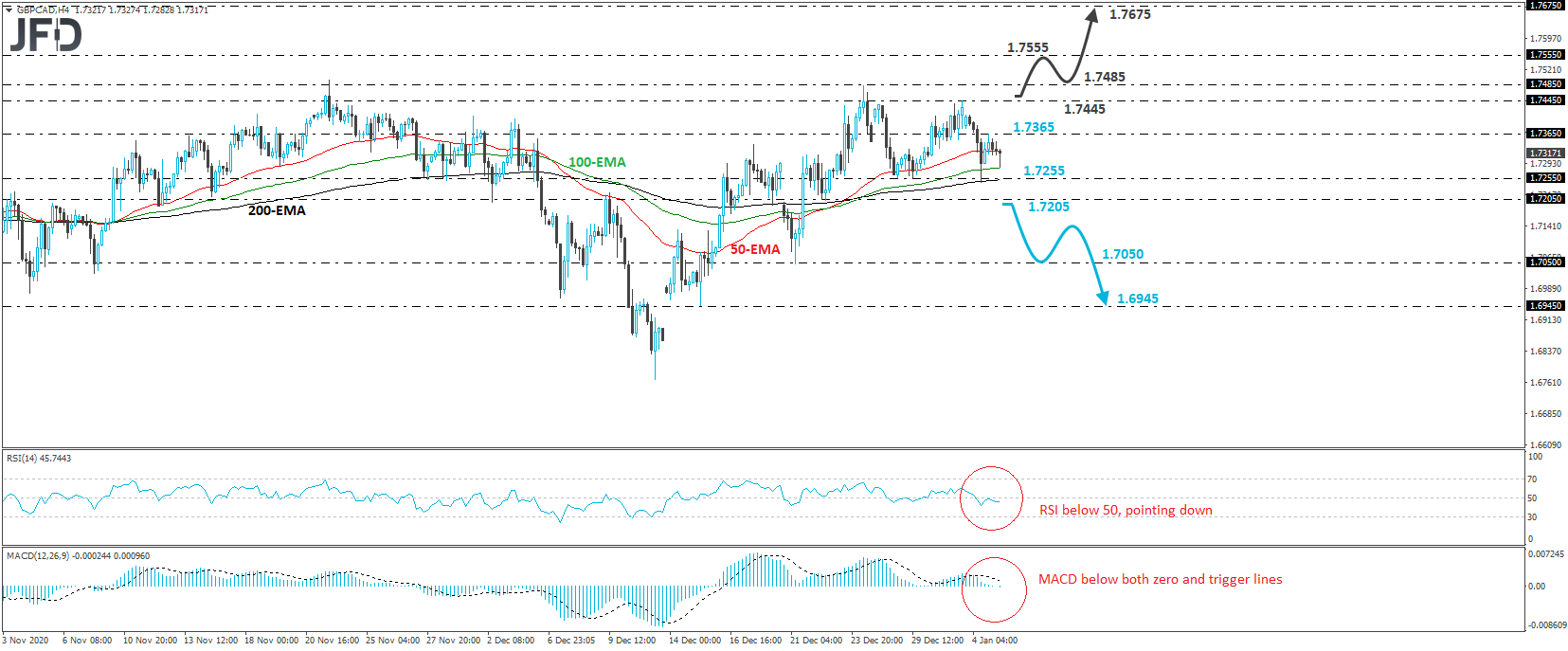

GBP/CAD traded higher yesterday, but hit resistance at 1.7365, and then it pulled back again. Overall, the pair looks to be forming a “Failure swing top” pattern, which if completed, could signal a bearish reversal. That said, until we get that completion, we will stay sidelined.

A break below the neckline of the formation, at 1.7255, could initially target the 1.7205 zone, which is the low of Dec. 22. A break below that zone could carry larger bearish implications and may pave the way towards the low of the day before, at around 1.7050. If that barrier doesn’t hold either, then we may experience extensions towards the low of Dec. 15, at 1.6945.

Looking at our short-term oscillators, we see that the RSI lies below 50, pointing down, while the MACD runs below both its zero and trigger lines, pointing south as well. Both indicators suggest that the price may have started to gather downside speed, which supports the notion for a completion of the failure swing, and thereby for further declines.

On the upside, a break above 1.7445 may discard the formation and may initially aim for the high of Dec. 24, at 1.7485. If the bulls are strong enough to overcome that zone as well, then we could see the rate climbing towards the 1.7555 barrier, marked by the high of Sept. 1, the break of which may set the stage for extensions towards the peak of July 31, at 1.7675.