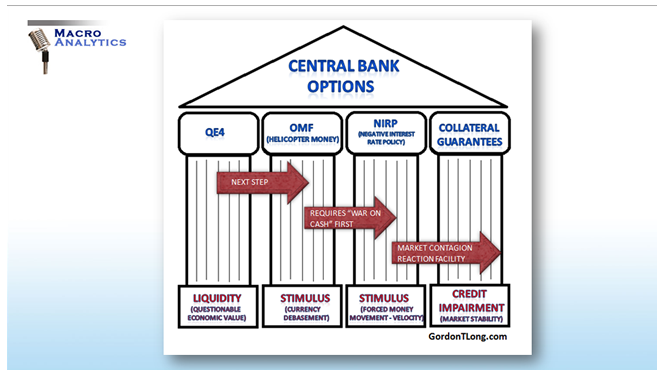

John Rubino and Gordon T Long discuss the strong possibility of of a sequence of "QE4 for the People", Helicopter Money, NIRP and Collateral Guarantees now being in our economic future as the US and Global Economies rapidly slow. The evidence is clear for all to see, with little debate, except in the hallowed halls of the US Federal Reserve!

Gordon T Long argues that there are three cycles that must be closely monitored. Of the three, the Credit Cycle always leads and it has now turned. He believes the evidence shows that the Business Cycle has also turned and that the Rate Cycle has been disconnected from reality since it skipped a "Cyclical Beat" due to Central Bank Monetary Malpractice.

John Rubino agrees but believes no on should be surprised that the Business Cycle has turned and a recession is a real possibility after experiencing over 6 years of an apparent cyclical recovery. What is particularly ominous and unique about this slowdown he feels is that it is arriving during a period when we have:

1- HISTORIC LOW INTEREST RATES: Little conventional Monetary Policy available to be a counter force mounting recessionary momentum.

2-CHINA SLOWING DRAMATICALLY: China's massive build out and credit expansion since the 2008 Financial Crisis has powered Emerging and Frontier Economies. Now the Chinese economic engine is sputtering and by some measures is not growing at all,

2- A GLOBAL COMMODITY CRASH: We are in the midst of a major global commodity crash which is impacting corporate earnings, sovereign current accounts and employment,

3- GROWING WAGE PRESSURES IN THE US: Years of corporate profit increases without wage increases has left many corporations under fire and earnings pressures, most evidently seen with labor issues at Walmart (N:WMT),

4- REGIONAL PROBLEMS IN CHINA, JAPAN AND THE EU: Leaving no economy bright light for reversing the US Economic Slowdown.

"How do you have an equity bull market and a recovery in economic growth in general at a time when the main engine for growth (China) is sputtering and corporate profits (in the US in particular) are starting to turn down HARD? The answer is you don't! You can't grow under those circumstances."

CANARY IN THE COAL MINE

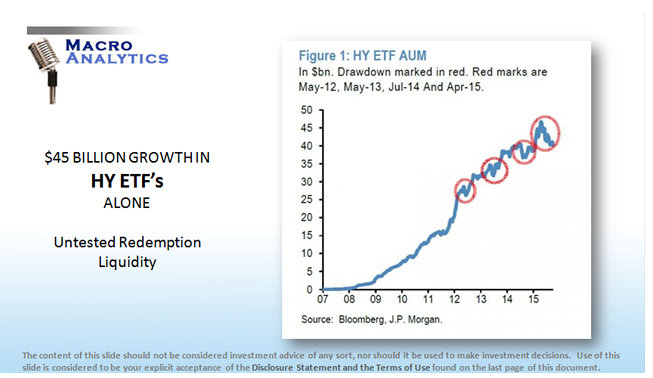

The dramatic collapse in HY (High Yield (N:JNK)) Bonds is signaling serious problems for the continuation of cheap corporate funding. It also has the potential for contagion as liquidity is a problem when large amounts have been bid up on price due to the explosion is the use of ETF's to buy HY bonds.

BOTTOM LINE

As the UK Guardian newspaper recently declared:

"The world needs inventive responses. It needs a bigger reinvigorated IMF whose constitution should reflect the global balance of economy power and that can rescue the emerging markets. It needs western governments to launch massive economic stimulus centered on infrastructure spending. It needs new smart money policies that will allow negative interest rates."

This is exactly what is going to sell political in the coming year!

The bottom line is the central bankers of the world are now left with few choices and none are traditional approaches and the political pressures on them have almost preordained the policies of: "QE4 for the People", Helicopter Money, NIRP and Collateral Guarantees to keep markets levitated.

"There is no political alternative but to 'double down' on existing policy approaches. The only alternative is austerity and we witnessed in one country after another in the EU what happens when this is attempted! ..... the only thing that will sell now is 'we are going to give you something'! "

Disclaimer : GordonTLong.com & Global Insights may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of Futures Contracts or Options on Futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.options on futures.