Gold is always seen as a perfect hedge against rising interest rates. Is this valid? Usually, a rising interest rates environment results from the overheating of the economy, and governments step in to "hold" the market. Overheating economy always is accompanied by higher inflation and a decreasing buying power.

Gold investments help investors balance or hedge their investment portfolios in rough times. Gold tends to perform very well when other asset classes like cryptocurrencies and stocks come crashing down in the presence of rising interests.

Economists argue that gold prices go up when interest rates rise, as some previous data implied. But is this still true? Let’s first examine interest rates, why they change and how they affect the prices of gold.

Interest rates

An interest rate is the percentage of principal charged by the lender for the use of its money. The principal is the amount of money loaned. Interest rates affect the cost of loans. As a result, they can speed up or slow down the economy. Interest rates are changing due to three basic factors.

- As with every financial component, supply and demand affect interest rates. More specifically, supply and demand concerning credits. This means that if the demand for credit is high, the interest rates will be high and vice versa. On the other hand, if the credit supply is higher, the interest rates will be low. This is how the supply and demand of credit affect the interest rates.

- The inflation rate is another factor that affects interest rates. Higher inflation leads to higher borrowing needs due to weaker buying power. On the other hand, lenders need higher security and ask for higher interest as compensation for the decrease in the purchasing power of the money, which will be repaid to them in the future.

- Governments use interest rates as a monetary policy tool. By increasing the cost of borrowing among commercial banks, the central bank can influence many other interest rates, such as those on personal loans, business loans, and mortgages.

Gold in a rising interest rates environment

Usually gold prices tend to decrease in a rising interest rate environment as investors can earn more money sitting in cash. Due to the higher interest rates, they avoid investing in gold because gold doesn’t yield any such profits except an increase in its intrinsic value.

On the contrary, when interest rates are low, investors tend to allocate their money to precious metals like gold as yields are low from other interest-bearing financial assets.

How can investors take advantage?

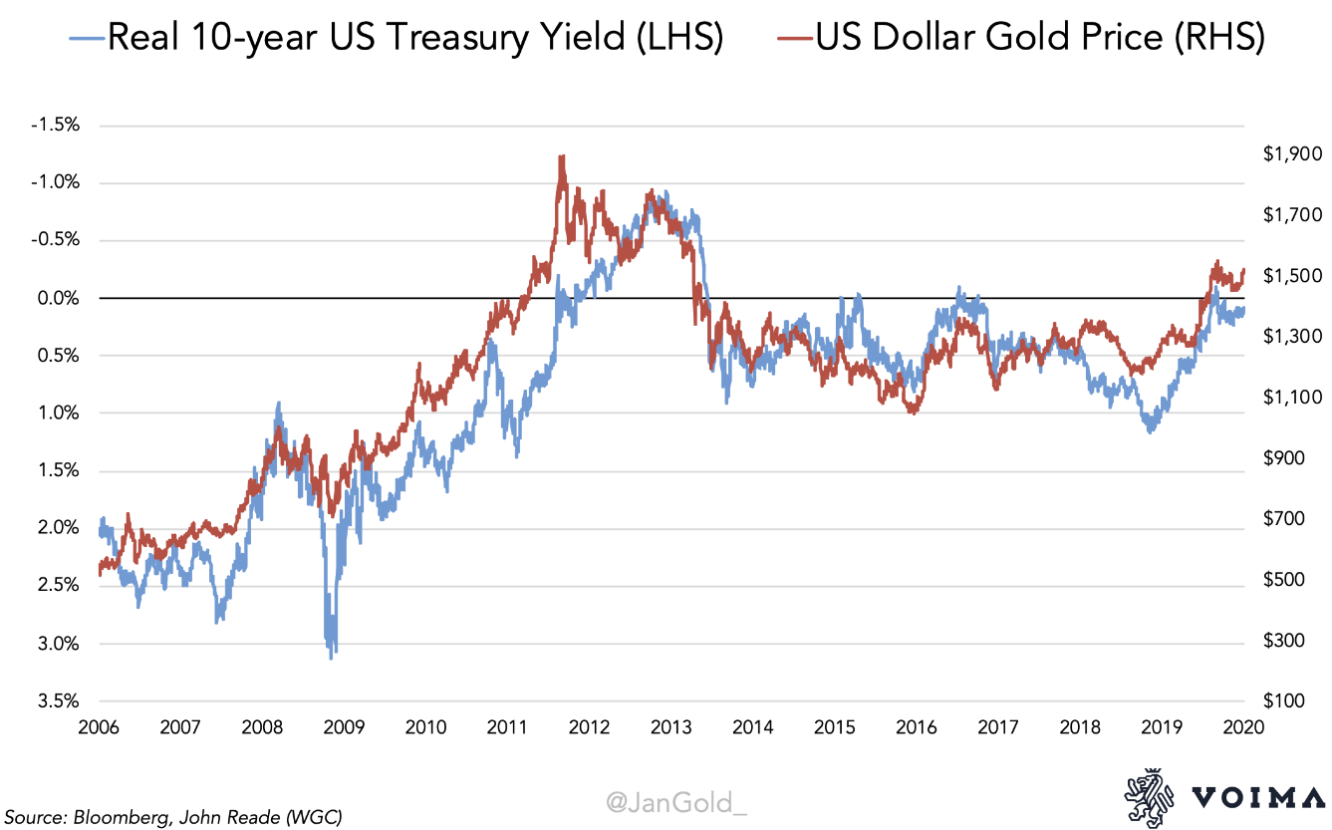

As we can see from the third chart, gold prices seem to lead the real United States 10-Year interest rates. This is mainly due to the discounting of the "Forward guidance," as it is called, which is the public announcement of the Fed's decision about the future interest rates. So investors should keep in mind that in distressing times like the ones we are experiencing now (high inflation), the increase of the interest rates does not imply lower gold prices.

On the contrary, seeing inflation insisting while interest rates are being raised rapidly to cool off the economy, investors start to become skeptical about whether the inflation is transitory or permanent and if an economic crisis is around the corner, as a lot of economists predict.

This mechanism favors the risk-off sentiment, and investors flee to safe-haven assets like gold, so we have a positive correlation; between rising interest rates and rising gold prices. In conclusion, every investor should carefully examine the interest rates and the macroeconomic environment before investing in safe-haven assets like gold.

Technical analysis - gold

Having in mind all the above and combining fundamental analysis with technical analysis, we managed to book a very nice profit yielding 9.40% with a downside risk of 1,55%, which has almost a Risk/Reward of 6.

On the technical side, we can see the downward channel on the daily chart of gold which is in line with the inverted correlation between rising interest rates and gold prices. We can easily identify the triple bottom, which shows the slowing momentum of the downside move.

By zooming in on the 4 hours chart, a bullish RSI (Relative Strength Index) is clearly visible. In addition, on the 4 hours chart of the break of the downward trendline, the re-test, and, in the end, the impulsive move after the confirmation of the breakout gave us a "textbook trade."