I wrote before that France represents the greatest vulnerability to the European Union. The problem was the French economy has been negatively diverging from the rest of the eurozone.

While troubled peripheral countries have undertaken reforms in various forms, the French government has been afraid of any economic pain and allowed France to underperform its European partners. (see Short France?):

There is a French elephant in the eurozone room that no one dares to speak about. While Brussels can manage crisis after crisis in peripheral countries, a blowup in France is too big to contain as the French-German relationship lies at the political heart of the European Union.

Since I wrote those words, the CAC 40 has been range-bound against the Euro STOXX 50 for the last four years.

As French stocks get closer to the bottom of that range, President Hollande boldly stepped into the spotlight (no, not the one highlighting his personal life!) and outlined a series of bold supply-side reforms which will be bullish for the long term outlook for European growth, according to this Reuters report:

French President François Hollande said on Tuesday he would cut public spending by 50 billion euros ($68 billion) in 2015-17 and ease the tax burden on companies by phasing out hefty family welfare payroll charges.

The savings will come from cutting businesses' payroll taxes to encourage hiring and reduce government spending by €50 billion. Ambrose Evans-Pritchard, who is no Europhile, described the reforms by comparing François Hollande to Tony Blair's New Labour government's policies:

The embattled French leader stunned the left-wing of his own Socialist Party by calling for a new economic strategy based on “supply-side” policies, accompanied by €30bn of fresh spending cuts by 2017 to pave the way for lower taxes and charges on companies.

The shift has been widely compared with Tony Blair's New Labour policies and the reform drive by German Chancellor Gerhard Schröder in 2004, though Mr Hollande vehemently denied any infection from market “liberalism” in a televised press conference.

Hollande had his chance at a Nixon in China moment in 2012. Is this the real thing? Or is this announcement designed to deflect attention away from stories about his private life? Deutsche Welle reported that the President was peppered with questions about his alleged affair with an actress after the press conference in which he dropped his economic bombshell:

But then the announcements of this year's new political paths are over, and the cold shower everyone had been expecting arrives. As soon as the floor is opened to journalists' questions, the first one comes: Will Valérie Trierweiler be accompanying the president on his trip to Washington at the start of February?

This is what is currently preoccupying France. Hollande's partner has been in the hospital for several days with "exhaustion," after a Paris gossip magazine reported an alleged affair between the president and an actress. "I understand you asking the question, and I am sure you will understand when I answer that everyone goes through trials in their private life. It hurts. But I have a principle: private business is dealt with privately."

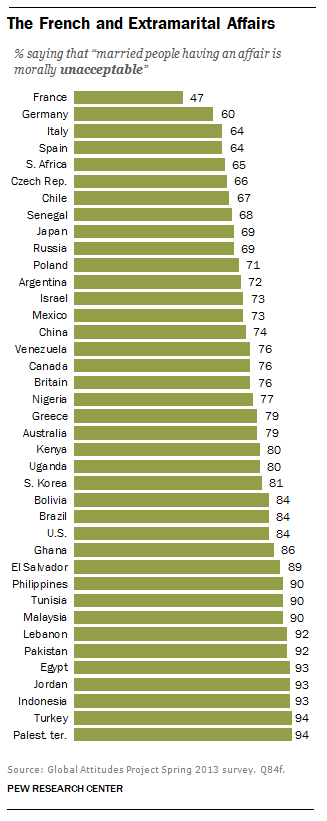

It sounds as if Hollande's government is getting serious about the discipline imposed by the markets and these announcements are not intended to distract the public from the stories about his private life. A Pew Research Center poll (via Business Insider) shows that the French public is far more relaxed than the rest of the world about the acceptability of extramarital affairs.

As an aside, no doubt there are some American politicians (named Clinton, Gingrich and even Palin) who wish that they were French after seeing the results of this poll.

Regardless, if Hollande were to be serious about these reforms, France may not have far to go in order to become an engine of growth for the eurozone. Already, a BBC report highlighted the fact that French productivity is in fact better than Britain's. What can Europe do if French business were to undergo a Renaissance?

France's labour productivity stands at a healthy €45.4 (£38) per hour worked according to Eurostat, well ahead of the EU average of €32.1, while the OECD reports that the average number of hours per week worked in France stood at 38 hours for 2011, compared to 36.4 in the UK and 35.5 in Germany. Productivity per hour in France is 15% higher than in the UK. Hard work indeed!

Bottom line: The news of this important political development must be regarded as another reason to be bullish on Europe (see my recent post A one-way bet on eurozone equities).

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.