Key Points:

- ECB extends QE program and lowers buying requirements.

- RSI and Stochastic Oscillators enter oversold status.

- Expect a euro dollar retracement in the coming days.

The euro dollar took a relatively strong hit overnight as news that the ECB would be extending their quantitative easing, whilst also reducing the buying limits, was released and immediately saw the pair touching levels not seen since the Brexit. Initially, the QE announcement kicked off a veritable rout which took the pair all the way through the 1.07 and 1.06 handles to currently trade around the 1.0593 mark. However, there are some encouraging technical signals which could suggest that a retracement may be in play over the next few days.

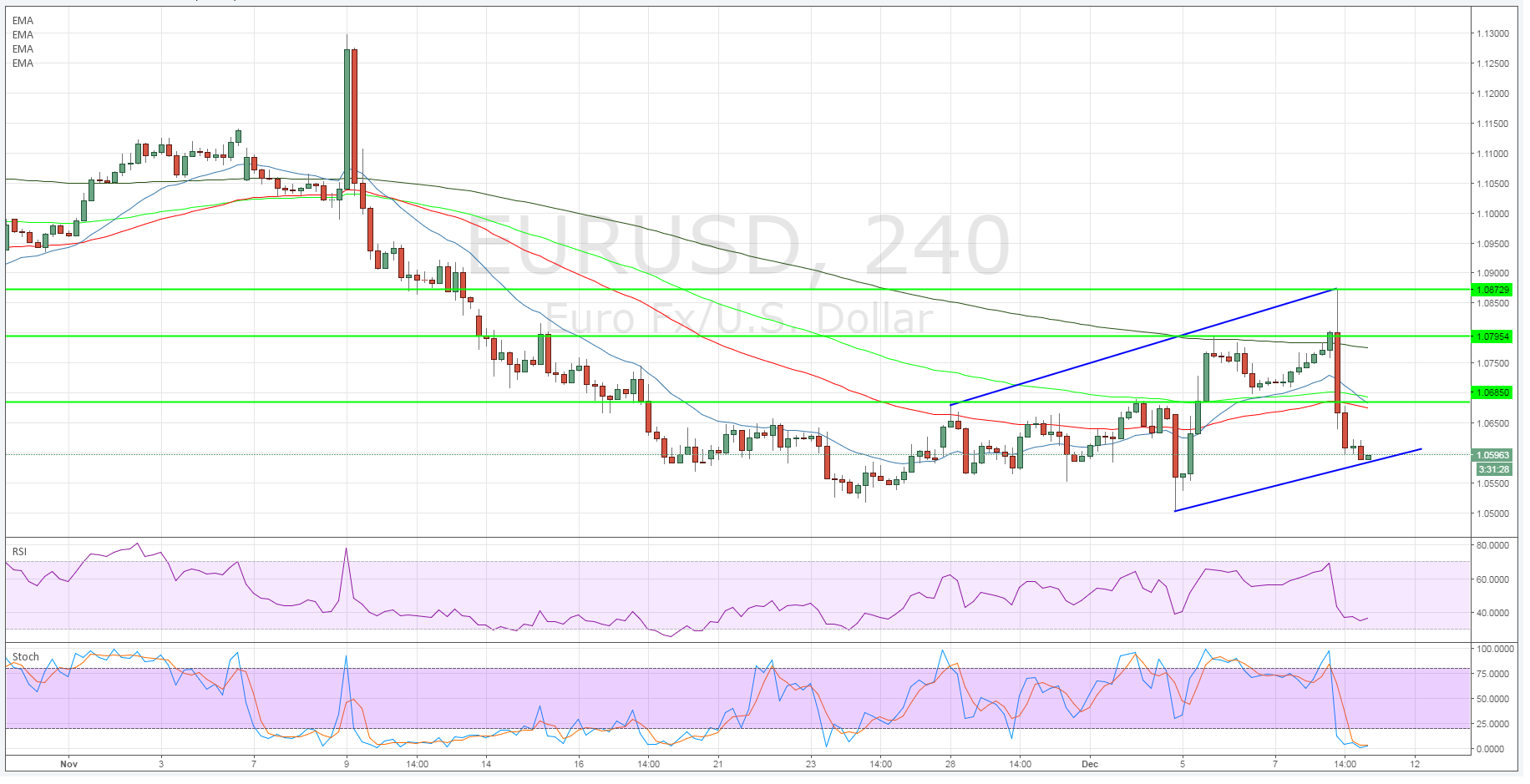

In particular, taking a look at the 4-hour timeframe demonstrates the crossroads that the pair is currently at. The recent decline has taken price action back within a key liquidity zone where plenty of support has been historically evident. In addition, the RSI and Stochastic Oscillators are both within oversold territory which is a further indicator of a potential correction to come. There is also a relatively clear cypher on the hourly chart which adds further weight to the bullish contention.

Subsequently, the most likely scenario is a short period of sideways movement around the 1.06 handle before price trends sharply higher to relieve the pressure on the RSI and Stochastic oscillators. A likely scenario would involve a retracement back towards the 1.0685 level, and 1.0795 in extension.

From a fundamental perspective, the extension of QE is unlikely to be as devastating to the EU economy as the market is currently predicting. It’s a relatively small increase given some of the QE levels seen within other nations (Japan) and may go some way to further stabilising the economy. In addition, as other countries around the world look towards an easing cycle there may be capital flows back towards the major western nations, and away from some of the yields currently available within the Asia Pacific region. Subsequently, although QE is unlikely to be a magic bullet, it really doesn’t pose a negative economic fundamental in the short run.

Ultimately, despite some of the fundamental factors impacting the euro’s current direction, the 1.0593 valuation was always likely to prove relatively depressed over the medium term. So it should be of little surprise that the pair is likely to retrace some of those losses as the market digests the economic risk that additional QE poses to the Eurozone. Subsequently, keep a close watch on the pair over the next few days as the current bearish trend is unlikely to hold for anything but the short term.