I’m sure all of our readers can name a few seasonal industries.

Tourism and hospitality earnings obviously fluctuate throughout the year. Some energy companies are affected by annual shifts between summer-blend and winter-blend gasoline. And it’s no secret that many retailers make most of their money in the last three months of the year.

But did you know that legal marijuana sales are also seasonal?

They sure are.

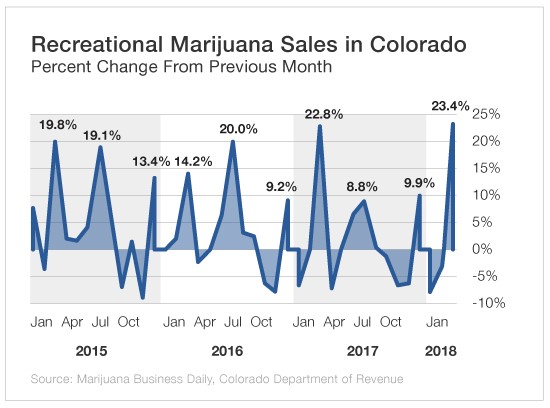

This week’s chart - compiled by Marijuana Business Daily using data from the Colorado Department of Revenue - shows a consistent surge in marijuana sales in the spring and summer and a drop-off in the fall.

This yearly pattern has big implications for marijuana investors - especially as Canada prepares to legalize the stuff nationwide this summer.

Why do legal marijuana sales follow the seasons?

You might think marijuana’s seasonality centers around 4/20, the annual stoner celebration. But if you look closely at the chart, you’ll see a consistent lull in April sales.

Instead, tourism seems to be the main driver of this spring and summer surge. And as I mentioned above, tourism is one of the most seasonal industries in existence.

Out-of-staters accounted for more than half of legal marijuana sales in Denver in 2014, according to a recent report from the Colorado Department of Revenue.

And a more recent study from the Colorado Tourism Office found that nearly half of the visitors polled came because of the state’s marijuana laws.

With these statistics in mind, it’s easy to see why marijuana sales fluctuate throughout the year in Colorado. They ramp up along with tourist traffic as the weather gets warmer. Then they fall during Colorado’s autumn off-season.

Why does any of this matter to your portfolio?

Because Canada is set to legalize marijuana nationwide in just a few months. It’s already the home of most publicly traded marijuana companies. And like Colorado, it has a beautiful summer tourism season and a chilly autumn off-season.

How do you play this seasonal industry?

If Canada’s marijuana retailers are anything like Colorado’s, their seasonal trends should also be exploitable.

You could simply buy pot stocks during the autumn off-season and sell them during the summer. And you could use call options to amplify your short-term gains.

Or, for even less effort, you could just read Matthew Carr’s newsletters. He’s The Oxford Club’s resident expert on both marijuana investing and seasonal trend trading.