King Dollar is a major player in the financial markets. And its moves are especially important to commodities and emerging markets.

Well, portfolio managers and traders in those markets may want to pay attention to today’s chart because the US Dollar Index may be setting up for a big move. Back at the end of February, we highlighted why the US Dollar was ready to bounce.

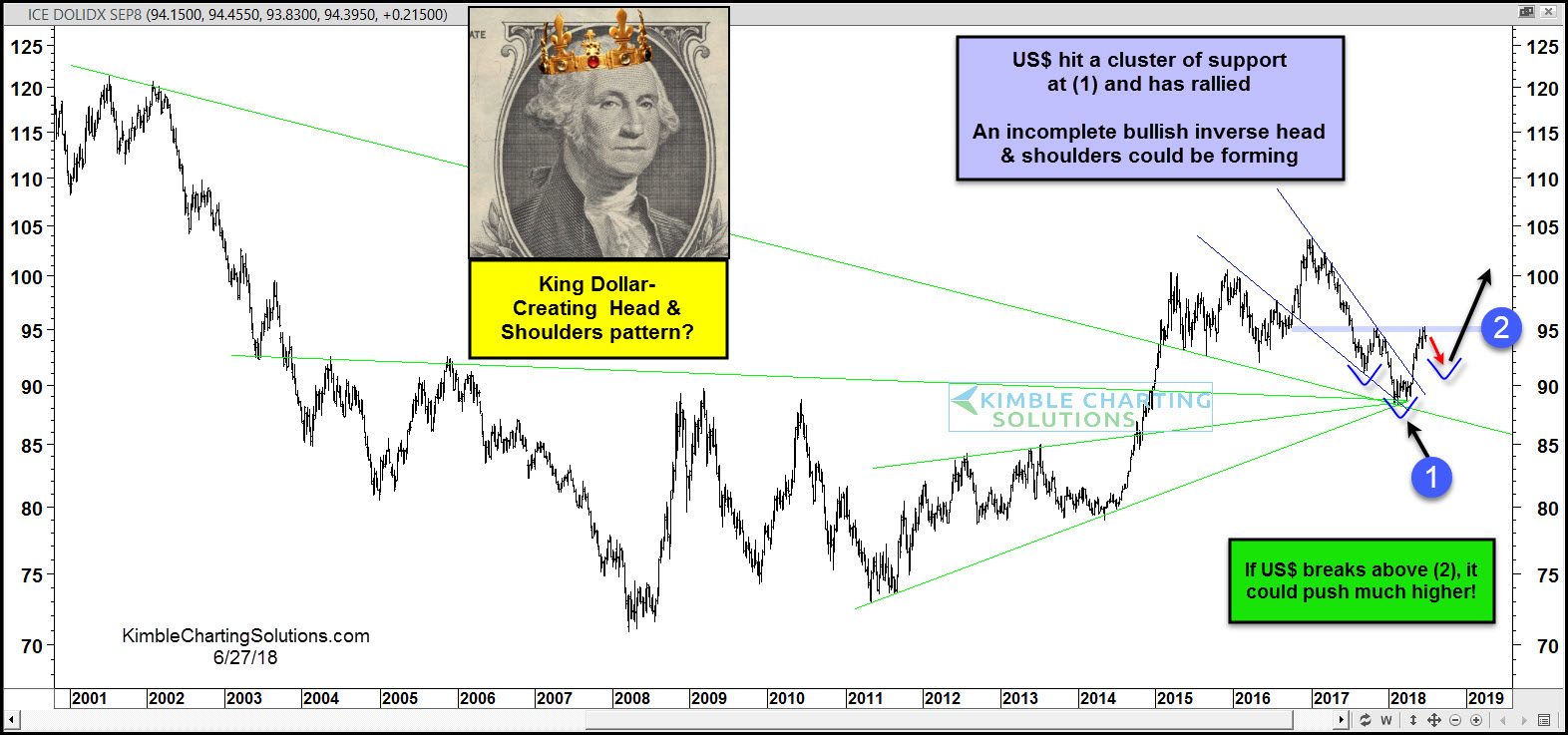

That post was written just as King Dollar was testing a confluence of support and nearing resolution from a bullish falling wedge pattern (point 1 on the chart below). Here’s an excerpt:

From a technical view, the dollar is attempting to poke its head above a bullish falling wedge pattern. This all occurring after hitting a cluster of price support.

Well, the Dollar did bounce higher. And if today’s chart pattern is a precursor, King Dollar may be ready to morph this bounce into a full-blown rally.

We are testing lateral resistance at the November 2017 highs (point 2). Could this resistance prove to be the neckline of a bullish inverse head and shoulders pattern? It’s currently an incomplete pattern, but even the slightest pullback could form the right shoulder.

In any event, a breakout here would be very bullish for the PowerShares DB US Dollar Bullish (NYSE:UUP) And this would likely effect the portfolios of investors around the world. Stay tuned!

US Dollar Index Chart