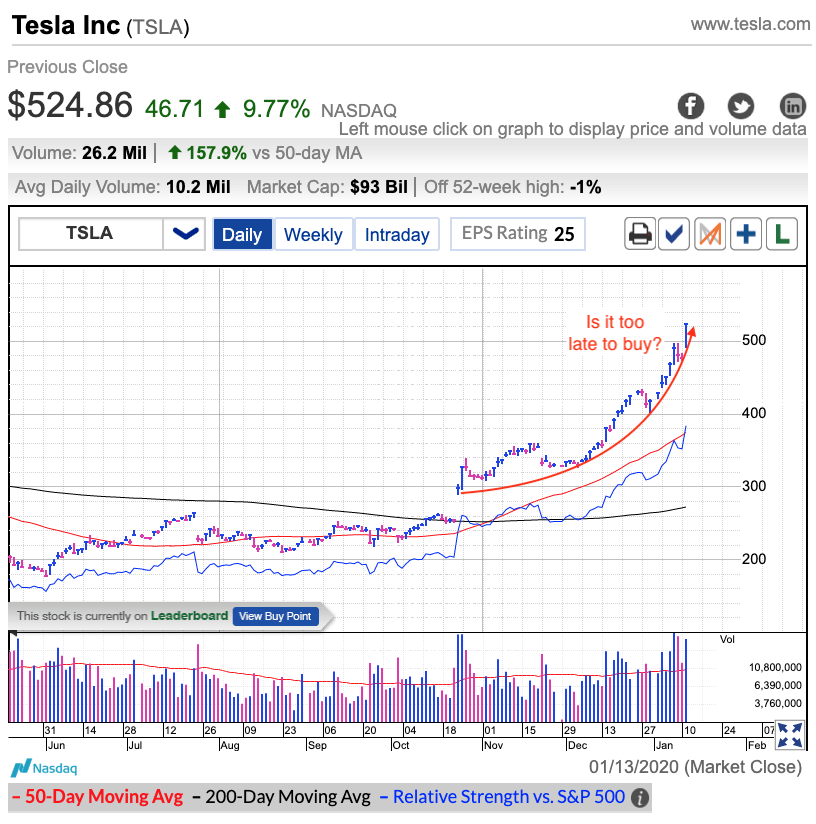

Tesla (NASDAQ:TSLA) is on fire right now. The buying frenzy got so heated yesterday the stock surged almost 10% in just a few hours. What triggered the excitement? Some analysist raised his price target. (Remember to be cautious of analysts' advice.)

We saw this surge before it happened. Back on December 19th, I wrote to expect something big out of TSLA as it challenged resistance that has been holding the stock back for nearly two years. Either the stock was going to smash through resistance, or it was going to get beaten back for the umpteenth time. Either way, this represented a golden trading opportunity. I suggested readers consider buying the stock above $390 and shorting it if it fell under $390. It doesn’t get any more straightforward than that.

That said, this trade turned out even easier than I expected. I figured the stock would stall at resistance for a little while before making its decisive move. No, it was in too much of a hurry and smashed through $390 resistance, making a quick 35% for anyone who was paying attention and willing to take the risk.

But now that the stock is 35% higher, would I consider buying it here? No way.

The risk given the high price of this stock is scary. Regardless of the company’s fundamentals, crazy surges like this are not sustainable. Expectations have become so high, it would be nearly impossible for the company’s earnings report to exceed them and send this stock even higher. We buy when everyone doubts the stock, not when it is making front-page news across the entire internet.

For those who jumped aboard this bandwagon last month, it could be wise to form a plan to get out. Whether that is taking profits proactively or following the stock higher with a trailing stop. Or even better, a little bit of both.