- EPAM Systems, Inc. showcases Q2 2023 resilience and growth, asserting dominance in the software and digital expertise industry.

- Market expansion, partnerships, and talent investment fuel financial prowess, setting the stage for lasting profitability.

- Consistent revenue rise, diversified portfolio, and strategic innovation drive EPAM's success.

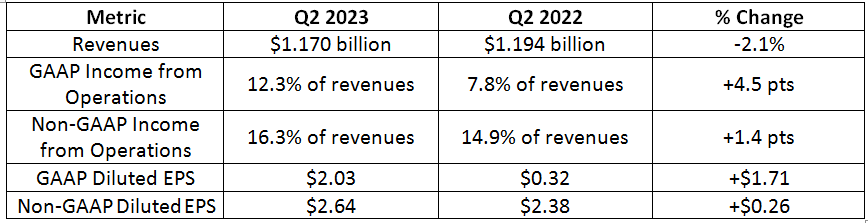

EPAM Systems (NYSE:EPAM) has demonstrated resilience and growth in the second quarter of 2023, establishing itself as a prominent player in the software and digital platform expertise industry. The company's strategic focus on market expansion, partnerships, and talent investment has fueled impressive financial performance and long-term profitability.

Steady Revenue Growth and Industry Leadership

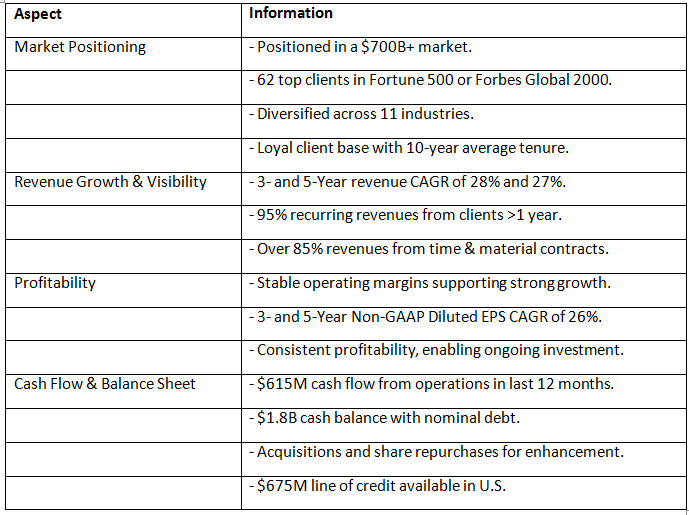

EPAM's consistent revenue growth, with a 3-year and 5-year CAGR of 28% and 27% respectively, sets it apart as an industry standout. The company's revenue streams are highly diversified, with over 85% of revenues originating from time and material contracts. This stability, coupled with reliable operating margins, drives strong earnings growth, reflected in a 3-year and 5-year non-GAAP diluted EPS CAGR of 26%.

Strong Financial Foundation and Expansion Potential

EPAM's robust cash flow generation and solid balance sheet position it favorably for future expansion. With a cash balance of $1.8 billion and minimal debt, the company is well-equipped for strategic acquisitions and share repurchases. Additionally, EPAM benefits from a $675 million line of credit in the U.S., enhancing its financial flexibility.

Empowering Innovation Through Partnerships

Strategic partnerships and go-to-market efforts have played a pivotal role in expanding EPAM's market presence. The introduction of the DIAL AI Orchestration Platform, merging LLMs and deterministic code, reinforces the company's enterprise innovation capabilities, offering a competitive edge in the market.

Global Presence and Market Reach

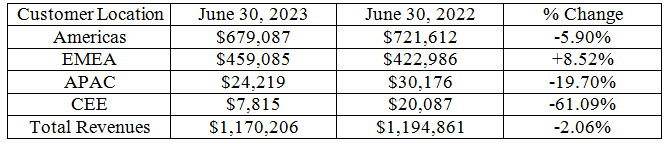

EPAM's revenue distribution across customer locations showcases its global reach and diversification. While the Americas experienced a revenue decline, the EMEA region exhibited strong growth. The company's focus on emerging markets, alongside successful partnerships with industry leaders, contributes to its international expansion and market penetration.

Versatility Across Industry Verticals

The breakdown of EPAM's revenue by industry vertical underscores its ability to cater to diverse customer demands. Despite challenges in sectors like software and hi-tech and life sciences and health, growth was evident in financial services and emerging verticals. This adaptability exemplifies EPAM's agility in various industry contexts.

Client Diversity and Growth Potential

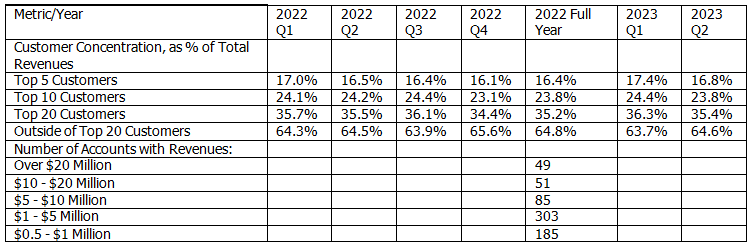

Although EPAM relies on key clients, the top 5 customers contribute an average of 16.4% to total revenues. Nevertheless, the company maintains a well-diversified client base, with revenue from clients beyond the top 20 accounting for 64.6% of total revenues.

Capitalizing on Market Opportunities

EPAM is strategically positioned to capture a substantial share of the Enterprise IT Services Market, projected to surpass $1.8 trillion by 2026. Focusing on high-growth segments like cloud, consulting, and security services, EPAM leverages its expertise to drive continued expansion.

Recognition and Leadership

EPAM's legacy of software and digital platform expertise, coupled with its global reach and adaptability, earned it a spot among Forbes' top 25 fastest-growing public tech companies. The company's commitment to transformative growth for leading corporations, the embrace of AI capabilities, and strategic partnership with Google (NASDAQ:GOOGL) Cloud solidify its reputation as an industry leader.

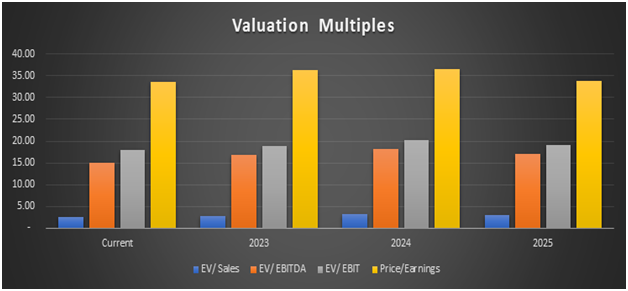

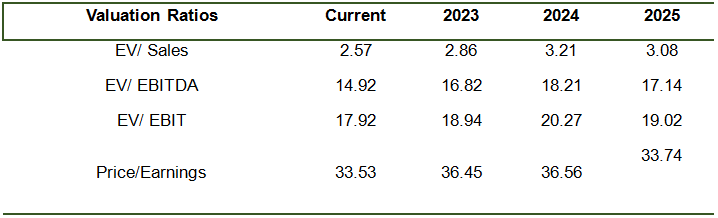

Valuation Multiples

Source/Note: Estimates are based on calculations by Equisights

Assessing the presented valuation multiples, the stock currently valued at $253.16 seems to warrant a buy rating with a target price of $267.50. The projected EV/Sales ratios show a potential upward trajectory, indicating the possibility of increased revenue. Similarly, the gradual rise in EV/EBITDA and EV/EBIT ratios suggests consistent operational performance and potential profitability improvements. Additionally, the relatively stable Price/Earnings ratio suggests steady earnings potential over the forecast period. Nevertheless, a comprehensive analysis, accounting for industry trends and company-specific factors, is recommended before making an investment decision.

Disclosure: We don’t hold any position in the stock.