As increased volatility from the pending FOMC meeting and potential rate hike spreads around the globe, Gold looks like it might be preparing to shine, albeit in the short term.

The precious metal has been on somewhat of a rollercoaster over the past few weeks, as it steadily trended lower—nearing the key $1,000 an ounce level. However, the past few days have seen a resurgence as gold appears to be finally ready to complete the final stage of a bullish crypto-pattern as it looks toward the reversal zone.

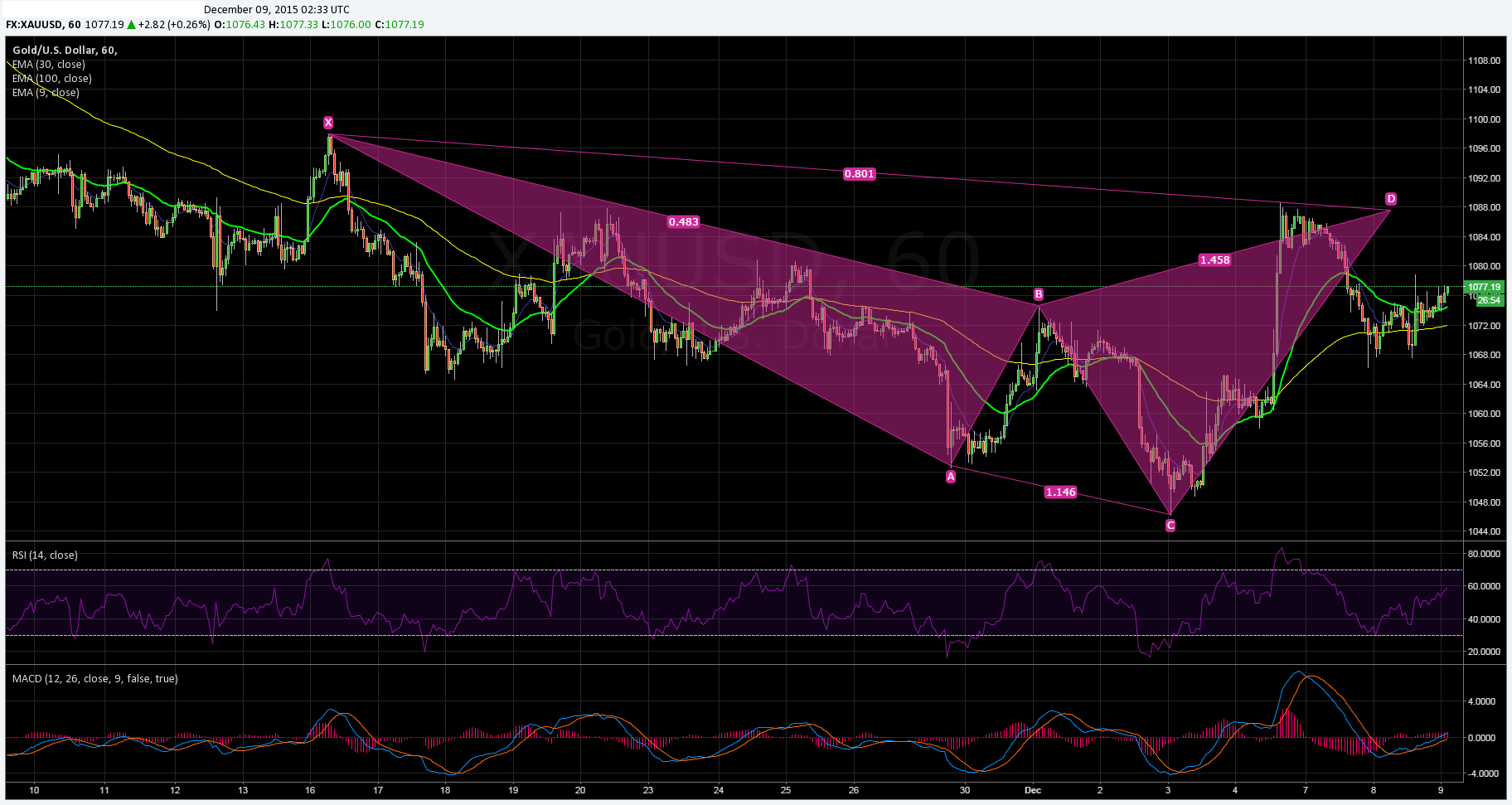

In addition, MACD is now also signalling the potential for a bullish move, with the indicator lines having crossed before trending higher. Given the recent highs, MACD is actually quite depressed and there is definitely scope for a move higher. In contrast, RSI continues to steadily trend higher within neutral territory signalling that there is plenty of room to move on the upside.

Further supporting the bullish contention is the fact that a cypher pattern is in the final stages of completion, with price action looking to move higher to complete the “D” leg. Subsequently, an upside target of $1088.40 is appropriate and represents a reversal zone where rallies could potentially be sold. On the downside, major support exists at $1060 an ounce and any breaks below could see the commodity declining sharply to around $1040.

However, keep a close watch on the US economic news in the lead-up to the much awaited FOMC meeting. The market is largely bullish on a rate hike and is ravenously hungry for data which will fuel the case for the Fed. Subsequently, tomorrow's US Unemployment Claims figures are likely to be monitored closely by the market and could cause some sharp volatility.

Ultimately, Gold is likely to see some relatively sharp swings, within the $1044 - $1100 range in the coming days, as pressure builds prior to the interest rate decision. This volatility should provide plenty of play for traders. However, be mindful of the looming risk event and the fact that the odds are stacked against the precious metal.