- Disney is under pressure on concerns that subscriber growth in the company's streaming app will slow

- Even as the stock slides, many analysts see an opportunity to buy, given the strength in the company’s other units

- Disney is one of those stocks whose values are down significantly but their earnings have rebounded

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

It’s hard to pick long-term winners as the current technology stock rout continues. Investors are quickly coming to terms with a grim new reality—the decade-long boom in earnings and increasingly soaring stock prices seems to have come to an end.

Many tech companies have announced job cuts and hiring slowdowns; some have also slashed growth projections and shelved expansion plans. This new phase of diminished expectations is also evident in the once-hot streaming video arena where some of the largest players are now struggling to win new customers.

Shares of the world's largest entertainment company, the Walt Disney Company (NYSE:DIS), are down about 30% this year on concerns that subscriber growth in the company's streaming app, Disney+, will slow after remarkable gains during the past two years.

Investors are already expecting slower growth in the segment after Netflix (NASDAQ:NFLX) shocked Wall Street by reporting a surprise drop in subscribers in April, then forecasting an even steeper loss in the current quarter. That setback forced the company, the streaming-industry leader, to change its course and announce plans for a lower-priced version of the service that includes advertising.

Even as Disney stock heads for its biggest annual drop in at least 47 years, many analysts don’t see a gloomy future, betting that the Burbank, California-based 'House of Mouse' can avoid the loss of streaming-video subscribers that crushed rival Netflix’s share price.

A 44% Upside Potential

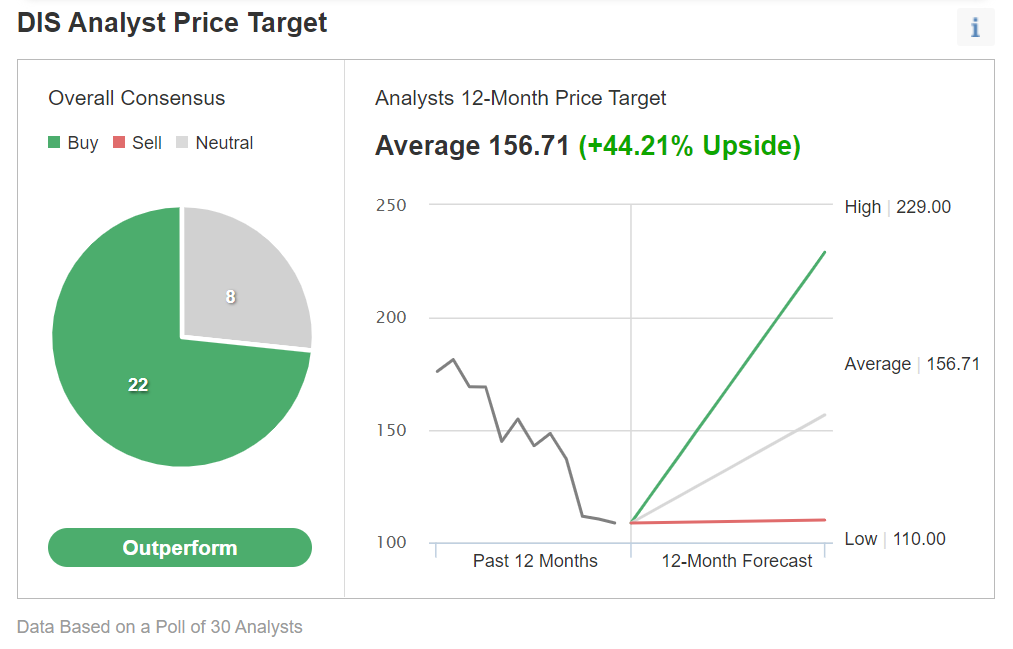

In an Investing.com poll of 30 analysts, the majority rated Disney a buy.

Source: Investing.com

Among those surveyed, the stock had a 44.21% upside potential with an average 12-month price target of $156.71.

Underpinning their bull case is the hope that Disney’s streaming unit still has room to grow and, unlike Netflix, DIS has a diversified business model which, along with its video platform, includes theme parks and resorts that are set to rebound now that pandemic lockdowns have ended in most parts of the world.

As well, in the most recent quarter, the company reported better-than-expected growth at its flagship Disney+ streaming service. The service finished the quarter with 137.7 million subscribers globally, up 33% from a year ago. Although the gain was smaller than the expansion during the previous three months, it was higher than Wall Street estimates of 134.4 million.

Sales at theme parks also recovered strongly. Earnings at the company’s resort division increased to $1.76 billion from a loss last year after guests returned to its hotels and theme parks. That trend will likely accelerate further during the summer months.

According to Credit Suisse, Disney is one of those undervalued stocks, down significantly this year, even though the company has seen earnings increase, making the stock look attractive at current levels.

Indeed, shares are down more than 40% from their high during the past one year, while the company’s EPS has jumped 46.3%.

In a recent note, the investment bank said:

“Given the severe and uneven decline in stock prices in recent months, sectors and portfolio characteristics (factors) have experienced dramatic shifts in their valuations, with some moving from extremes back to normal, and others still exhibiting substantial discounts or premiums relative to the market. Bottom-line, market disruptions realign opportunities.”

Needham, in a note last week, said it’s particularly bullish on Disney's Parks division, adding:

“In the Parks division, we expect revenue and OI (operating income) upside from increased capacity and higher per capita spend at the U.S. parks, as well as stronger than previously estimated results in the Paris and Tokyo parks, offset in part by the closure of the Shanghai park.”

Bottom Line

It’s hard to predict which direction Disney stock will go from here, given the highly uncertain macro environment which is hurting the majority of growth stocks.

But one thing is clear, the Burbank, California-based entertainment giant is in a much better position to weather the economic downturn than many of its rivals due to a diversified business model, allowing Disney to recover quickly once COVID conditions improve.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »