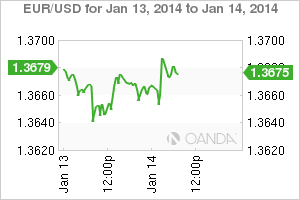

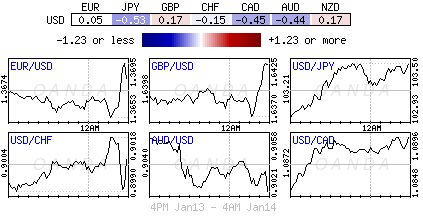

Today's US retail sales report is this week's headliner. The release will indicate how the holiday sales season fared this side of the Atlantic. Investors require a relatively strong distraction from last Friday's disappointing job numbers. So far, they have just about been kept awake by the plethora of Fed head speakers, and today is no different with the market honoring the presence of Philadelphia Fed President Plosser (2014 voter, hawk) and Dallas Fed President Fisher (voter, hawk). The danger is that the US headliner may not be enough to appease the dollar bulls. They certainly do need a win, as the weaker USD longs are beginning to have some doubts, especially now that the 18- member single currency has surpassed its NFP highs earlier this morning. EUR/USD" border="0" height="200" width="300">

EUR/USD" border="0" height="200" width="300">

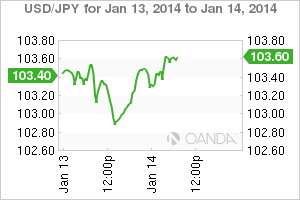

So early in the New Year and already investors are having to buy into the theory that weather has more to do with US job numbers that previously expected. As per usual, weather can play a distorting role despite seasonal adjustment procedures. Was last month's employment report an aberration or not? Other employment data has been more favorable, including ADP and various surveys. If we rely on the weather this would imply that the market should be expecting a sluggish January also. The December jobs report raises questions on whether the Fed should taper further at the end of the month and whether Congress should extend unemployment benefits. These are two themes that could handcuff the forex market while the Fed gets to soak up every indicator between now and the next meet at the end of this month before deciding on their next taper move.  USD/JPY" border="0" height="200" width="300">

USD/JPY" border="0" height="200" width="300">

The near term dollar price action is most certainly being dominated by the weaker-than-expected tone of the employment report, especially in light of the strong yield fuelled dollar rally in the week heading into the report. Currently, there is not enough evidence to really change ones views on a dollar dominating with yield advantage just yet. Many in the market are willing to view this dollar pullback as an opportunity to establish more USD longs again, but at much better levels or at least improve their "core short average." Investors should be looking at the weaker trend setting trio of the AUD, JPY and CAD and in particular the more vulnerable EM FX currencies for guidance and opportunities. GBP/USD" border="0" height="200" width="300">

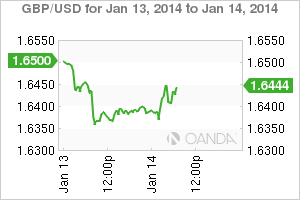

GBP/USD" border="0" height="200" width="300">

Wading across the pond this morning it seems likely that the BoE Governor Carney is getting off lightly, certainly better than his predecessor, as the UK CPI (+2.0%) moves back to BoE target for the first time in nearly five years. This number will help the bank in its task to dilute the importance of the +7% employment threshold. Many had been expecting the BoE to comment or potentially move their forward guidance parameters after last weeks MPC meet because of the central banks underestimation of employment data in particular. The fact that inflation is not rising will help Carney to guide markets away from the UK recovery and "speedier utilization of spare capacity" as it looks to strengthen forward guidance through communication. However, Carney job is far more difficult than the Fed's. Bernanke and Yellen are faced with low inflation while the UK is bang on target. Who do you think is going to have the tougher task of convincing the markets that rates are going to stay lower for longer? The pound has managed to finally catch a bid on the back of the release, but does it have the momentum to stay there? The biggest problem with sterling positions this year is that everyone is in love with it, and they are all caught the same way – long GBP. Through 1.6355 on the downside could create further short term panicking.  EUR/GBP" border="0" height="200" width="300">

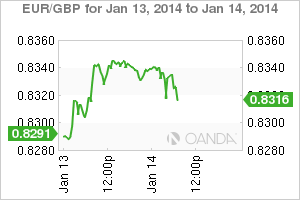

EUR/GBP" border="0" height="200" width="300">

The EUR's better bid witnessed this morning has more to do with the ECB Nowotny's optimistic take on the economy rather than the Euro-zones November Industrial Production headline which rose at the fastest pace in three and a half years (+1.8% m/m and +3% y/y). On the release, investors were quicker to book profits and with the retracement going nowhere the speculators have taken their hand off the "sell" the EUR button for now.

Headline release like this should be capable of removing some of the doubt about the regions economic sustainability. Of late, strong hard data has been hard to come by for the embattled region. Despite business surveys being positive through to December 2013, hard data like IP and retail sales were weak in October. But the month of November seems to be coming up rosier for policy makers. Today's headline, combined with last weeks retail sales figure climbing at the fastest pace on record, should shore up the currency in the short term, and have many of the weak dollar longs that bit more nervous. Even more so with the month of October being revised higher (-0.8% vs. -1.1%). The Euro Policy makers should be happier now that output was spread across most of the Euro-zone and across a number of different industries. The dollar bulls are required to play a patient waiting game. Despite the blend on the news, the single currency has now bettered last Fridays NFP EUR high (1.3694). Perhaps the increasingly bullish techs may convince the gradual speculator to move into EUR longs? A brave move at lofty heights, but so far, any single currency retracement has been limited. Should we be expecting US retail sales to be a tipping guide?

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Dollar Confidence Beginning To Doubt?

Published 01/14/2014, 07:22 AM

Updated 03/05/2019, 07:15 AM

Is Dollar Confidence Beginning To Doubt?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.