The Trump administration claims that the U.S. is “transitioning to greatness,” and that energy companies are going to see “massive gains.” U.S. Secretary of Energy Dan Brouillette says there is “stability” in the oil market, and that economic activity will “explode” on the other side of the pandemic. Thanks to the leadership of President @realDonaldTrump, the transition to greatness is well underway, and our economy along with our U.S. energy companies are going to see massive gains on the other side of this pandemic. pic.twitter.com/EZ2DFnlcUw

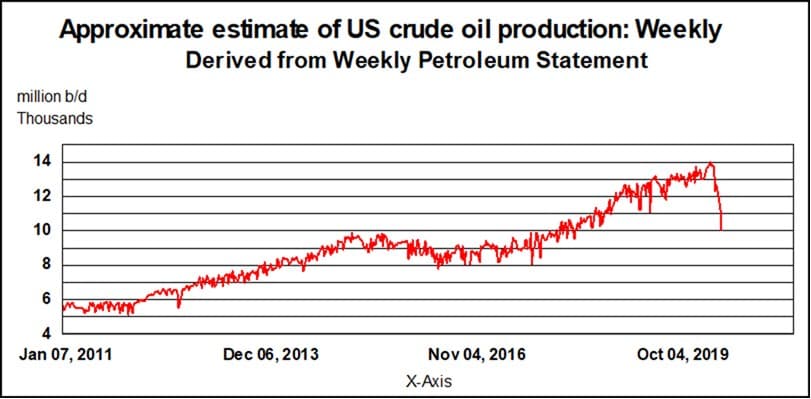

Meanwhile, back in reality, U.S. oil production continues to decline as drillers shut in wells and cut back spending. Output has already declined by 1.1 million barrels per day (mb/d), and more losses are likely. New data from Rystad Energy predicts U.S. oil production declines of roughly 2 mb/d by the end of June.

“Actual production cuts are probably larger and occur not only as a result of shut-ins, but also due to a natural decline from existing wells when new wells and drilling decline,” Rystad said in a statement.

Energy expert Philip Verleger, in an article for Energy Intelligence reports that the magnitude of output declines is much larger. His latest research shows that production as of May 10 is down by almost 4 million bpd from its peak as the below chart shows.

To be sure, the U.S. government is doing quite a bit to try to bailout the oil industry. A new report finds that some 90 oil and gas companies will benefit from the Federal Reserve’s corporate bond buying program. The Trump administration is also quietly reversing environmental protections on the oil and gas industry.

But in the face of a historic meltdown in the oil market, even handouts from Uncle Sam won’t stop declines. The U.S. oil industry continues to idle drilling rigs at a tremendous clip, and the rig count is down by more than half in two months. “[W]e think that the last time there was so little drilling activity in the US was the 1860s during the first decade of the Pennsylvania oil boom,” Standard Chartered analysts said. The investment bank said that the contraction was notably acute in Oklahoma, where rigs fell to just 11 across the state, down 89 percent from the same period a year earlier.

The sharp decline in rigs, drilling and completion activity means that the steep decline rates endemic to shale drilling will overwhelm what little new production comes online. Standard Chartered said that if activity were to remain stuck at current levels, U.S. production in the five main shale basins would fall by 2.89 mb/d by the end of 2020.

Those declines would come on top of the output that has only been shut in temporarily. Standard Chartered envisions a “squashed-W pattern” for supply, in which temporarily idled output comes back online in a few months, but more structural declines continue thereafter.

The EIA, characteristically, is much more optimistic about the state of U.S. supply. The agency said on Tuesday that it only sees a 0.5 mb/d decline in oil production this year, compared to 2019 levels. Notably, Secretary of Energy Dan Brouillette says production will increase in the third and fourth quarters as the economy roars back.

Others aren’t so sunny. A report from Wood Mackenzie released on Wednesday says that oil demand will take years to recover.

“Production is falling sharply in the US, and some producers are reluctant to sell forward,” Commerzbank wrote in a note.

But while some oil drillers have hesitated to lock in hedges, others have decided that they can stomach hedges at extremely low prices, not because they can profit at such low levels, but likely only to guard against another meltdown. “The strike prices achieved in the latest surge of hedging have been low, these appear to be hedges designed to improve the probability of survival should market conditions deteriorate further,” analysts at Standard Chartered (OTC:SCBFF) wrote in a report.

“Some of the hedges have been fixed at very low prices: one company has a USD 20.73/bbl WTI hedge for Q2, another has three-way collars for Q3 and Q4 with a floor of USD 25/bbl Brent,” Standard Chartered added.

The unease from some drillers regarding oil prices is understandable. The Secretary of Energy may predict “greatness” ahead, but others see a long, protracted economic recovery.