According to Liberty Street Economics:

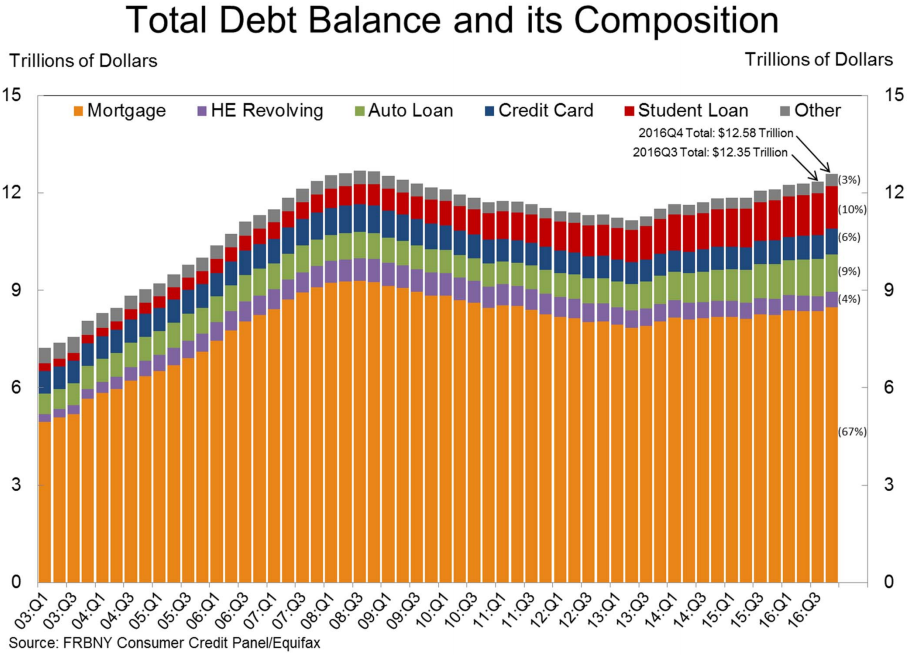

The latest Quarterly Report on Household Debt and Credit from the New York Feds Center for Microeconomic Data showed a substantial increase in aggregate household debt balances in the fourth quarter of 2016 and for the year as a whole. As of December 31, 2016, total household debt stood at $12.58 trillion, an increase of $226 billion (or 1.8 percent) from the third quarter of 2016.

Follow up:

The bottom line of this Liberty Street post was that consumer debt is now less than 1% below 3Q2008 peak. Debt contributed to the Great Recession, and to know we are back to the pre-recession levels does not deliver warm thoughts.

Graphic source

Keep in mind:

- That mortgages are THE main component of household debt. Most people spend similar amounts on mortgages or renting a home - so mortgage levels are not important when thinking through consumer debt.

- That student loans are now the second largest component of student debt.

- And that home ownership has fallen around 6% from the peak in 2004 - but home mortgages levels are down 8.8% from its peak in 2008.

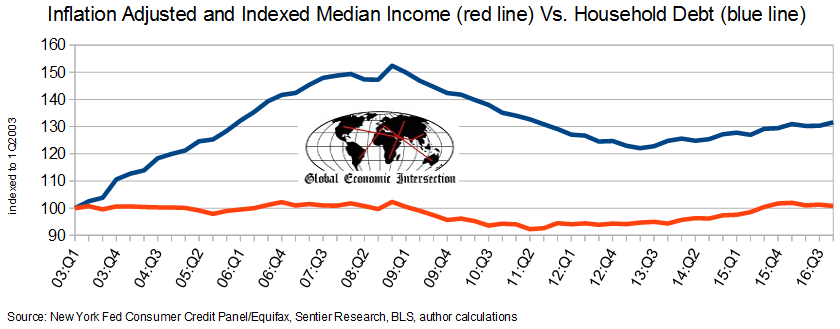

The hard part of understanding debt levels is that debt is not inflation adjusted or normally correlated to any benchmark except GDP. The graph below is inflation adjusted and indexed showing median income as a benchmark.

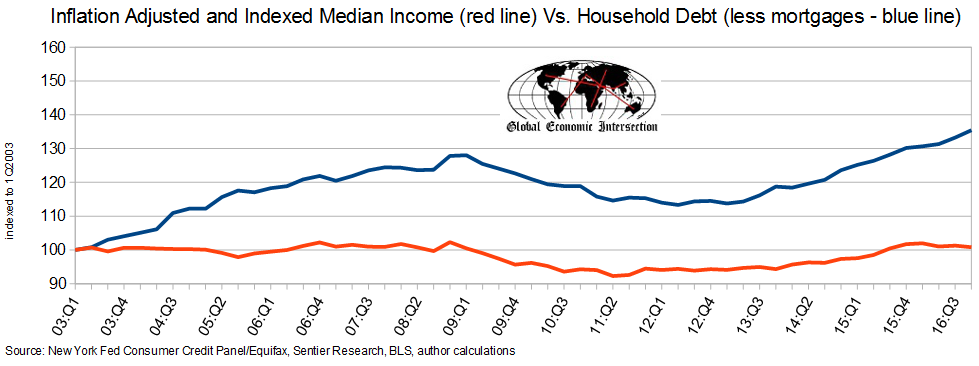

A better way to look at consumer debt levels is to remove mortgages (see graph below):

Although median income is little changed, consumer credit (not including mortgages) outstanding has risen 35%.

