After the surge, the Crude Oil WTI still faces some global risk sentiment strong enough to make it fly higher. Will it pop like a helium balloon?

Fundamental Analysis

It appears that oil prices are being supported by speculators who have ignored signs of a slowing economy around the world. Nonetheless, the black gold may face a bearish supply forecast soon, which could potentially put it at risk of a pullback.

Furthermore, with a disappointing GDP in China in the third quarter and industrial production falling in September in the United States, the world's two largest economies have lost momentum, which could affect the level of energy demand.

Consequently, this context of state interventionism on energy prices is likely to reduce the transfer of demand from the coal market to petroleum products, depriving the crude of one of its wings that lifted it for a number of weeks.

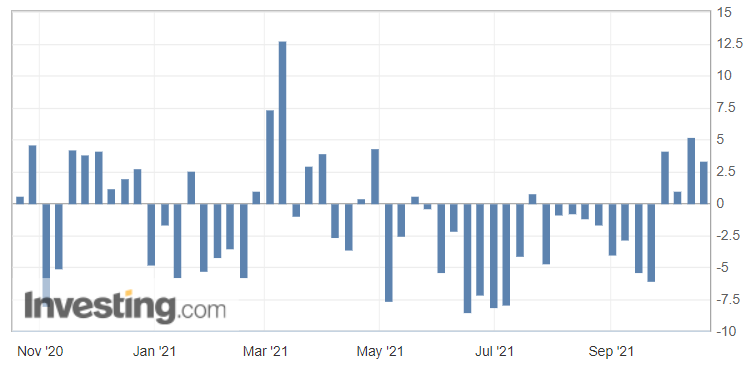

U.S. API Weekly Crude Oil Stock

Regarding the API figures published Tuesday, the increase in crude inventories (with 3.294 million barrels versus 2.233 million barrels expected) implies weaker demand and is normally bearish for crude prices.

However, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report.

If that scenario is confirmed by the EIA’s figures later today, then the black gold may be set for a corrective wave, possibly back to previous support levels.

In conclusion, anything can happen in this market in the forthcoming days… Therefore, no position in the WTI Crude is justified from the risk-reward perspective at the moment. However, things change quickly, and when they do, you don’t want to miss it!