Social media giant, Facebook Inc (NASDAQ:FB) is reportedly bidding for rights to stream highlights from the upcoming FIFA World Cup from Twenty First Century Fox (NASDAQ:FOXA) , per Bloomberg. Twenty First Century Fox has the U.S broadcast rights for FIFA.

The FIFA World Cup is a quadrennial international football tournament. The 21st FIFA World Cup will be held in June next year in Russia, with 32 national teams participating for the coveted title.

The tournament is one of the most prestigious sporting events and garners very high viewership. Per Bloomberg, the finale of the 2014 FIFA World Cup was the most-watched soccer match in the country’s history with over 25 million viewers.

Apart from Facebook, Twitter Inc (NYSE:TWTR) and Snap Inc (NYSE:SNAP) are in the race. The companies are ready to shell out millions of dollars to gain the World Cup highlights rights, adds the report. However, there has been no official word on the matter so far.

Since last year, Facebook has been ramping up its live video efforts. Online video is emerging as a big opportunity to boost ad revenues, which contribute over 95% to Facebook’s total revenue. As a matter of fact, the company has been on a signing spree to bring more live video content, especially sports. Streaming, particularly live sports, is one of the most lucrative opportunities as it helps to boost engagement levels (especially millennials) and brings more advertisers.

A few days back, Facebook reportedly partnered with FOX Sports to live stream UEFA Champions League soccer matches during the 2017–18 season, which begins in September in the U.S. Earlier this year, the company inked live-streaming pacts, including with Major League Baseball, the Major League Soccer and Univision, for Liga MX matches.

At present, Facebook carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

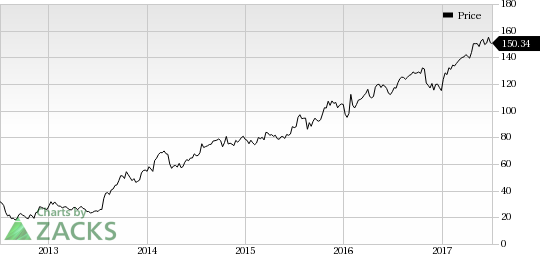

We also note that it has outperformed the Zacks categorized Internet - Services industry in the last one year. The company’s shares have gained 28.8% compared with the industry’s rise of 20.9%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Facebook, Inc. (FB): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research