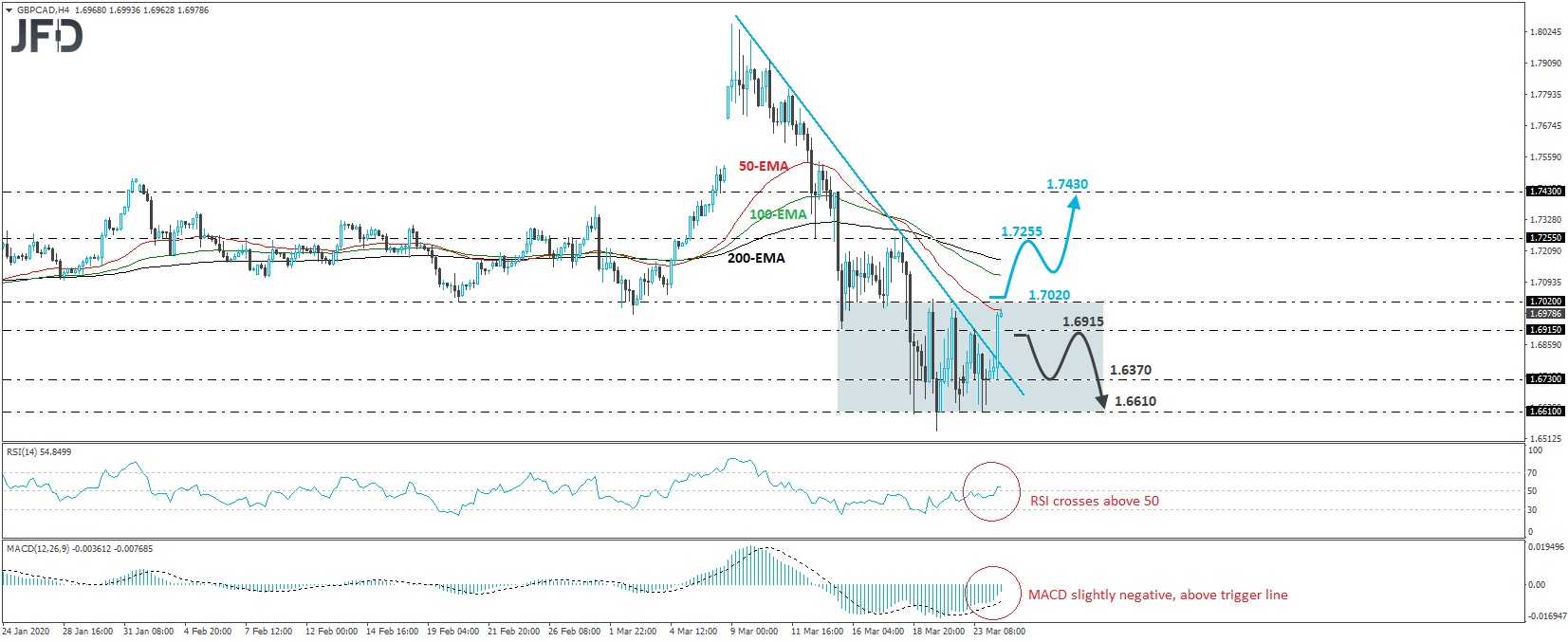

GBP/CAD traded sharply higher today, breaking above the downside resistance line drawn from the peak of March 10th. However, that rate still stays within the consolidative zone that has been containing most of the price action since March 18th. That area is between the 1.6610 and 1.7020 barriers. Although there are decent chances for some further advances, we would stay neutral for now and we would start looking north as soon as the upper bound of that consolidative zone gets broken.

Such a break may wake up more bulls, who could decide to climb towards the high of March 18th, at around 1.7255. They may decide to take a break after reaching that zone, thereby allowing a small retreat. However, as long as such a retreat stays limited above the 1.7020 hurdle, we would expect buyers to recharge and shoot again. This time, they may breach the 1.7255 level and perhaps put the 1.7430 obstacle on their radars. That barrier is marked as a resistance by a small intraday swing high formed on March 13th.

Taking a look at our short-term oscillators, we see that the RSI has just poked its nose above 50, while the MACD, already above its trigger line, looks to be heading towards zero. It could gain a positive sign soon. These indicators suggest that the pair may soon start picking the necessary upside momentum for overcoming the 1.7020 barrier.

On the downside, a dip back below 1.6915 may signal that traders want to keep this exchange rate range-bound for a while more. Initially, we could see a slide towards the 1.6730 level, marked by today’s low, the break of which may encourage some sellers to challenge yesterday’s low, at 1.6610, which is also the lower end of the pre-mentioned trendless zone.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is GBP/CAD Set To Start Trending North?

Published 03/24/2020, 08:56 AM

Updated 07/09/2023, 06:31 AM

Is GBP/CAD Set To Start Trending North?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.