Illinois based Ingredion (INGR) is a global ingredient solutions provider to the food, beverage, brewing and pharmaceutical world. Think corn, wheat and potatoes being turned into things like sweeteners, starches and fibers. What’s not readily apparent is that many ingredients show up in the rest of your world as well. For instance, did you know that starches are used as adhesives in the corrugating industry and binders in the paper industry? Or that they are oil and water absorbent and thus are used in personal skin care products? Perhaps you might even be interested in knowing that various medical tablets are formed via these ingredients.

Ingredion is well aware of these particulars and has, in fact, proven itself to be a worldwide leader in this area. With over 11,000 employees serving 60 separate markets in over 40 countries, Ingredion had total sales over $6.5 billion last year. In a sentence, here’s how the company describes its purpose:

“We make foods and beverages taste better, baby powders and cosmetics smooth to the touch, cereals and crackers crisper, breads brown evenly, IV solution for patients in need, ingredients for the pharmaceutical industry, and much more.”

In other words, it’s one of those companies that you might not readily notice, but you could very well consume their products on a daily basis. As such, we thought it might be interesting to observe the “company behind the stock”.

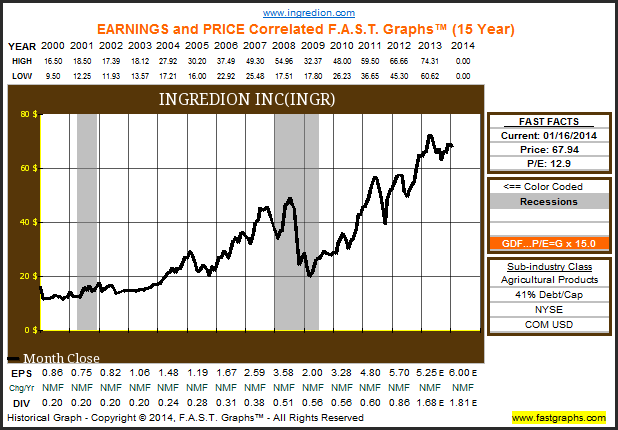

When viewing most financial websites the first – and all too often only – thing that one sees graphically is the price of a given security. For instance, below we have included just Ingredion’s price over the last 15 years. In observing this graph, it can be seen that Ingredion has increased rapidly in price over the last few years and consequently now sits at a substantially higher level than it ever has.

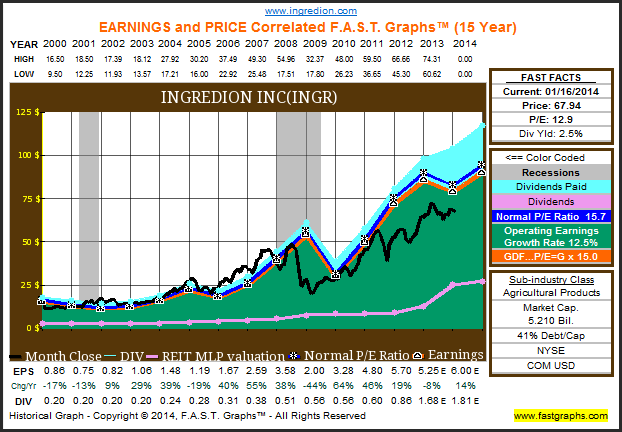

While this is true on a nominal basis, this type of thinking ignores the relative earnings power of the business. Below we have added back all of the components that make a F.A.S.T. Graph a F.A.S.T. Graph. Notice that the price line is precisely the same. However, earnings (orange line), dividends (blue shaded area and pink line) along with a “normal” P/E ratio (blue line) have been added. By using this view it is much easier to determine both how the business has performed and where the present valuation sits in reference to the company’s history.

Here we see that operating earnings per share have grown by about 12.5% per year for the last decade in a half. In addition, it is clear that Ingredion had a large dip in earnings after the most recent recession but has generally been a strong company - having positive earnings in 10 of the 15 years. The dividend has not been cut and, in fact, has increased handsomely over this period from $0.20 a share in 2000 to today’s mark of $1.68 – a more than 15% annual rate. The market has placed a “normal” P/E ratio of 15.7 on the company, while it presently trades at 12.9 times earnings with a 2.5% dividend yield.

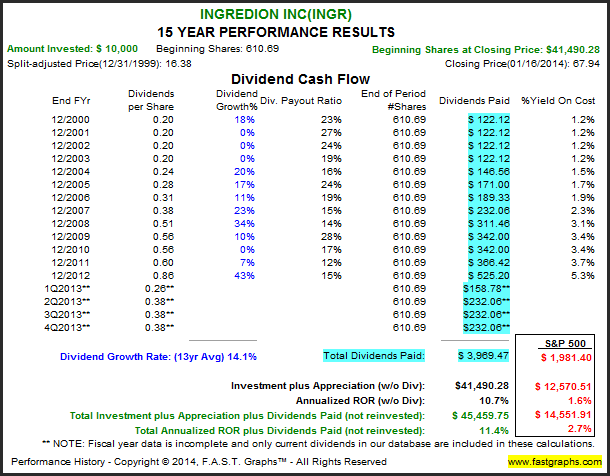

In stark contrast to the price only graph, this Earnings and Price Correlated F.A.S.T. Graph demonstrates that Ingredion is well within its historical valuation and perhaps even slightly below it. Given that Ingredion was trading at a reasonable valuation in both the beginning and end of this period, it should be expected that performance results roughly tracked business results over the long-term. And this is precisely what we see: over this period Ingredion returned 11.4% a year while the business grew at about 12.5%. A hypothetical $10,000 investment would now be worth over $45,000 – or more than 3 times as much as a similar investment in the S&P 500 index. Furthermore, one would have received roughly double the dividend income.

