Gold has largely been on a roller coaster ride since it formed a high above the $1300 handle in Early May. Subsequently, a number of swings have been seen since that point as the metal has struggled with the movable feast that is the US Federal Reserve. However, despite gold bugs' protestations otherwise, the short term looks relatively bearish for the metal as it faces the need to complete a downward “D” leg in the coming days.

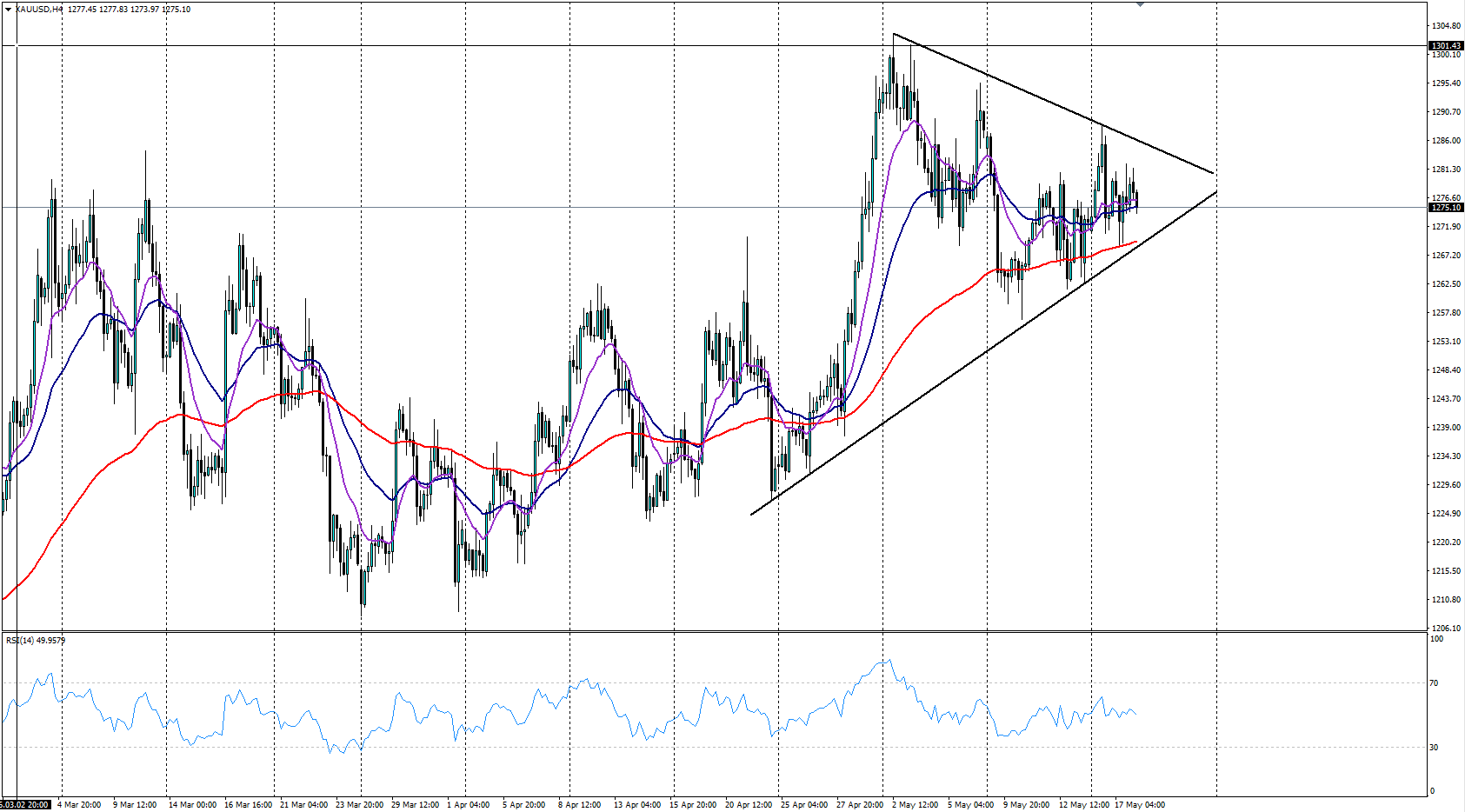

It is clear from reviewing the 4-hour chart that the commodity is currently at a cross roads with its current meandering trend. An ABCD pattern is also evident and commenced on the 10th of May with the “C” leg subsequently completing around the $1285.33 mark. Gold is therefore now largely predisposed to decline to finish the pattern which would likely put its completion around the $1263 mark.

In addition, the 4-hour chart for the commodity is clearly showing some building pressure for the precious metal as a wedge pattern has become evident and price action has formed lower highs over the past few weeks. Subsequently, as price continues to be squeezed within the wedge, the probability of a breakout increases.

Subsequently, given the sharp wedge pattern, and the need for a retracement to complete the “D” leg, a downside breakout is the likely outcome. Price action will therefore need to breach the support zone at $1271.58 to cement a move towards the likely target of $1263.

However, from a fundamental perspective, gold’s direction is largely tied to the Fed’s future monetary policy decision. Subsequently, the latest round of rhetoric from the central bank has placed the June meeting in focus as a “live” event. So the metal is likely to see plenty of volatility as the market repositions constantly in the lead-up to that decision.

Ultimately, from a technical point of view, gold is likely to remain under pressure in the coming days due to a range of factors on its chart. However, keep a close watch on any of the Fed rhetoric in the coming week as it could ultimately spoil the party.