Ichimoku Cloud analysis of the Gold futures market indicates a flat, bearish market. With the recent news of a potential Russian altercation along with ongoing inflation worries, investors are jittery. Gold has always been viewed as a safe haven when inflation is rising. The market is skittish and Friday's afternoon trading saw a move in gold prices.

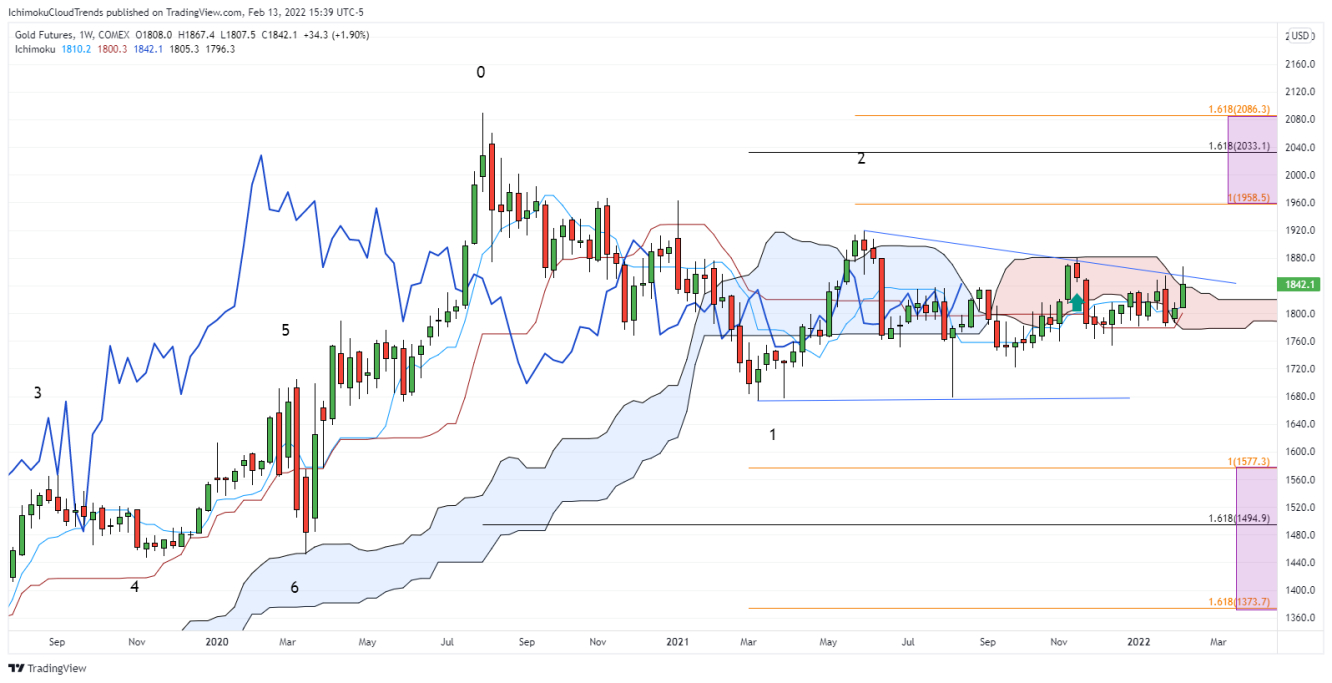

The gold market has been consolidating for the last year. The Ichimoku Cloud shows a downtrend, with a bear flag formation. The pole down was set in Wave 0 to Wave 1, and a long clear flag has been established. Price has struggled to break either above or below the Ichimoku Cloud. A downward sloping diagonal trend line can be drawn from the Wave 2 high as the price has consolidated.

Should the price break above the diagonal trend line, the temptation to buy will occur. However, a more conservative approach would be to use an Ichimoku Cloud resistance point. The Span B at 1883.3 highlights a price at which gold likes to trade. Price will encounter a lot of resistance at that Span B point. If the price can break above, Ichimoku Cloud Span B Gold should head up to the target zone and retest the Wave 0 high.