On the share repurchase front, Ingredion appears to be willing but not yet effective. For instance, here’s an excerpt from CEO Ilene Gordon during a recent press release:

“As we become more comfortable with our cash flow for 2013 and the outlook for cash flow in 2014, we repurchased a substantial number of shares. We continue to see great value in appropriately buying back our shares and expect to do so in the future to at least cover dilution created by option issuance.”

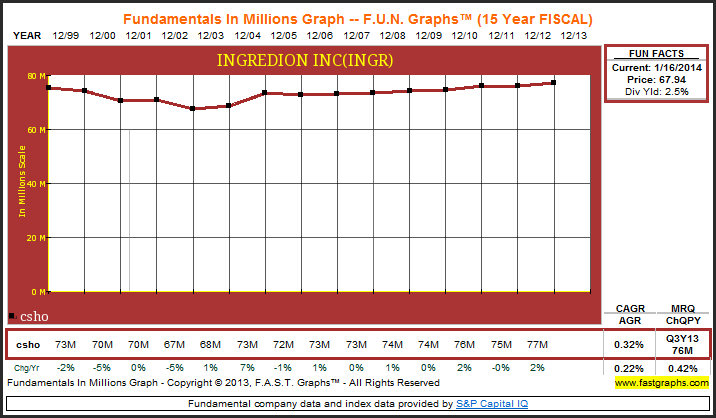

Within this announcement, Ingredion also stated that the board authorized the purchase of up to 4 million additional shares by the end of 2018. This would represent roughly 5% of the company and sounds reasonable. However, if history is any guide, the company will have to work harder than it has previously to make this program effective. For instance, here is a view of Ingredion’s common shares outstanding (csho) for the last decade and a half. Despite management’s intent, it’s clear that shares outstanding have remained the same or even slightly increased in the past few years.

Taken collectively, we have seen that Ingredion has been a very strong company with a penchant to reward shareholders. Operating earnings have grown nicely and the dividend growth has been quite strong. It’s not often that you can find a company who is able to both increase the dividend per share by a double digit rate and simultaneously decrease the payout ratio for the better part of a decade. It is true that the share repurchase program leaves something to be desired, but overall Ingredion has proven itself to be a very compelling company.

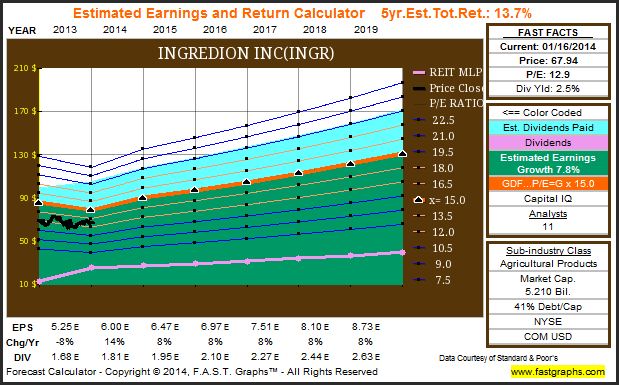

Moving forward the question becomes: are such results sustainable over time? The Estimated Earnings and Return Calculator below can provide some insight into this question. Eleven analysts reporting to S&P come to a consensus estimated earnings growth rate of 7.8% for the company – about 5% a year less than what it has done in the past 15 years. Further, the calculator assumes that the payout ratio remains the same – at about a third of earnings. Both of these appear reasonable if not possibly on the safe side of assumptions. If Ingredion shares are trading at 15 times earnings in 6 years and the earnings estimates materialize as forecast, this would indicate a 13.7% yearly estimated total return.

Now it’s important to underscore the idea that this is simply a calculator which defaults to analysts’ consensus and a P/E ratio that is commensurate with its earnings estimates. However, it does provide a very strong baseline for how analysts are presently viewing the company.

Overall, we find Ingredion to be an interesting company with reasonable upcoming prospects. The fact that it makes everyday items without being readily noticed, speaks to the Peter Lynch “perfectly simply yet perfectly boring” type of company. Ingredion has been able to consistently reward shareholders and presently offers a valuation point at the lower-end of its historical range. However, as always, we recommend that the reader conduct his or her own thorough due diligence.

Disclosure: No position at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Ingredion The Missing Ingredient In Your Portfolio?

Published 01/19/2014, 12:17 AM

Updated 07/09/2023, 06:32 AM

Is Ingredion The Missing Ingredient In Your Portfolio?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.