Key Points:

- Price action rallies as geopolitical risk in North Korea increases

- RSI Oscillator strongly overbought

- Watch for a period of moderation before the rally recommences

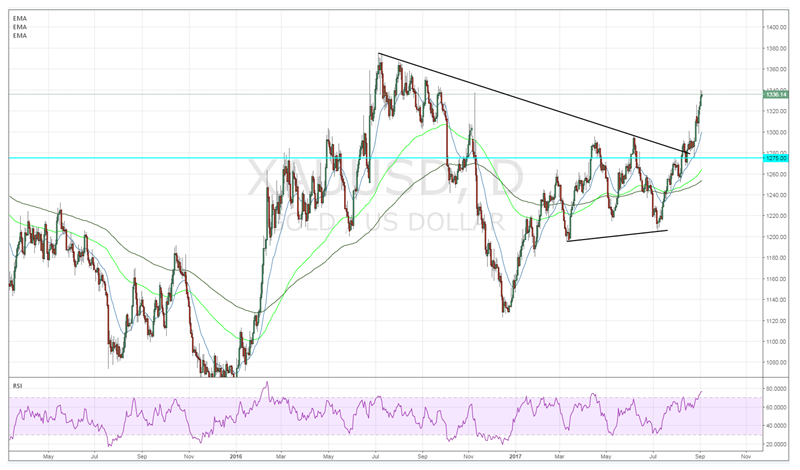

The past few weeks have proved to be a relatively large boon for gold markets as increased geopolitical risk, as well as slipping U.S. centric economic data, has seen the precious metal assail the $1300 handle to trade around the present $1336 an ounce mark. However, the question remains as to whether the current valuation will hold in the coming weeks given that the oscillators are currently strongly overbought.

In particular, the RSI Oscillator is presently providing some cause for concern given that the metric is indicating relatively strong overbought levels. Additionally, price action is now nearing a key swing point from last year’s gold flash crash around the $1337.34 mark. This was a key level back in November 2016 and should prove to be relatively interesting in the days ahead.

Much of the rapid upward momentum in gold prices has been largely to do with rising geopolitical risk in North Korea. Presently, there appears to be no end in sight with the potential for armed confrontation growing as neither Trump nor Kim Jong Un appear willing or able to back away from the precipice. Subsequently, this situational conundrum bodes well for the precious metal which is typically seen as a safe haven especially when the risk of flying missiles is on the increase.

In addition, the metal has been buoyed by successive rounds of disappointing data emanating from the U.S. and a central bank that appears schizophrenic in their approach to monetary policy. In fact, a range of misses within labour market and slipping GDP estimates have proved highly bullish for the metal over the past few weeks. This has led to a significant pullback in the U.S. Dollar Index and the valuation of the greenback.

Ultimately, the technical perspective argues for a short term pullback or period of moderation given the highly overbought oscillator levels. However, fundamentals are largely driving the metal's current trend and these factors remain highly biased to the upside. Subsequently, the most likely scenario is one where gold turns sideways for a period of moderation before recommencing its run higher. The reality is that gold prices have turned the corner and that the time for a recoupling between prices and the M2 figures is long overdue.