Just a few years ago, bitcoin was worth pennies. Investors could be forgiven for writing it off as a fad.

Today... not so much.

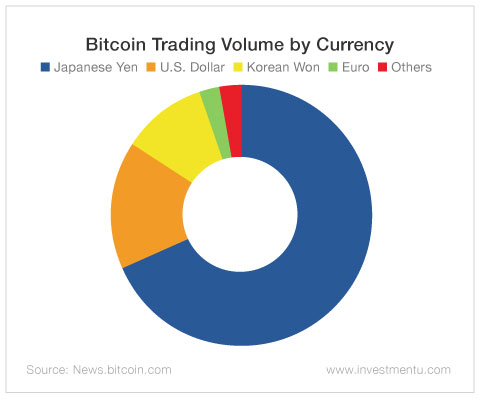

The cryptocurrency’s price crossed the $10,000 mark for the first time last week. And as you can see from today’s chart, it has indisputably gone global.

More than three-quarters of bitcoin trading volume today is conducted in Asian currencies - specifically the Japanese yen and the Korean won. On top of that, it’s gaining popularity in emerging markets like South Africa and Estonia, as well as in distressed economies like Venezuela.

This surge in global adoption is great news for longtime bitcoin holders. But for the rest of us, it raises a troubling question: Is it too late to buy bitcoin and get in on the gains?

Late to the Party

Believe it or not, many cryptocurrency experts think it might be. Consider these words from a recent article by Andy Gordon, co-founder of Early Investing...

When [one of my relatives] said that bitcoin was in a bubble, he was roughly right. Not that the current bullish sentiment lifting bitcoin’s price to new heights is wrong. But sentiment can be fickle and can turn against an asset class, driving prices down as quickly as they had gone up. Who am I to say that bitcoin is immune to such a reversal? Of course it’s not.

Bitcoin has had quite the wild run this year. Neither the bulls nor the bears can tell you with any certainty whether that run will continue into 2018.

But just because you might be a little late to adopt bitcoin - and that’s still debatable - that doesn’t mean that you’ve missed the boat on all cryptocurrency investment opportunities. In fact, the biggest gains in cryptocurrency history are likely still ahead of us. They just might not be in bitcoin.

The Birth of a New Asset Class

Thanks to the open-source nature of bitcoin, developers are free to copy its source code, make their own improvements to it and launch their own cryptocurrencies.

There are thousands of these alternative coins (or “altcoins”) in circulation today. And they’re already hammering away at bitcoin’s market share.

I recently spoke with Adam Sharp, Andy’s business partner and the other co-founder of Early Investing. He rattled off this surprising statistic about the cryptocurrency market...

For most of cryptocurrencies’ history, bitcoin has been dominant - 95% of the entire market. Today it’s only around 50% of the entire market.

Maybe bitcoin will keep racking up quadruple-digit gains in the years ahead... maybe it won’t. But for its younger, cheaper altcoin cousins, the sky’s the limit.