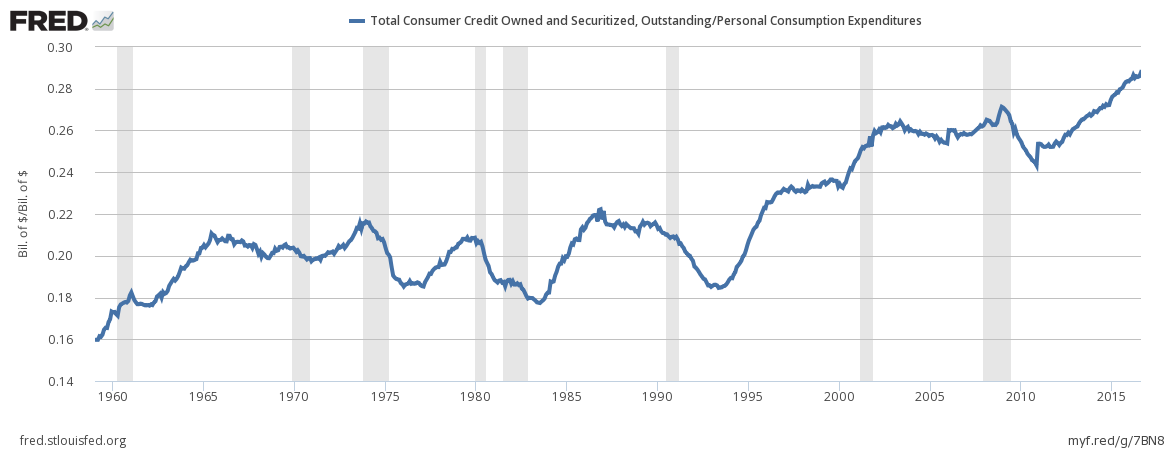

And consumer credit outstanding (does not include mortgages) continues to grow in relation to consumer spending.

Ratio of Total Consumer Loans Outstanding to Consumer Spending

I do not know (nor have I seen any study) what the maximum debt levels which can be carried by households. I suspect it varies significantly household-to-household. It would also depend of the type of debt and the interest load paid on the debt. Debt that creates income is not in the same category as borrowing money for a vacation, so to properly assess debt burden and sustainability many details need to be defined.

And, of course, debt in 2017 is not the same as debt in 2000 or 2003 - interest rates are different.

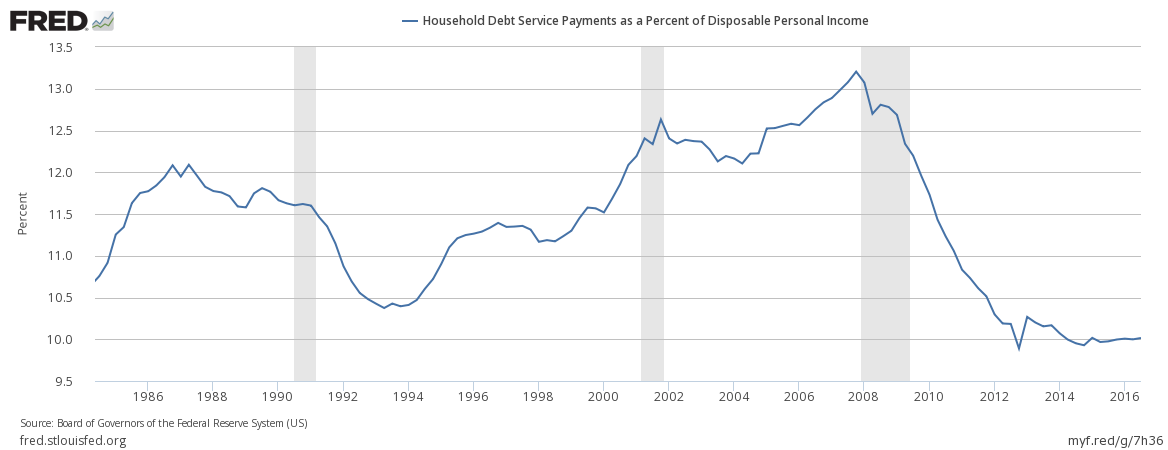

Household Debt Payments As A Percent of Disposable Income

Because of the low interest rates - consumer debt may be in better shape than any other period in recent history.

Despite the low interest rates, I do worry about student debt. One should avoid starting their professional life with a debt load to juggle as well as setting up a household.

Other Economic News this Week:

The Econintersect Economic Index for February 2017 again improved but the value remains in the territory of weak growth. The index remains well below the median levels seen since the end of the Great Recession. But there are several indications in the data we view of better dynamics in the future. Six-month employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: none

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: