- Volatility has yet to take a breather

- Global record low yields a new norm

- Low yields favor the dollar

- EUR bear itching to sell more

- Buy government bonds on capital keys

- Only buy AAA rated paper including loans, and

- National Central Bank’s buy their country government bonds based on capital keys

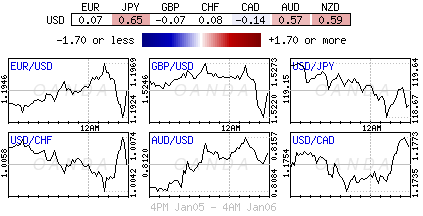

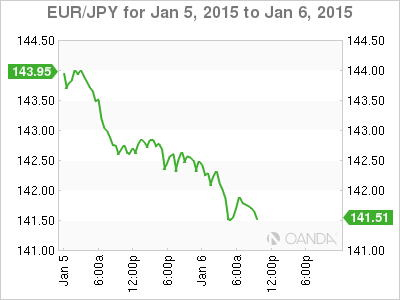

The market has yet to take a breather in this New Year, basically carrying on where we left off Q4, 2014. Traders and dealers are happy that there is strong price movement from all the asset classes – bonds, equities and forex. It provides market opportunity. Early current market signs would suggest that nothing is about to change anytime soon as the market continues to print new intraday record currency high/low’s (mainly driven by central bank rate divergence), while pressurizing government yields even further as tumbling oil prices dampen the outlook for inflation and raised the prospect central banks will extend stimulus measures to boost growth. No one seems concerned with the transfer of wealth from oil producers to the consumer just yet. Basically price and yield moves are ignoring basic fundamentals. (German 5-year paper has been trading in and out of negative yield territory).

The CBOT VIX (implied volatility) finished 2014 about +40% higher than where it started the year. Historically, the VIX is usually inversely correlated with equities – nevertheless, they both ended 2014 up. Last year the VIX averaged just shy of 15 (currently north of 20 and up +4% in 2015), which is below its historical norm, but well off its lows for the year (10.28). The VIX of the VIX (or VVIX – volatility of volatility measure) has been trading above 97 for the past three-months, and now straying into territory that has some investors nervous. The present equity rout is a good example, reminiscent to last October’s equity shock driven by the possible finality that the Fed is to increases interest rates (when – is another question).

Low yields makes dollar attractive

Even Government bond directions are a coin toss for many. Currently, the market seems unconvinced by direction of U.S yields, presently lower yields are currently winning out. A small percentage of the market is betting that U.S. 10-Years could reach new lows in 2015 (+1.388%) and this despite the possibility that the Fed could raise rates in H2. Why? Lower global yields should make the U.S. market most attractive and a rising US Dollar adds to its appeal. Others point out the possibility that the “slam-dunk” that is the ECB beginning to act (rather than just talk) in building its balance sheet to €3trillion may not happen on cue as expected at the January 22 meeting. Note that the ECB’s balance sheet has already been bumped some +8% from September’s levels but still some -€850m from the target.

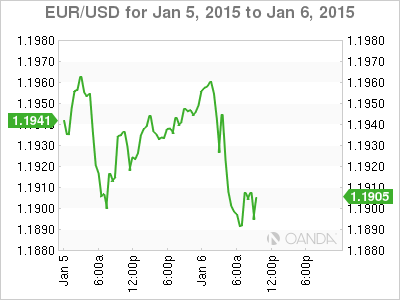

The currency market is being dominated by the “mighty” dollar while the EUR faces a three-prong attack – inflation or lack of, Grexit and the dollar itself. The EUR trading is now trading at levels last seen in late 2005/early 2006 and providing more uncertainty to the global equity markets. The market will be looking to tomorrow’s Euro flash CPI for further evidence of low inflation.

Euro modest growth story

This morning’s eurozone composite PMI was revised to 51.4 in December (expected 51.7), and further proof of only modest growth despite business continuing to cut their prices. The combination of weak economic growth and low inflation maintains pressure on the ECB to provide additional stimulus, and supports market expectations that a government bond purchase plan will be revealed at the January 22 meeting. The composite PMI for Q4 was the lowest since Q3, 2013 and an indication that Euro growth has taken a further step backwards from its already weak pace.

The market is reporting that the ECB is eyeing three possible outcomes for QE on Jan 22:

If true, then the QE debate can be interpreted as shifting towards QE modalities with the ECB eager to show that QE is “not” adding credit risk by getting NCB’s to hold the risk. Perhaps more of a concern is that QE could be pre-announced on Jan 22, but short on details. The final result for this month’s highly touted ECB meeting could end up being an “uneasy” compromise on criteria, terms and magnitude of Eurozone government bond purchases. Draghi will not want to, nor can he afford to disappoint the market. Deflation, low inflation and market reputation are all at stake from his perspective. Many analysts have noted that the President may find himself “over compromising and under delivering.”

EUR bears grow impatient

The EUR (€1.1900) has again turned south on focus of the details. Market consolidation was always expected after the massive break of the psychological €1.2000 on the weekend. So far, the EUR solid downtrend has made any recoveries rather weak. The IMM futures market would suggest that there is even more room for EUR speculators to go shorter. Current future EUR shorts are still -15% below last years peak and -30% below the 2012 record. The obvious risks from Grexit and the ECB meet should keep rebounds relatively weak. Option and corporate EUR bids below €1.19 will provide some temporary support, but algo or black box stop-losses ahead of yesterday’s Asian low €1.1860 could prove attractive. The market needs to break through this level with conviction for greater bear action. This will certainly open the way for the February/January lows 2006 (€1.1826 & €1.1800).

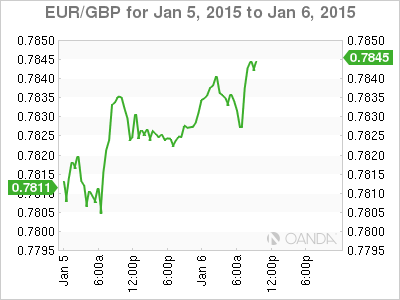

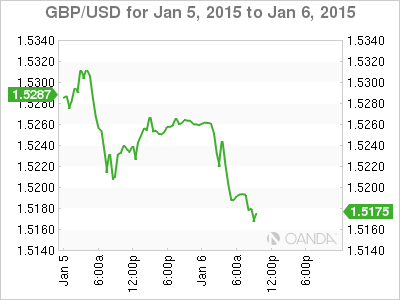

U.K data pushes rate hike back

The EUR is not alone on the disappointing PMI front. Business activity in the U.K’s dominant service sector sputtered in December. It has weakened to 55.8 from 58.6 in November, solidifying the lowest reading in 18-months. The slowdown mirrors a disappointing December for both U.K construction and manufacturing. The weak headline suggests that economic growth in the U.K has slowed further in the final three-months of 2014 to a quarterly rate of +0.5% from +0.7% in Q3. The data should put pressure on Governor Carney at the BoE not to hike rates anytime soon. The market has been pricing in a BoE rate hike for late Q3 or early Q4. Nevertheless, the survey shows signs of stronger wage growth a key component watched closely by the BoE. For Prime Minister Cameron, the report is not good news, as the Conservative party will be fighting a general election in Q2 with a focus on growth.