Crude oil (WTI) has had a troubling week, as the commodity continues to slide lower as growing concerns over supply point to further falls ahead. In fact, as a veritable conga line of tankers navigate towards the United States, some are now asking at what point “peak storage” have been reached.

A range of factors have contributed to the global oil supply glut including diminished demand, as well as the introduction of Iraqi supply to the market. Although slow to start, Iraqi oil exports are now ramping up and, as we speak, a 2-mile long line of tankers is heading towards refineries in the United States.

However, a tanker backlog is already underway in Houston, where over 39 oil laden vessels stand idle waiting for a turn to unload their cargo of crude oil. The current combined supply nears a capacity of over 28 million barrels, which doesn’t include the ships currently enroute to the port of Houston. In fact, the storage problems are so dire that many energy firms are requesting ships to undertake slower voyages in the hope that the situation improves.

Globally, the supply situation is just as severe with Indonesia, Malaysia, Singapore, and most Asian producers relying upon floating storage options. In fact, Asia currently has floating stocks in the realm of 35 million barrels aboard VLCC’s. The UAE is also suffering at the hands of the supply glut as approximately 8 million barrels are aboard vessels waiting for storage space and demand.

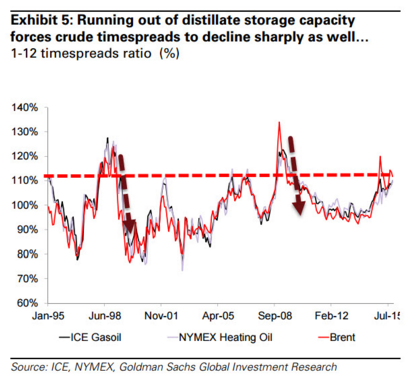

Subsequently, many pundits are now wondering at what point we will actually run out of distillate and crude storage capacity. Modelling undertaken by Goldman Sachs seems to suggest that we are now reaching into an area of around 110% of storage being utilised (floating storage included).

Historical precedent actually paints a relatively bleak picture for the oil industry in an over-capacity scenario. The exact scenario actually occurred in 1998 and lead to the desperate need to liquidate stocks at any costs. The subsequent impact was for prices to drop sharply below their cost as efforts were made to clear the excess and rebalance the market.

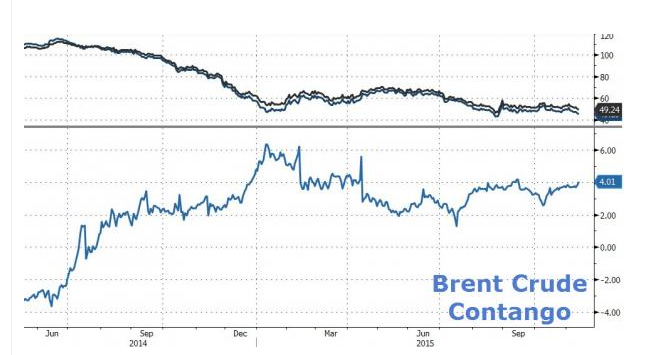

Subsequently, the smart money remains on crude oil trading at a significant discount in the coming months as the market attempts to quell the stockpiles. In addition, OPEC may very well seek to cut supply; however, the rebalance will not be quick as large stockpiles around the world will need to be cleared. OPEC members, therefore, face a tough decision given the financial pain of crude prices below $40.00 a barrel.

The coming months are therefore likely to be relatively bearish for crude oil prices as the over-supply hangs perilously over the market. When a rebalance finally occurs, it will be rapid and the new equilibrium price is likely to catch many by surprise. Subsequently, don’t be surprised to see WTI crude oil prices falling into the low $30.00 a barrel range as traders scramble to clear their excess.