The answer to the above question is "yes!". Its amazing how many traders and investors don't know that the three most common Europe indexes, FTSE, CAC, and DAX have all started new bear markets.

The FTSE is the London Financial Times Index. The CAC is the French CAC 40 Index, and the DAX is the German DAX Composite index.

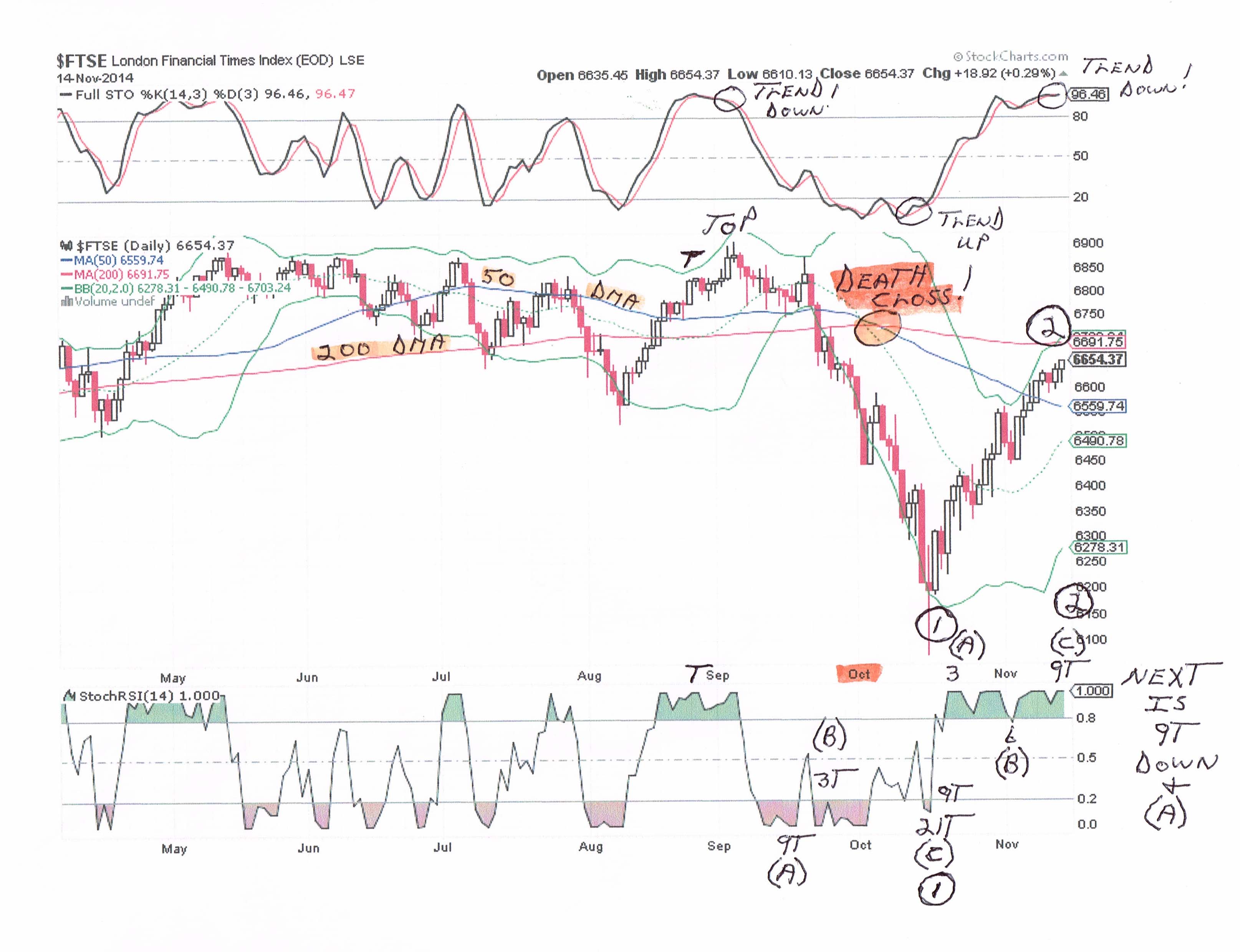

I have included all three charts with this article, so you can take a look at each index and see when they entered their new bear markets.

When the 50 day moving average crosses the 200 day moving average it forms the dreaded "Death Cross". To stock market old timers and stock market technical analysts, this has always meant that the affected index is starting a new "bear market".

It's important because many stock market experts believe that the European markets might be "leading" the way down for the USA stock market. That could be true, because some of our common stock market indexes are getting closer to their death crosses". Example: The NYSE Composite index is currently just 17 points away from its death cross.

The exception is the Russell 2000 index. It had its death cross soon after the DAX index and I believe the Russell 2000 is leading the way down for the USA stock market indexes. It did it for the 2000 and 2007 bear markets and its doing it again.

We have been in a up trend since the middle of October. Some of you remember when the Dow 30 went down 460 points in one day. That was the end of my main trend down and then we started a new uptrend. I believe we are just days away from a top on this current uptrend. When the next down trend starts executing, I think we could see a lot more "Death Crosses" appearing.

I also think the next down trend will start showing some "fear" in the stock market. For those investors and traders not prepared it could be very bad news, but for those prepared and waiting, it will be a great opportunity.