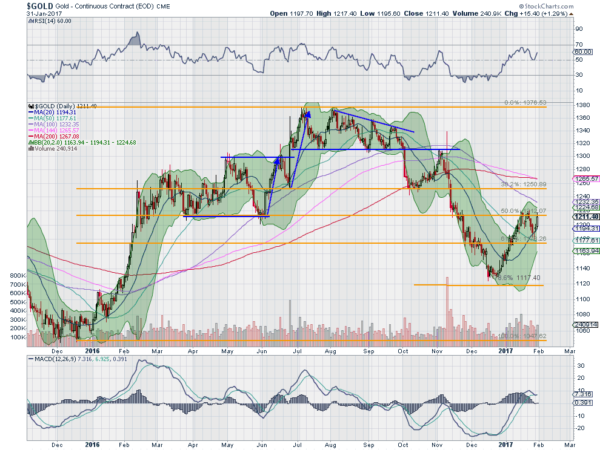

Gold ended 2016 with a whimper. The last 2 months saw it fall from 1315 to a low of 1125, almost 15% lower, thanks to a strong USD and perhaps Donald Trump’s policies. Whatever the cause, the drop then reversed, driving gold back over 1200 in the next 2 weeks.

At that point, I spoke to a group in Canada about gold's prospects and was asked what I thought about the near-term outlook -- up or down? My answer was 'sideways.' But there was nothing about gold that excited me then. It had bounced to the same height as the failed November 2016 bounce and stalled at a significant Fibonacci level, a 50% retracement of the entire 2016 rally. Gold looked good as a trade above 1215 and as a short under 1185. In between, it was off limits.

And it has not broken that range since. As I write, gold is sitting near the top of the range, pressing near 1215. But again stalling. Will it break it to the upside this time? That's anybody’s guess and I don't want to speculate. But if it does break up, gold will be on a streak to the upside with the next resistance near 1250. Until then, 1185 to 1215 is no-man’s land.