstarts will be able to generate significantly more profit per car, mainly by taking advantage of better distribution and autonomy/add-on services. The analyst points out that this assumption is not entirely without merit since full autonomous driving priced at $10K per car would radically change the margin (and valuation) profile of the industry.

But Sacconaghi begs to differ with the assumption that pure EVs like Tesla will always maintain a huge operational advantage over their late-to-the-party ICE (NYSE:ICE) rivals:

"That said, our contention is that the automotive industry is an increasingly global and hypercompetitive industry and we believe that surplus profits and technology innovation will likely be competed away over time, as has been the case historically."

Further, EV companies remain vulnerable to short-term headwinds including valuation concerns and supply chain bottlenecks , with newer pure-play EV upstarts such as Fisker (NYSE:FSR), Faraday Future Intelligent (NASDAQ:FFIE), Lordstown Motors (NASDAQ:RIDE), Nikola (NASDAQ:NKLA), Nio (NYSE:NIO), XPeng (NYSE:XPEV), Li Auto, Canoo (NASDAQ:GOEV) and Rivian (NASDAQ:RIVN) more vulnerable.

Indeed, whereas TSLA boasts an impressive 54.3% YTD return, many EV startups are struggling: FFIE (-15.6%), RIDE (-74.5%), NKLA (-12.3%), XPEV (+12.8), Li (+11.6), GOEV (-21.7%), and WKHS (-65.7%). Fisker and Lucid Motors are outliers in this category with YTD returns of 46.1% and 425%, respectively.

Lithium boom

Investing in the lithium sector appears like a safer way to play the EV boom.

With the energy transition in full swing, Wall Street experts have predicted that metals that power the clean energy sector such as lithium, copper, nickel, and cobalt are poised to become the oil of the future.

According to a recent Eurasia Review analysis, prices for the four metals could reach historical peaks for an unprecedented, sustained period in a net-zero emissions scenario, with the total value of production rising more than four-fold for the period 2021-2040, and even rivaling the total value of crude oil production.

In a net-zero emissions scenario, the metals' demand boom could lead to a more than fourfold increase in the value of metals production–totaling $13 trillion accumulated over the next two decades for the four metals alone. This could rival the estimated value of oil production in a net-zero emissions scenario over that same period, making the four metals macro-relevant for inflation, trade, and output, and providing significant windfalls to commodity producers.

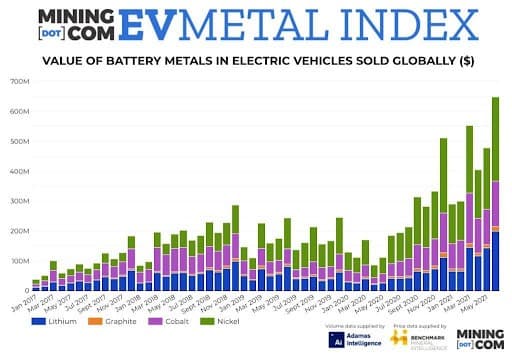

Last year, Mining.com launched the EV Battery Metals Index, a tool that tracks the value of lithium, cobalt, nickel, and other battery metals flowing into the global EV industry at any given point in time. The index combines two main sets of data: prices paid for the mined minerals at the point of entry into the global battery supply chain and the sales-weighted volume of the raw materials in electric and hybrid passenger car batteries sold around the world.

According to an August Mining.com report, the EV Metal Index clocked in at $2.68 billion by the end of June, which in effect means that more EV battery metal business was done in H1 2021 than all of 2020, itself a record year.

Lithium continues to lead the way, with average lithium on a per-vehicle basis, including hybrids was up 30% year over year in June, jumping from 14kg to just over 18kg. According to Benchmark Mineral Intelligence, lithium prices have doubled year-to-date and now tops $16,500 a tonne (hydroxide ex-works China mid-August).

Jiangxi Ganfeng Lithium, the world's largest lithium mining company with a market capitalization of $19 billion, has predicted that lithium prices will continue to rally as lithium production struggles to keep up with massive demand for EVs. The Chinese company has some decent street cred--after all, it counts leading EV automakers such as Tesla Inc. and BMW (OTC:BMWYY) among its customers.

