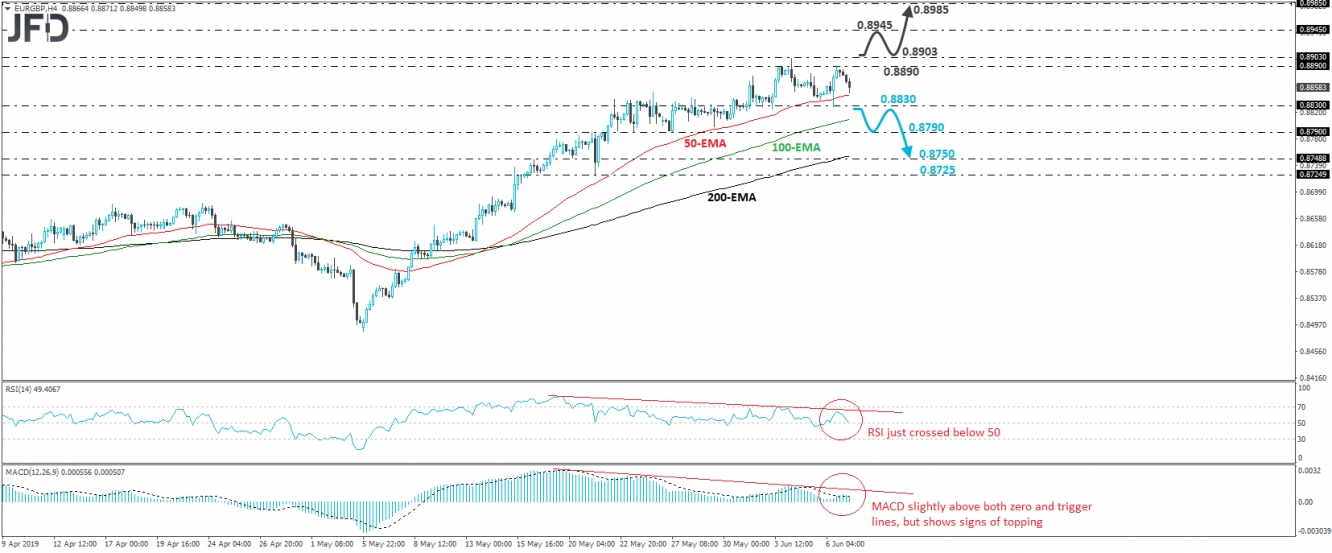

EUR/GBP traded lower on Friday, after it hit resistance near 0.8890 on Thursday. Following a short-term uptrend that had been in play since May 3rd, the pair has flattened and entered a sideways mode recently, between roughly the 0.8830 and 0.8903 levels. Thus, the rate’s failure to push for a higher high, but also the lack of a clear trend reversal signal, keep us sidelined for now.

A clear and decisive dip below 0.8830 would confirm a forthcoming lower low on the 4-hour chart and may signal a short-term reversal to the downside. This could encourage the bears to take the driver’s seat and perhaps aim for the low of May 27th, at around 0.8790. Another dip, below 0.8790, could carry more bearish implications, perhaps setting the stage for the 0.8750 zone, or the 0.8725 hurdle, which is defined by the low of May 21st.

Looking at our short-term oscillators, we see that the RSI turned down and just touched its toe below its 50 line, while the MACD, although still above both its zero and trigger lines, has started to top. These technical studies indicate that the pair has run out of positive steam and suggest that a trend reversal may be around the corner. However, we repeat that we prefer to wait for a clear dip below 0.8830 before we get confident on that front.

On the upside, we would like to see a decent recovery above 0.8903 before we start examining whether the prevailing uptrend has resumed. Such a move could initially pave the way towards the 0.8945 zone, the break of which may allow the bulls to drive the battle towards the high of January 15th, at around 0.8985.