A bear-market bias continues to weigh on the US Dollar Index, which has tumbled sharply this year. That’s a bullish tailwind for US investors holding assets denominated in foreign currencies. Owning gold and cryptocurrencies—alternative forms of “money” untethered to the greenback—have been a profitable trades this year too.

Supporting the bearish dollar view: this year’s aggressive US fiscal and monetary policies to offset the coronavirus blowback, with more of the same expected in the new year as the incoming Biden administration focuses on repairing the economy. Some analysts also see higher inflation in 2021 and beyond as the economy rebounds on the back of vaccine rollouts. By some accounts, it all adds up to a perfect storm for the world’s reserve currency.

If you’re inclined to agree, diversifying into non-dollar-denominated assets looks appealing. The first question: How do you define dollar hedging? There are many possibilities, including The Capital Spectator’s newly minted Dollar Hedge portfolio (DH), which will make periodic appearances on these pages as an equal-weighted benchmark of ten publicly traded funds (primarily ETFs) of various asset classes that are:

- priced in something other than US dollars;

- track a short-dollar beta;

- hold a basket of the main cryptocurrencies, including Bitcoin and Ethereum (weighted by market capitalization); and

- own gold and an equal-weighted mix of commodities, both of which tend to offer low correlation with changes in the dollar:

SPDR® Bloomberg Barclays International Treasury Bond ETF (NYSE:BWX)

VanEck Vectors International High Yield Bond ETF (NYSE:IHY)

VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC)

Invesco DB US Dollar Index Bearish Fund (NYSE:UDN)

Grayscale Digital Large Cap Fund Ll (OTC:GDLC)

Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA)

Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO)

WisdomTree Continuous Commodity Index Fund (NYSE:GCC)

Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI)

The idea here is to naively track the opportunity set for the obvious choices for non-dollar assets via publicly traded securities (US listed). The choice of equal weighting the ten funds is a conscious effort to sidestep active bets and instead focus on the aggregated beta footprint. Accordingly, this tracking strategy offers a real-time measure of how non-dollar investing is trending.

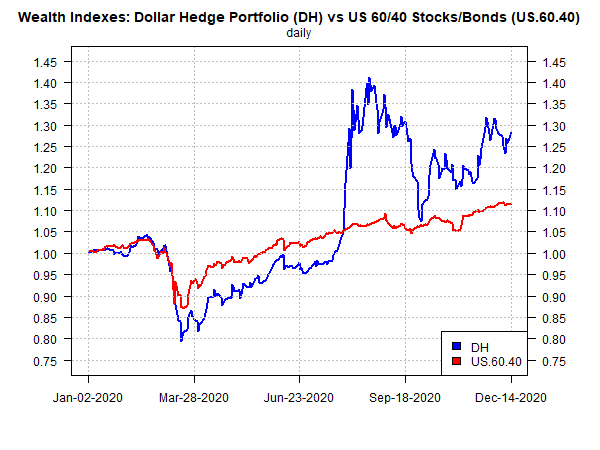

With that in mind, the chart below shows how the DH strategy fares so far this year against a simple 60/40 US stock/bond mix. For the moment, DH is in the lead by a wide margin, in part because of the extraordinary run in cryptocurrencies this year: Grayscale Digital Large Cap Fund LLC (GDLC) is up more than 200% year to date (through Dec. 14).

Will the dollar will continue to fall in 2021? If it does, the odds appear favorable that DH will continue to capture upside at the greenback’s expense.