Source: Mining.com

Investors who entered the lithium space a few years ago jumped the gun then, partly out of poorly timed over-enthusiasm, and partly because the logic ran like this: Any new lithium mines that could contribute to the EV battery onslaught would take years to bring online, from scratch--so best to get started in advance.

Now, with the EV boom squarely in the front view mirror and with battery gigafactories promising to be heavy-hitting purchasers, we can finally see the much-anticipated supply crunch forming.

Battery-grade lithium carbonate prices started to buck a three-year downturn during the second half of 2020 thanks to robust EV demand roaring back from the coronavirus. Lithium carbonate prices have gained 91% so far in 2021.

That's mainly thanks to the postponement of lithium project expansions in South America--due to previous demand forecasts as well as the impact of the pandemic. This is expected to slow down the short-term supply of the lithium compound and improve pricing, according to Ganfeng.

Here are some top stocks to play the ongoing lithium and EV boom.

1. Albemarle Corp.

- Market Cap: $32.3B

- YTD Returns: 85.3%

Albemarle Corporation (NYSE:ALB) is a Charlotte, North Carolina-based lithium producer that develops, manufactures, and markets engineered specialty chemicals worldwide.

The company's Lithium segment offers lithium compounds, including lithium carbonate, lithium hydroxide, lithium chloride, and lithium specialties for use in lithium batteries for consumer electronics and electric vehicles, high-performance greases, thermoplastic elastomers for car tires, rubber soles, plastic bottles, catalysts for chemical reactions, organic synthesis processes and other markets.

In its latest earnings report, ALB posted Q3 revenue of $830.6M (+11.2% Y/Y), beating the Wall Street consensus by $66.01M; Non-GAAP EPS of $1.05 beat by $0.28 while adjusted EBITDA clocked in at $217.6 million.

About a week ago, Degas Wright, founder and CEO of Decatur Capital, told CNBC that ALB shares Albemarle should benefit from the euphoria over electric vehicles.

2. Lithium America Corp.

- Market Cap: $4.0B

- YTD Returns: 162.3%

Lithium Americas Corp (NYSE:LAC)--formerly Western Lithium USA Corporation--is a Canadian lithium exploration company that operates as a resource company in the United States. LAC owns interests in the Cauchari-Olaroz Project located in Jujuy province of Argentina and Thacker Pass project located in northwestern Nevada.

In March, investment advisory B. Riley initiated coverage of LAC stock with a Buy rating and a price target of $25, noting that the company was nearing completion of a major lithium project and developing another long-term resource in the United States. LAC shares have been rallying after the company successfully expanded the mineral resource estimate at its Thacker Pass project in Nevada to 13.7M metric tons of lithium carbonate equivalent and raising planned Phase 1 capacity to target 40K mt/year of lithium carbonate.

Lithium Americas has also been expanding inorganically, and has agreed to buy Millennial Lithium for ~US$400M in cash and stock. The company says the addition of Millennial's Pastos Grandes lithium brine project in Argentina provides an attractive regional growth opportunity in proximity to its Caucharí-Olaroz project, with the potential to extract significant synergies.

3. Livent Corp

- Market Cap: $4.8B

- YTD Returns: 58.2%

Pennsylvania-based Livent Corporation (NYSE:LTHM) is one of the newest companies in the lithium space having been incorporated in 2018. Livent manufactures and sells performance lithium compounds primarily used in lithium-based batteries, specialty polymers, and chemical synthesis applications in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Last month, Citi upgraded LTHM to Buy from Neutral, saying the company should benefit from improved pricing and planned capacity expansions in 2022 and 2023.

Citi sees the lithium sector continuing to benefit from tight fundamentals thanks to robust demand from electric vehicles while supply is struggling to keep pace.

Meanwhile, analysts at Piper Sandler recently initiated Livent with an Overweight rating citing an upbeat outlook for the battery chemistry and materials sector.