The Federal Reserve is expected to raise interest rates again later this month, but if that’s another signal that headwinds are building for fixed-income securities the warning isn’t resonating in the junk bond market these days.

The crowd’s appetite for below-investment-grade US debt remains strong in the eighth year of a US economic expansion. By some accounts, the hour is late and so there’s reason to wonder if a full-throttle embrace of junk is wise. With yield spreads near post-recession lows and the expected trajectory of interest rates still pointing upward, the bears argue that low-grade corporate debt’s best days are in the rear-view mirror.

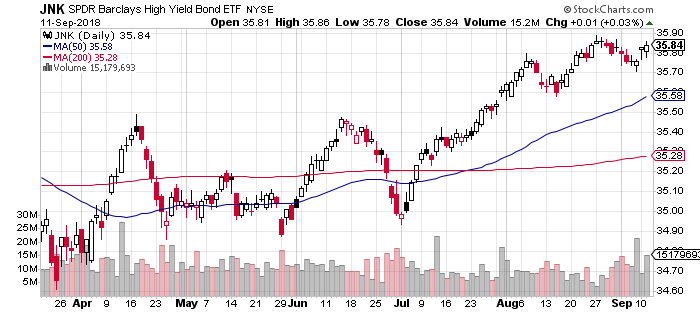

Yet the sentiment reflected in prices presents a different view, based on several widely held funds targeting US high-yield bonds. SPDR Barclays High Yield Bond (NYSE:JNK), for example, closed yesterday near its all-time high. Ditto for iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) and Vanguard High-Yield Corporate Inv, which celebrates its 40th birthday in December.

Despite the long-running bull market in junk, trailing returns remain moderate. VWEHX, for instance, delivered an annualized 5.2% total return over the past five years through yesterday’s close (Sep. 11). That’s roughly double the return for iShares Core US Aggregate Bond (NYSE:AGG), which tracks a popular benchmark that’s widely used as a broad investment-grade bogey for US bonds.

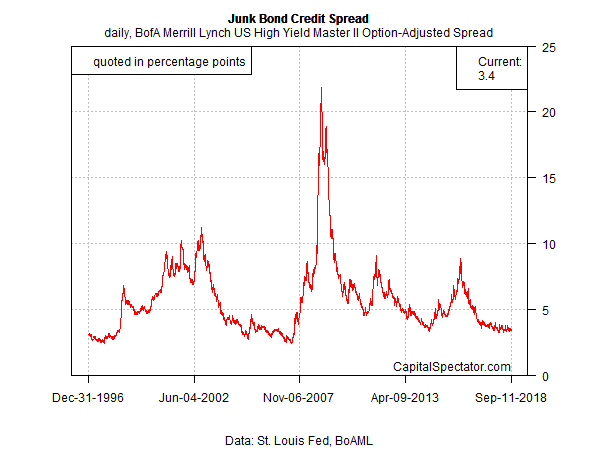

From a valuation perspective, however, the argument for caution isn’t easily dismissed. The ICE BofAML US High Yield Master II Option-Adjusted Spread has fallen to 3.4 percentage points – close to the lowest premium over a comparable Treasury yield since the recession ended in mid-2009.

One researcher last week opined that the US high-yield market has become a refuge of sorts for investors looking for an alternative to stormy weather in some corners of global markets — think emerging markets, for instance.

“The high yield market has taken on a new role this year, which is being a relatively quiet haven in an environment where many other key asset classes…have experienced at least temporary, if not more substantial repricing,” advised Oleg Melentyev, an analyst at Bank of America Merrill Lynch (NYSE:BAC), in a research note on Friday, according to MarketWatch.

Skeptics are quick to point out that junk bonds are a poor substitute for genuine safe havens – short-term Treasuries, for example. Nonetheless, the bullish bias in JNK and similar funds in recent months offers a talking point to argue otherwise.

It’s no trivial issue for junk-bond bulls that the US economy continues to post strong results. Yesterday’s impressive gain in job openings, which jumped to a record high in July, is the latest example. The update suggests that the healthy trend in the labor market – private-sector jobs continued to increase at a solid 1.9% year-over-year rate in August – will continue for the near term. In turn, a solid labor market will provide crucial support for the macro trend and expecting that the bull market in junk still has room to run.

But with the Fed in a tightening mode, the potential for a correction in junk bonds is lurking out there somewhere. Yield spreads, after all, aren’t going to zero. Meantime, the operative question: how much additional compensation is reasonable for the extra risk that’s embedded in high-yield corporates over a comparable Treasury?

At the moment the crowd’s answer: 3.4 percentage points will suffice. That may be reasonable in a world where unusually low interest rates prevail. But the Fed’s plans imply that a regime shift is underway, albeit in the early stages.

In any case, history reminds that the reasonable compensation for junk’s yield premium varies through time, sometimes dramatically, rising to as much as nearly 20 percentage points during the last recession.

Today’s low risk premium for junk is essentially priced for perfection and the upbeat outlook for the economy doesn’t offer a reason to think there’s trouble on the near-term horizon. But for anyone sitting on handsome gains vis-à-vis junk-bond allocations, the case for rebalancing still looks compelling.

True, the good times may roll on for the high-yield market. But for anyone who respects probabilities, the odds don’t look especially favorable. After all, the problem with holding assets that are priced for perfection is that we live (and invest) in an imperfect world.