The daily Ichimoku Cloud chart is in an uptrend. Price has broken above the Ichimoku Cloud Span B. The lagging line is above price and the cloud, indicating a bullish trend has started. Price on Friday went to retest the old highs of Wave 1.

Should price break above wave 1 highs, look for it to continue pushing to the daily target zone. However, gold is likely to first encounter resistance at 1883.3 as it heads up.

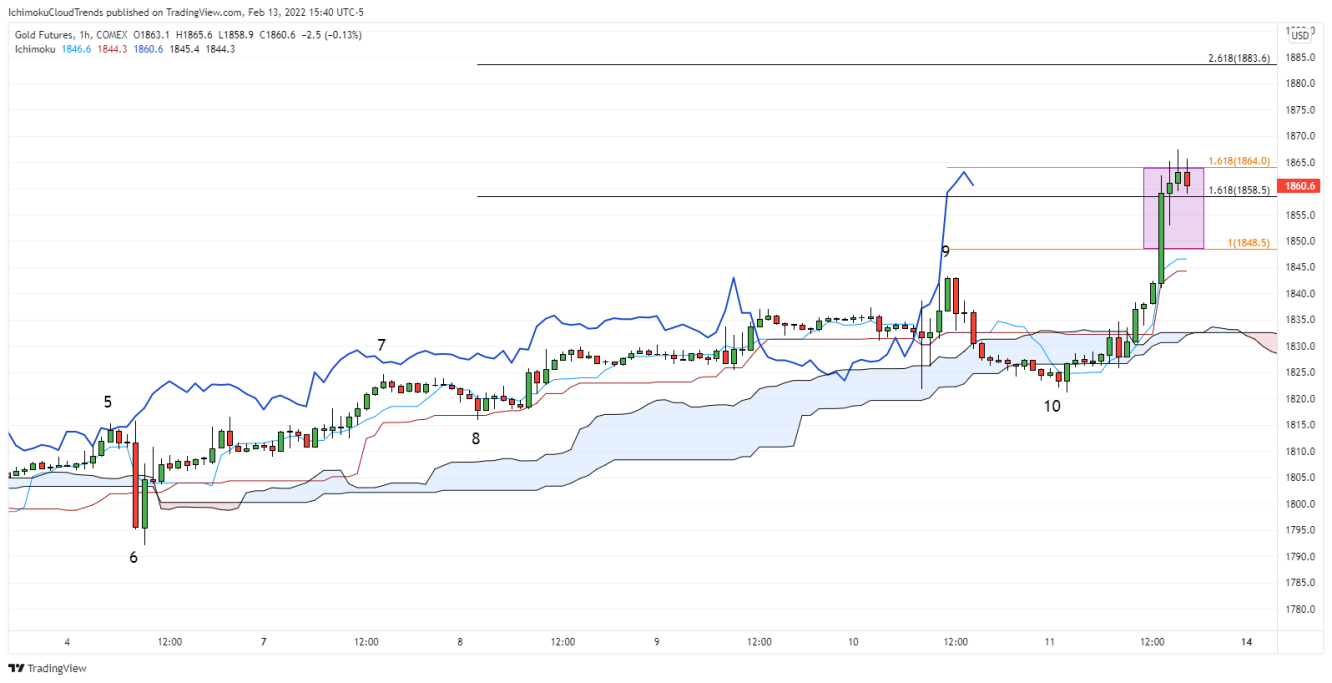

Gold shifted into an uptrend on the 60-minute chart in early February. Since then, price and the lagging line have remained above the Ichimoku Cloud, and the uptrend has been strengthening. Friday afternoon's news scared the market and caused prices to jump straight up to the target zone. Note how the 1 pm bar was much larger than typical in gold.

If the market's reaction to Friday's news was a short-term panic, the target zone should hold. Price will then recede and retrace down as the market looks overbought based on price's distance from the Ichimoku Cloud.

Should price back-off, it would mean the up move in gold was a short-term aberration. However, if the price breaks through the target zone, expect gold to head higher. Gold's next 60-minute target is $1883.6. As the weekly Span B resistance zone is $1883.3, it would not be surprising to see gold head up to test this zone before determining whether to go even higher or fall back.