While industrial metals started 2019 in an upward trend, the complex showed weakness as 2019 progressed.

In fact, all of the industrial metals hit down around current support levels — and lower at times — during the past few weeks.

With industrial metals down across the board, are we moving into bear market territory? Or have we witnessed a temporary blip resulting from less certain macroeconomic conditions?

To examine the situation in more detail, let’s have a look at some of the key industrial metals and recent prices.

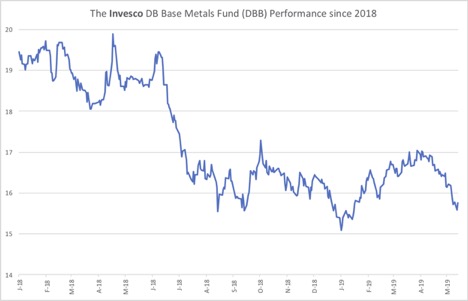

The DBB Trended Back Down to Mid-January 2019 Values

After a bullish start to the year, the (NYSE:DBB) peaked on a short-term basis in early April, then trended back down once more.

Compared with July 2018’s larger drop, this one appears milder, but the short-term downward trend remains.

The DBB tracks three key industrial metals: aluminum, copper and zinc. Let’s take a look at each metal to assess price performance using the LME 3-month futures price.

LME Aluminum

Looking at weekly trading volume, it looks like the downtrend in price is played out (based on recent positive trading volume). Also, both positive and negative weekly volumes looked weak recently, with a lack of momentum in prices.

This indicates continued sideways movement on the LME aluminum price.

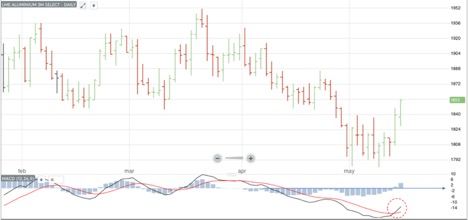

Given that the aluminum market moved largely sideways during the course of 2019, the Moving Average Convergence/Divergence (MACD) can also indicate where the market is at this time.

The MACD tracks the difference between two exponential smoothed moving averages (using the 12- and 26-day averages); it’s the black line in the graph below, which sits along the bottom edge below the price line. The red line, or signal line, uses the nine-day exponentially smoothed average of the MACD.

When the values hold above zero, this indicates the market is overbought. When they are below zero, this indicates the market is oversold. If the lines continue to trend downward, then the downtrend is still in process.

By this indicator, the aluminum market looks oversold and a buy signal emerged recently when the longer-term line turned up after a couple of days of upward market momentum and edged past the signal line. The signal line followed a day later, indicating the downtrend lost steam.

Based on this analysis, aluminum prices may have already hit bottom and turned around; therefore, the aluminum market itself does not look bearish at present.

LME Copper

LME copper prices lately have showed clear weakness. However, they found support again recently in daily trading, stopping a further slide in price.

With negative trading volume still registering on a weekly basis, the price dynamic for copper still looks weak.

Looking at volume on a weekly basis, we can see that it trended up again last week. Through the first few days of this week, volume registered as negative on the partial week’s data.

Copper prices still look weak.

LME Zinc

Like the other industrial metals, LME zinc prices trended downward in April.

Looking at weekly volumes for zinc, the price action looks mixed. (Note that the last bar shows only partial data for the week in progress.)

Given the clearer trend when looking at LME zinc prices, we can use the 4-9-18 day moving average analysis to assess the state of the current downtrend. The result of the analysis shows the downtrend remains in process as the moving averages queue in the expected order, with the 18-day average on top (blue line), followed by the nine-day (purple line), then the four-day average (red line).

Therefore, in the case of LME zinc (using this method) the downward trend continues. The red line, however, the shortest average and therefore most sensitive, has recently shown signs of turning back up.

Looking at a MACD analysis, based on the 12-, 26-, and nine-day periods, the downtrend continues with the signal line in red sitting above the MACD line in black, while both continue in a downward trend below the zero point of the MACD indicator bar.

Readings below zero on the indicator show bullishness in the sense that prices may turn around. However, in this case the lines continue moving in a downward trend, so we may not have seen the bottom of zinc prices just yet.

What this Means for Industrial Buyers

During recent weeks, the main industrial metals tracked by MetalMiner showed weakness. Will this be temporary or are we looking at a more cyclical movement into bear market territory?

While aluminum prices look relatively stable, copper and zinc prices appear weaker, with no clear signal given that the downturn has passed.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

Therefore, while it’s too soon to call a bear market, it’s also too soon to say we’ve avoided one.

by Belinda Fuller