Cryptocurrency trading marketplace Coinbase (NASDAQ:COIN) stock triggered a short squeeze on its horrendous Q2 2022 earnings report. Shares are still down (-66%) for the year even after more than doubling off its $44.15 lows on June 30, 2022. The stock had a 21% short interest heading into its earnings report which fueled a squeeze as high as $98.70 before pulling back.

The favorable CPI data indicating possible peak inflation also added to the buying. Coinbase went from making $771 million in net income in Q1 2021 to losing (-$430 million) one year later, swinging nearly $1.2 billion from big green to deep red. Competition from mainstream brokers and fintechs like Robinhood (NASDAQ:HOOD) continues to build as they provide more access to cryptocurrency markets. Coinbase has grown its institutional client base north of 13,000 clients through its Coinbase Prime platform. Institutional clients account for over 75% of the trading volume, and the trading volume is directly tied to the revenues. Bitcoin has fallen over (-48%) this year but is attempting to stage a rally. Therein lies the key.

Where Bitcoin Goes… So Goes COIN

Bitcoin collapsed from a high of $69,000 on Nov. 8, 2021, to a low of $17,567 on June 18, 2022. It’s no coincidence that Coinbase stock collapse coincides with the collapse in bitcoin prices. You can peg the price of Coinbase stock to the movement of bitcoin. As bitcoin collapsed, so did Coinbase shares. Bitcoin has been attempting to breakout after basing the $20,000 price level. The key resistance sits at $25,150, which is also the key breakout level. If bitcoin manages to breakout, then Coinbase stock should also rally. One could argue that the bar has been set very low moving forward to provide a floor for the stock and better odds of an earnings beat. If the lows are behind for bitcoin, then it should also apply to COIN shares.

Nasty Numbers in the Second Quarter

Coinbase released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported earnings per share (EPS) loss of (-$4.98) versus (-$1.23) consensus analyst estimates, a (-$3.75) miss. Revenues collapsed of (-63.7%) year-over-year (YoY) to $808.3 million missing (-868.39) consensus analyst estimates. Monthly transacting users (MTUs) grew 2.3% YoY to 9 million. Trading volume fell (53%) to $217 billion.

It Gets Worse

Coinbase provided its forecast for the next quarter. For Q2 2022, MTUs are expected to be lower than Q2 2022. Total trading volume is also expected to be lower than Q2 2022. Subscription and services revenues are expected to be modestly higher. For the full-year 2022, Coinbase expects the MTUs to average between 7 million to 9 million, from the prior guidance of 5 million to 15 million. Average transaction value per user is expected in the low $20s. Subscription and services revenues should come in over $600 million. Expectations have been set low.

CEO Comments

In the Q2 2022 conference call, CEO Brian Armstrong pointed out that things are never as good as they seem or bad as they seem. He noted that this is the fourth crypto cycle they’ve been through acknowledging that they are in a down cycle. During down cycles, the Company is focused on building. Down cycles are a “breath of fresh air” compared to up cycles where they are frantically growing and scaling. Down cycles enable them to focus on product and platform innovations and paying down tech debt. The Company is also focused on managing expenses so that it can outlast any type of down cycle, for which they raised cash in 2021. He pointed out that crypto is not linear and any given quarter or year could be up or down. Instead, investors should focus on the business across price cycles to get a better picture. He summed up the challenge:

“So the goal of these products, of course, is to help 1 billion people access eventually the primary to access the open financial system and be the primary financial account for them."

BlackRock and Meta Wins

Meta Platforms (NASDAQ:META) selected Coinbase as a partner in developing its crypto offerings in the metaverse. The world’s largest asset manager BlackRock (NYSE:BLK) has selected Coinbase to provide its Aladdin software users to access crypto trading and custody through Coinbase Prime. Aladdin is BlackRock’s asset management platform used by over 200 institutions since 1999. BlackRock also launched its first private trust offering bitcoin exposure to U.S. institutional clients. Many feel this has helped solidify the bottom in bitcoin as more institutions come into the picture.

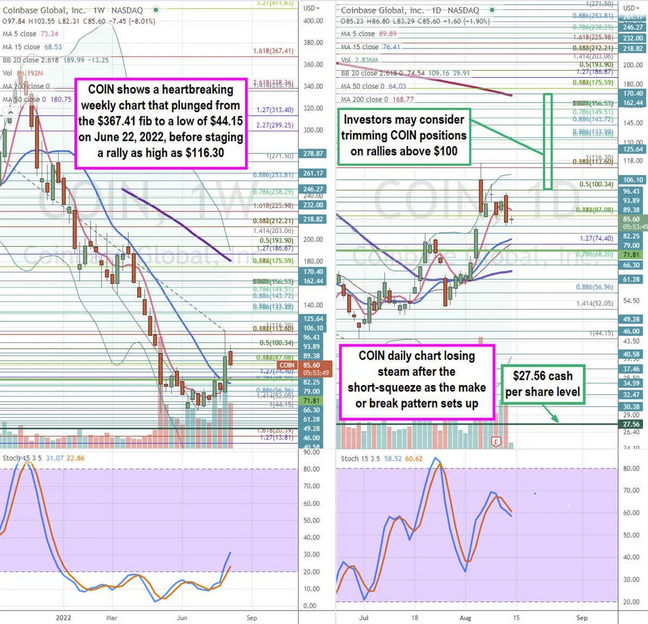

Here’s What the Charts Say

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for COIN stock. The weekly rifle chart peaked near the $367.41 Fibonacci (fib) level before plunging to the $44.15 lows on June 30, 2022. The weekly rifle chart managed to finally bounce hard the stochastic formed a mini pup up through the 20-band triggering the weekly market structure low (MSL) buy signal on the $71.81 breakout. The weekly 5-period moving average (MA) support at $73.24 through the 15-period MA at $68.53. The weekly 50-period MA is falling at $180.75. The daily rifle chart uptrend peaked as momentum is slowing down. The daily stochastic crossed back down at the 70-band. The daily 5-period MA support is sloping down at $89.89 and 15-period MA is slowing at $76.41. The daily 200-period MA sits at $168.77. Investors looking to trim down their positions on COIN can look for any spikes above $100 to trim shares. This would require the daily stochastic to cross back up and likely through the 80-band. COIN has a cash-per-share value of $27.56 which would be a solid support area for those waiting for a deep pullback. Keep an eye on bitcoin as mentioned, COIN tends to follow the trend with bitcoin.