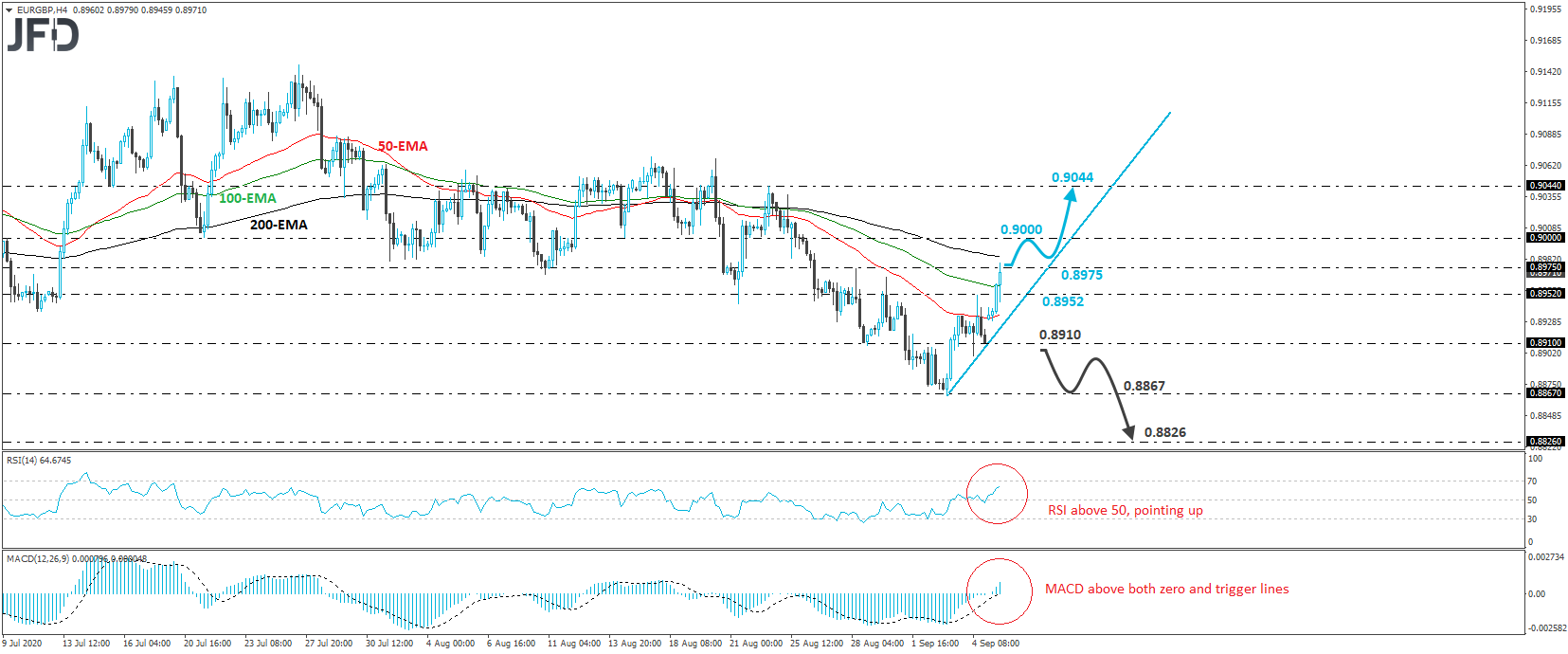

EUR/GBP edged north on Monday, breaking above the resistance (now turned into support) barrier of 0.8952, marked by Friday’s high. The rate also broke briefly above the 0.8975 level, but retraced back below it. Overall, EUR/GBP is trading above a new short-term upside support line drawn from Thursday’s low and thus, we would consider the short-term outlook to be somewhat positive for now.

Another attempt and a successful break above 0.8975 may encourage the bulls to push the battle towards the psychological round number of 0.9000. If they are not willing to stop there, a break higher may set the stage towards larger advances, perhaps towards the high of August 24th, at around 0.9044.

Looking at our short-term oscillators, we see that the RSI lies above 50, points up, and looks to be approaching its 70 level, while the MACD stands above both its zero and trigger lines, pointing up as well. Both indicators detect strong upside speed and corroborate our view for some more short-term advances.

In order to abandon the bullish view, we would like to see a strong dip below 0.8910. The rate would already be below the aforementioned short-term upside line, something that may encourage the bears to shoot for the 0.8867 barrier, defined as a support by Thursday’s low. Another break, below 0.8867, would confirm a forthcoming lower low and may extend the decline towards the 0.8826 territory, marked by the low of May 15th.