Miners rejoice as transaction fees on Ethereum hit a high for 2020. But with staking on the horizon, how long can such revenues last?

Key Takeaways

- Transaction fees on Ethereum has become considerably more expensive.

- DEXes and derivatives exchanges that rely on on-chain settlement for transaction confirmation could see volumes reduced if high fees persist.

- Sale of Ethereum-based stablecoins may explain the increase in transaction fees.

- Miner revenue has substantially increased, but scalability innovation threatens the continuation of this trend.

The average transaction fee on Ethereum has increased by over 160%. Miners are enjoying higher revenue at the expense of users, but this could change in the near future.

Transacting on Ethereum Is More Expensive

Ethereum transaction fees have been increasing over the month of May, with the average transaction fee rising to nearly $.30 this month.

This has been a cause for concern as it makes using the network more expensive.

The average transaction fee for 2020 thus far is $.15 or 0.00085 ETH. However, the average transaction fee for the month of May alone is $.29 or 0.00143 ETH, per data from CoinMetrics.

But there are anomalies where higher transaction prices prevail. On Synthetix, for example, the average transaction fee to mint SNX is $7.4 at the time of press.

Ethereum’s core value proposition hinges on being able to seamlessly transact over the network.

Several projects built on the network stand to suffer from reduced transaction volume if user activity drops due to high fees. DEXes stand to lose the most, as they require on-chain settlement for transaction confirmation.

The reasons for high transaction fees are myriad, but one theory lies in growing bullish sentiment for all cryptocurrencies since Bitcoin’s latest halving event. In the previous bear market, many investors had been hoarding Tether (USDT) awaiting a market shift.

The time to deploy this sidelined liquidity may have finally come.

Stablecoins represent about $10.5 billion of the total cryptocurrency market cap, out of which $7.3 billion exists on Ethereum.

Since Ethereum is home to a majority of stablecoin volume, a mass exodus from stablecoins into more speculative assets like BTC and ETH could explain the rise in transaction fees.

Miners, Proof of Stake, and Scalability

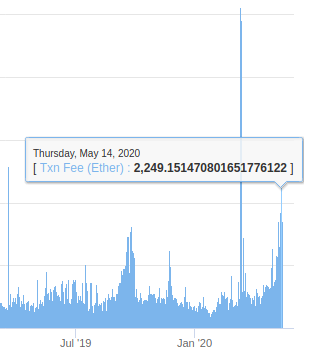

Over the course of 2020, miners earned a daily average of 631 ETH from transaction fees. But in May, this average has risen to 1,216 ETH – a near 2x increase.

While users endure the burden of high transaction fees, miners have been thrilled by increased revenue.

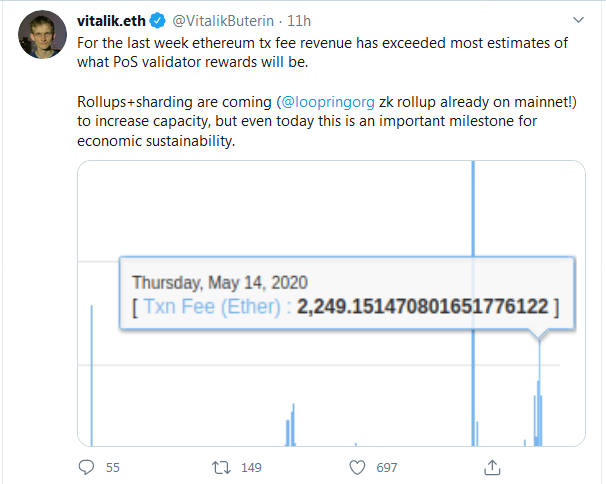

Vitalik Buterin noted that the current fees earned by miners are higher than the staking reward estimates for ETH 2.0. This gives rise to the notion that Ethereum is developing into a fee market, where demand for block space pushes transaction fees higher.

Scalability innovation, such as optimistic rollups, attempts to solve high transaction fees by allowing more transactions to be settled with the same amount of block space.

With improved scalability, miners’ revenue would be the first victim.

To make up for lost profits, the Ethereum network will need to onboard more users so they can earn their revenue through more transactions at a lower fee rather than a few transactions at a high fee.