The market could be showing its own version of the disconnect.

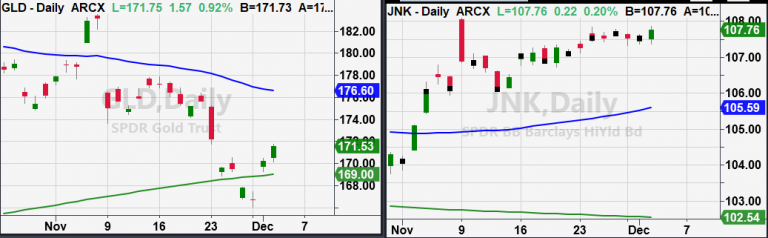

In the past, we have looked at High Yield Bonds SPDR® Bloomberg Barclays (LON:BARC) High Yield Bond ETF (NYSE:JNK) to get a picture of the market's risk appetite.

In general, if JNK moves higher, investors are willing to accept more risk.

Conversely, gold (GLD (NYSE:GLD)) is seen as a less risky play as investors look for safe places to store money throughout high inflationary periods or downward market trends.

Yesterday SPDR® Gold Shares (NYSE:GLD) confirmed a second day over the 200 day moving average.

Its recent gap up from the 166 low proved that investors haven’t thrown in their golden towel, even with market highs close by.

JNK also performed well closing just under last week's high of 107.85.

If both GLD and JNK continue to move higher it could be showing that while the market wants to continue to new highs, it’s also worried.

Whether it’s worried for longer-term inflation, pending geopolitical stress or a renewed market correction is hard to tell. Watching the correlation between the two’s performance, especially if they diverge further, could be a great tell for the near term.

S&P 500 (SPY) Support 363.12

Russell 2000 (IWM) Support 10-DMA at 181.04 with 185.44 resistance.

Dow (DIA) Resistance 300. 292.20 support.

Nasdaq (QQQ) 300 new support.

KRE (Regional Banks) 51.07 Resistance. Support 47.22

SMH (Semiconductors) All-time high close.

IYT (Transportation) 225.49 resistance with key support 215 key.

IBB (Biotechnology) Doji Day. Sitting in support around 145 area.

XRT (Retail) 61.40 resistance. Support the 10-DMA at 59.57