A large-cap company which in my opinion is undervalued is British American Tobacco (LON:BATS).

British American Tobacco, headquartered in London, is a worldwide provider of cigarettes and tobacco products like vapor, gum tobacco, e-cigars and more.

The portfolio of cigarettes includes brands like Dun hill, Lucky Strike, Pall Mall and Rothmans. The company is considered as a market leader in more than 50 countries and has operations in over 180 countries.

The company, which has a market cap of £82 billion, is also considered a dividend investment with a history of paying good yield (currently around 5%).

The tobacco industry is declining in the West and official figures show that while about 25% of UK/US adults were smokers in 2000, that figure had declined to 15% by 2016. It is a completely different story in other parts of the world with China leading the pack with 30% of adults that smoke. Because of this, BAT is trying to push smokers to higher end or alternative smoking products.

The firm has highlighted its leading market position by acquiring Reynolds American (NYSE:RAI) and now a significant portion of its revenues come from the US. As the value of the GBP fell following the Brexit referendum, BAT benefitted from the GBP weakness as this meant that its earnings, when exchanged for pounds, increased.

Why I think this is a good investment?

- P/E ratio of 2.07 vs 17.38 of the industry (Forward P/E stands at 13.95)

- P/B ratio at 1.39

- Dividend yield 5.5%

Although tobacco demand is declining across the western world, the acquisition of Reynolds American and investment in alternative tobacco products is providing the necessary push with earnings still on the rise.

Higher revenues are being generated from a weak pound since the majority of the sales are coming from outside the UK. Should a no deal BREXIT be avoided in the coming months, it would make sense to invest in pounds now and lock the rate of exchange and then benefit on the longer-term dividends/growth which will provide an additional gain as the pound gets stronger.

Price has now reached the a point which acted as resistance back in 2016 and 2015 (see chart)

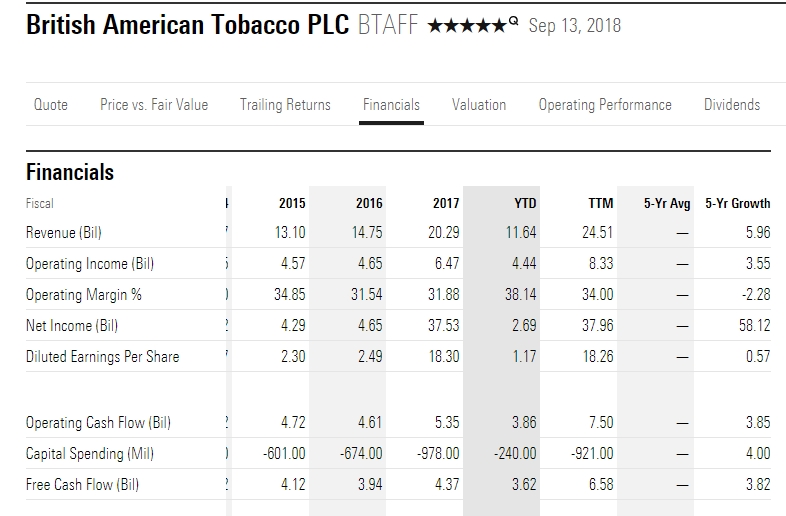

Indicators showing undervalued signals

Source: Morningstar

Based on all the above, I think this is a very good longer term opportunity going forward bearing in mind the current price, the high dividends, the exchange rate gain potential and the good financial results of the company.

What do you all think?

Article written by Christian Buhagiar