Voices are ruminating for change in the oil production industry as the unthinkable is called for, the repeal of the crude oil export ban. The U.S economy has long faced an imperfect oil production sector which has been distorted by a range of policies that seek to intrude upon the flourishing of the free market.

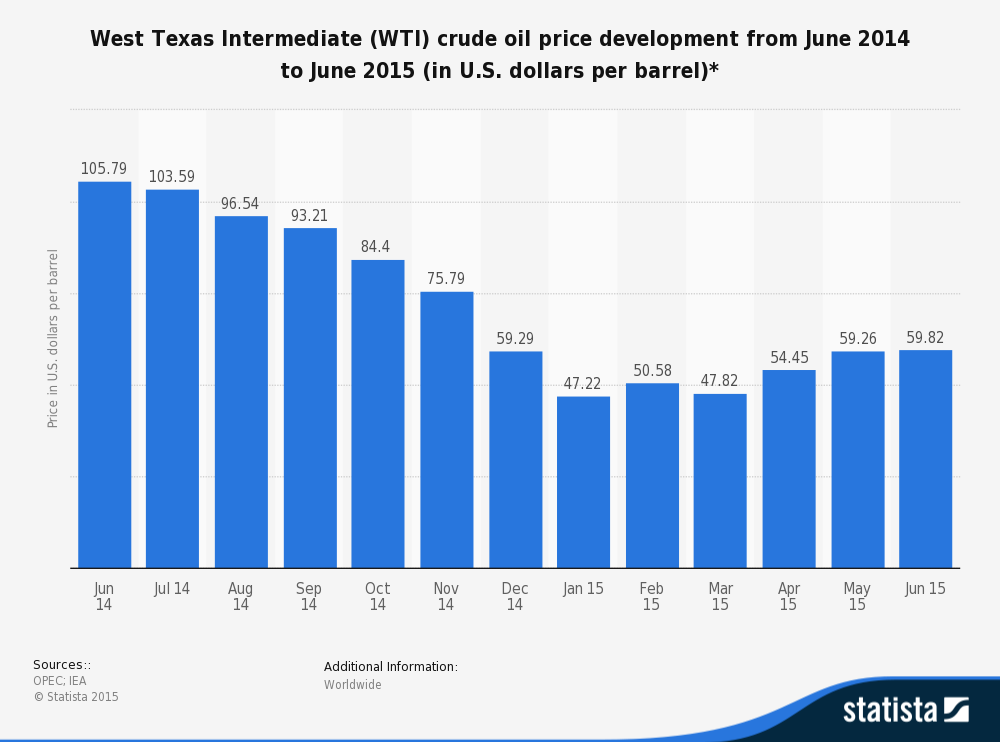

Although history tells us that the Arab oil crisis of the 1973 is to blame for the export ban, the reality is that the chief culprit for its continuance is now politics. However, as crude oil inventories mount, and the price of West Texas Intermediate continues to be depressed, strong voices in the industry are calling for change.

Many within the industry have been calling for the liberalisation of the oil market for years to no avail. However, the truth is that those within the environmental lobby have seen the export ban as a way to impinge upon the free market evolution of crude and subsequently to damage its long term prospects.

The silent minority have often won the debates over repeal of the ban through private lobbying of key members. However, the time is now ripe for a renewed push towards lifting the ban as a cacophony of voices call for the liberalisation of the crude oil markets.

Senator Lisa Murkowski, of Alaska, has been one of the chief proponents of the export ban repeal and has worked exhaustingly through the legislature to effect change. Murkowski presents a credible advocate for the issue considering her position as Chairperson of the U.S Senate Energy and Natural Resources Committee. That push might soon to pay off with the House looking to vote upon the issue as early as September.

Opponents to the ban cite a range of concerns that stem mainly from the need to protect U.S consumers from any potential price increases. However, the point is moot as most economists, including myself, see fuel prices actually declining over the medium term as new investment and efficiency improvements flow into the supply chain. This could potentially see gasoline as low as $2.88 a gallon at the pump which would be a welcome relief for many within the continental United States.

The long-run economic benefits to the sector would subsequently vastly outweigh any potential concerns. This is especially prescient considering the reliance upon the crude oil industry for employment in states like Texas. Although any structural change within the industry would take time, lifting the ban would lead to greater production efficiencies which would provide a net benefit to the U.S. Economy.

Regardless of your political view, the ramifications for keeping an industry locked down domestically are too numerous to count. The net benefits that an open industry can provide to the American economy are innumerable and it is subsequently short sighted for the current administration to keep the ban in place.

Ultimately governments, irrespective of their political leaning, shouldn’t dictate productivity or viability…the free market does that!