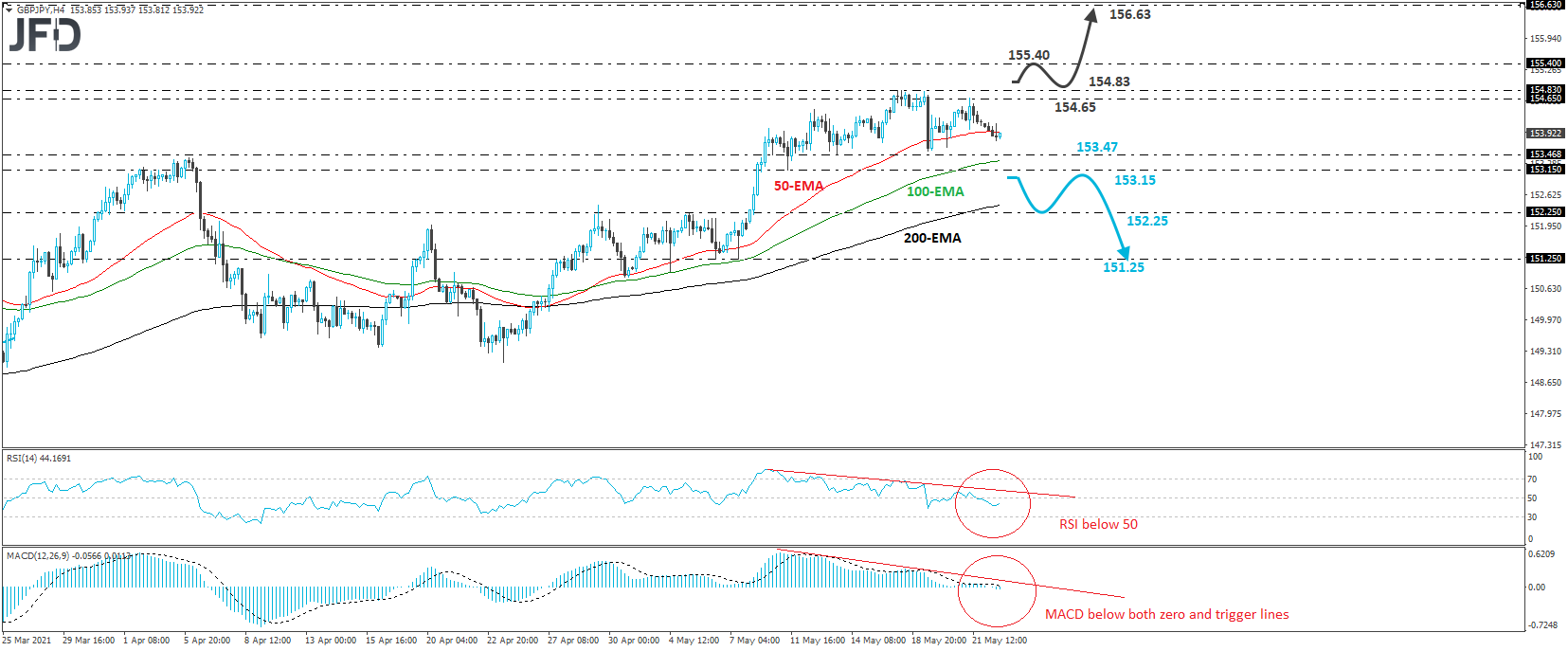

GBP/JPY traded lower on Friday, after it hit resistance at around 154.65, with the slide continuing today as well. Overall, the pair has been in a trendless sideways path since May 10, between the 153.47 area and the 154.83 hurdle, and thus, we will adopt a neutral stance for now.

However, bearing in mind that the pair has recently formed a lower low, we would see some chances for a correction lower, but in order to start examining that case, we would like to see a dip below 153.15, marked by the low of May 11. This may encourage the bears to push the action down to the 152.25 area, marked by the inside swing high of May 5, the break of which could extend the slide towards the 151.25 territory, defined as a support by the lows of May 6 and 7.

Shifting attention to our short-term oscillators, we see that the RSI, although it ticked up, it remains below 50, while the MACD lies below both its zero and trigger lines. More importantly, there has already been negative divergence between both these oscillators and the price action. Our momentum signs are another reason why we see reasonable chances for a correction lower.

In order to start examining the resumption of the prevailing uptrend, we would like to see a move above 154.83. This will confirm a forthcoming higher high and may initially pave the way towards the peak of Feb. 5, 2018, at 155.40. If that hurdle is not able to stop the bulls from marching higher, then we may see advances towards the peak of Feb. 2 of that year, at around 156.63.